Today we have the second article in a series dedicated to reflections on the basics of Bitcoin and cryptocurrencieson the whole.Let’s walk through the history of financialcrises that periodically mature in such an imperfect monetary system. Do not forget to review the first part, and stay tuned so as not to miss the subsequent articles in this series.

</p>Table of contents

Suddenly - Part 1: Bitcoin, not blockchain

To be continued...

In August in Jackson Hole, Wyoming, passedannual economic symposium, where bankers from central banks, economists from the establishment, journalists and others gather to discuss systemic problems of the economy. It seems like they are constantly looking for an answer, but they don’t find it, is the eternal dilemma of Jackson Hole. This event is always accompanied by great fanfare, and this year was no exception. Perhaps this whole performance was well summarized by Lawrence Summers, the former US Treasury Secretary and also the former President of Harvard University. In a 28-part Twitter series, Summers questioned a number of fundamental assumptions of the economic mainstream, to which he himself belongs. Playing blindly in the nets, Summers came a little closer to the goal, but was still looking in the wrong direction. Perhaps he identified the symptoms of the problem, but, like most mainstream economists, he did not ask the obvious question. Could the entire central bank policy apparatus be the underlying cause of the problem, rather than a constantly elusive solution?

Summers basic question: can central banks, as we know them, be the main instrument of macroeconomic stabilization in the industrial world over the next decade? Summers doubts this, but what if the best question is whether central banks are the main cause of macroeconomic instability? Since the financial crisis, the main tool that central banks have used in an attempt to stabilize the economy and artificially create inflation has been quantitative easing. The plan was as follows: increase the money supply, lower interest rates and conduct asset price reflections so that existing levels could be maintained and even more debt created.

However, despite a record lowinterest rates, the global economy began to deteriorate again, and many, of course, doubted the effectiveness of quantitative easing. As Summers notes, what has long been portrayed as an axiom is now in doubt. Contrary to popular belief, quantitative easing actually creates instability that it should have avoided. If you understand its basic mechanism, it becomes clear that quantitative easing has always been a futile undertaking. As Nassim Taleb writes in the preface to the book A Brief History of Money, macroeconomic experts are not only experts, they don’t even know about it.

“The risk of the economy falling into a significant recession appears to have diminished over the past month,” Former U.S. Federal Reserve (Fed) Chairman Ben Bernanke, June 2008.

History has repeatedly shown that expertslimited in their own area of specialization, but policies like quantitative easing continue to be pursued, mainly because macroeconomics and central banks are, as Taleb describes, a monoculture. The mainstream political position begins with the assumption that central banks are the core of the economy, and further discussions focus on what leverage to press and how best to manage the economy through central banking planning. Active money management through quantitative easing is taken for granted; the question is not whether this should be done, but when and to what extent.

However, there is an opposite economic pointview, arguing that the very function of the central bank and the active management of the money supply are harmful to the economy. This opposition point of view cannot in practice coexist with the central bank, since it represents the antithesis of its function itself, and that is why there is a monoculture and no other course is considered. The economic disputes that unfolded over the course of the 20th century ended with the triumph of what became the current mainstream position. The result was an economic system that depended heavily on monetary depreciation and credit creation, achieved through quantitative easing.

Now that Bitcoin exists, it's not justtopic of intellectual discussions. Now we have two competing, sharply contrasting money systems: one is trying to create stability by actively managing the money supply, while the other allows for intermediate volatility in the interest of maintaining a fixed supply. Over the past ten years, a new ambitious project, deprived of external support, has gradually won back territories from the consolidated system, as evidenced by its adoption and a steady increase in value relative to other currencies. Choosing Bitcoin means giving up quantitative easing, and although the path may be volatile, the long-term trend will continue as central banks continue to use the very tool that Bitcoin does not allow.

Trying to be a source of macroeconomicstabilization, central bankers unwittingly create volatility through the manipulation of the money supply. Due to the manipulation of money supply, all global pricing mechanisms are distorted. As Hayek describes in the article “The Use of Knowledge in Society,” the price mechanism is the greatest system for disseminating information in the world. When the price mechanism is distorted, false signals propagate in the economic system, and the result is an imbalance of supply and demand, which ultimately creates instability and fragility. Today, instability is mainly created and supported by quantitative easing. The financial crisis has clearly shown that the size of the credit system is unstable and exorbitant. Instead of allowing the system to naturally reduce its leverage, the Fed carried out asset price reflections and facilitated further credit expansion so that existing levels of debt could be maintained. In fact, the approach of central banks to solving the problem of excessive debt amounts to creating even more debt, which was the original source of instability. Fortunately, Bitcoin solves this.

What is quantitative easing?

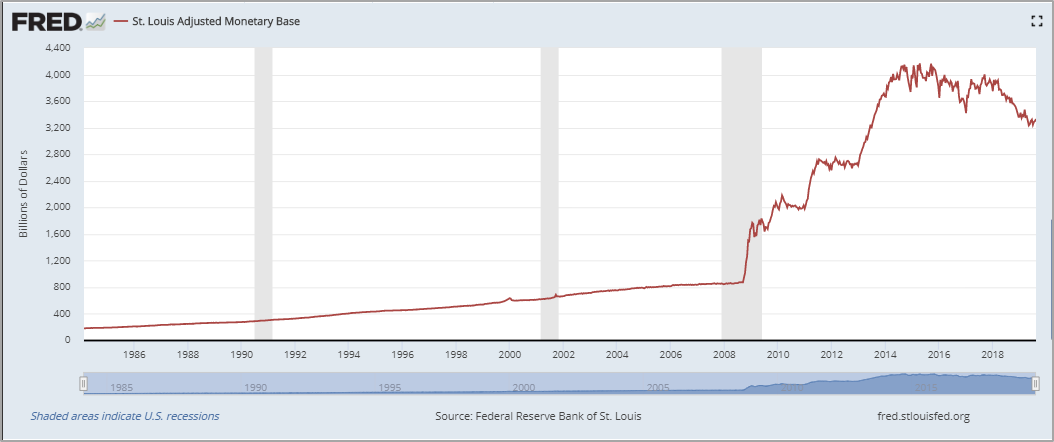

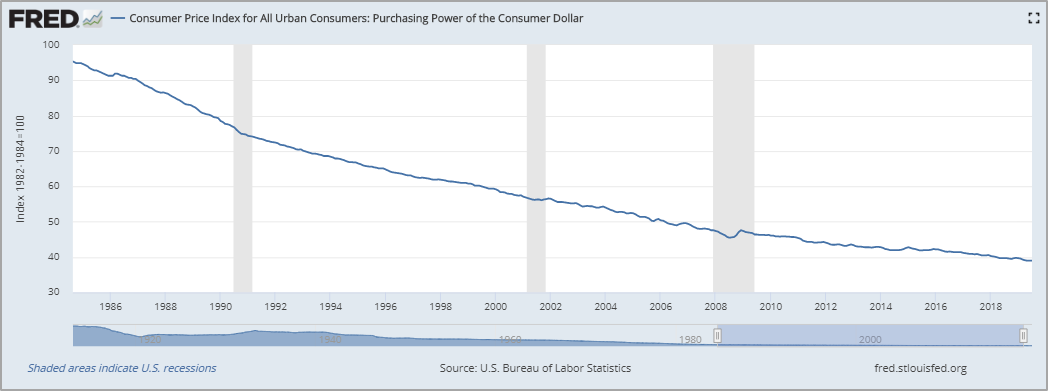

To put it simply, thenquantitative easing is a technical term that describes how the Fed creates new dollars. Formally this is not"Printing money"but, essentially, it’s the same. The Fed creates new digital dollars in the registry (literally from the air) and uses them to purchase financial assets, such as US Treasury bonds (government debt) or mortgage-backed securities. After the financial crisis, the Fed poured into the banking system through a quantitative easing of $ 3.6 trillion, putting down its balance sheet. As a result, the banking system has more dollars in the form of bank reserves that can be used to lend or purchase other assets. Simply put, there are more dollars, which is why the value of each individual dollar has fallen.

Quantitative easing– the fundamental reason why tomorrowyour dollars will buy you less than today. The effect of quantitative easing gradually spreads through the economy through the expansion of the credit system. In other words, quantitative easing allows banks to issue more and more loans; for every dollar created through quantitative easing, several times more credit can be created. This credit (in the form of car loans, mortgages, student loans, etc.) is then used to purchase goods in the real economy, causing the prices of goods to rise and the relative value of the dollar to fall.

Does quantitative easing work?

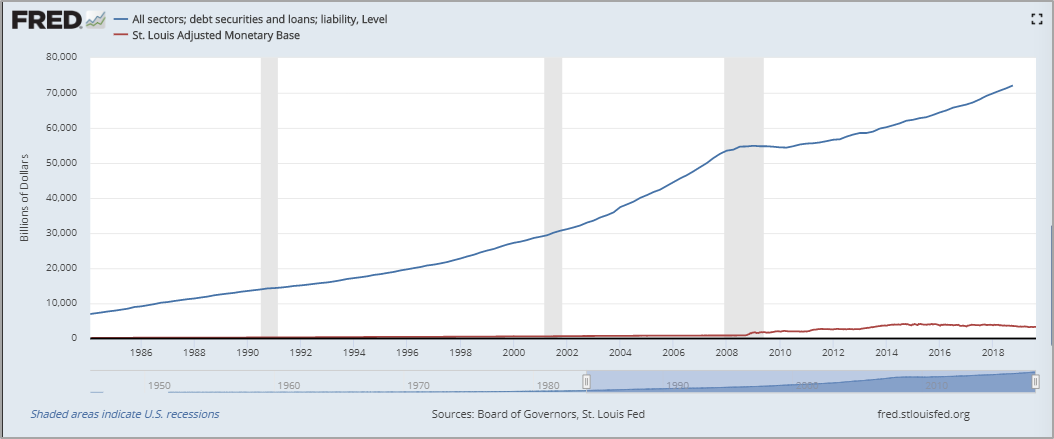

In short, no.While many believe that QE was necessary, it only delayed the problem and ensured that even more QE would be needed in the future. The underlying cause of the crisis was that the financial system became overleveraged. At the time of the financial crisis, there was 150 times more credit in the banking system for every dollar (see Fed Reports Z.1 and H.8).There was too much debt and too little dollars, which was an indirect consequence of maintaining the Fedeconomic imbalance. With each recessionary economic cycle over the decades leading up to the crisis, the Fed has increased the supply of dollars to lower interest rates and promote credit expansion. Instead of allowing the system to adjust the exchange rate within the framework of the natural functioning of the market, the constant reaction of the Fed was to reflect asset prices by increasing the money supply, which allowed maintaining existing levels of debt and creating even more credit.

Through this function, the Fed involuntarily calledthe instability that existed in the system in 2008, since conditions were created that for decades allowed the accumulation of huge debt. Although this policy has been pursued for decades, the financial crisis created a situation that provoked a more radical Fed reaction. In fact, the Fed needed larger-scale measures, and in response to market instability, it increased the offer of dollars by $ 3.6 trillion to delay the impending financial collapse. This time the situation was different. Although everywhere they wrote about the crisis of subprime mortgages, the real problem was the combined effect of the supported imbalance of the credit system that has accumulated over many cycles, and the overall degree of credit overload in the system.

In the Fed's economy, the credit system has becomemarginal price mechanism. And since the Fed is mandated to maintain price stability, it must implicitly support the size of the credit system so that the overall price level is maintained. During the financial crisis, the credit system began to decline, and asset prices quickly and randomly fell. To reverse this effect, the Fed was forced to sharply increase the money supply (quantitative easing) in an attempt to maintain the size of the credit system. Even when the peak of the crisis was over, the Fed considered it necessary to pour in trillions of new dollars to continue to maintain a weak system, despite recognizing the limitations of its monetary policy instruments. This is the Fed’s vicious cycle: even though it’s wrong, the Fed prefers to increase rather than reduce quantitative easing by default.

“I’m quite ready to accept the argument thatmonetary policy is not the main tool, that it is not the main problem of the economy; but our duty is to do everything possible, to have a mitigating effect, to help as much as we can, even if we cannot solve fiscal, structural and other problems. ” - Ben Bernanke, former Fed Chairman, August 2011

“I don’t think that monetary policy is literallysense is completely ineffective. I think you can see the impact on financial markets, which, in turn, should affect wealth, confidence and some other decisive factors of spending and production. If the effect is weaker, then this may serve as an argument in favor of increasing rather than decreasing incentives. ” - Ben Bernanke, former Fed Chairman, September 2011

Responding to quantitative easing, the Fedcontributed to the large expansion of the credit system, already overloaded with debt. Today, the US credit system supports approximately $ 73 trillion of fixed-term debt, which corresponds to an increase of $ 20 trillion (+ 40%) from the pre-crisis level (Fed report Z.1, p. 7). This debt is opposed to only $ 1.7 trillion actually existing in the banking system (Fed report H.8). As a result, there is still too much debt, and too little dollars. As quantitative easing contributes to the creation of trillions of dollars of new debt, it is more like a drug than a medicine. The more it is applied to the financial system, the more dependent this system becomes on it and the worse it will be when it is canceled.

Bitcoin solves it

Until 2009 all were forced to use this system, since there were no effective alternatives. But now such an alternative is Bitcoin, which exists to a large extent as a reaction to global quantitative easing. There is no simpler explanation for the existence of Bitcoin. Although Bitcoin would present a better alternative even in the absence of quantitative easing, the global monetary depreciation in response to the crisis reinforces the contrast. It is thanks to this contrast that the existence of Bitcoin is much more intuitive. Bitcoin literally exists because very smart people identified the problem and tackled it. Bitcoin represents the best solution to the money problem.

Since the existing financial systemstill dependent on leverage, future quantitative easing is not just likely, but predetermined. With regard to the future quantitative easing of the Fed and other central banks of the world, the only question is “when”. In 2008, the credit system was unstable and unstable. Due to quantitative easing, it has increased dramatically and now supports $ 20 trillion more debt in the US alone. Every time the Fed or any other central bank announces a new round of quantitative easing, this is a market signal confirming why Bitcoin exists. It is all a matter of choosing between a currency that is constantly and systematically depreciated by the central bank and a currency with a fixed supply that cannot be manipulated. Bitcoin is a counterbalance and a way out of the problem of quantitative easing.

In her speech at the Nobel ceremonyPrize in economics in 1974, entitled “The Illusion of Knowledge”, Friedrich Hayek postulates the main reasons why the fragmented knowledge of all market participants surpasses the knowledge that any individual mind possesses. Using this argument, he explains why the prevailing macroeconomic theory and monetary policy that guides central banks is inherently imperfect, and why the tools used by central banks, such as quantitative easing, do more harm than good. I strongly recommend that you read the whole speech, as it provides an alternative view in comparison with the monoculture of modern economic policy. Our current system trusts the distribution of trillions of dollars to just a few people. The point is not that these people do not have enough knowledge, but that any small group of people inevitably has much less knowledge than the hundreds of millions of people that make up the economy.

When trying to manage the economy throughmoney supply manipulation not only knowledge of the multitude is replaced by knowledge of a small group, but the collective knowledge base as a whole is distorted. The mechanism that controls supply and demand can no longer function effectively, which creates an imbalance that can only be maintained through further market manipulation. The final negative impact on the economy is much greater than it would be if there were no central bank intervention. The financial crisis is a “zero patient,” and the response in the form of quantitative easing has made today's situation even more precarious. The first-order effect is the depreciation of the currency, but the final consequence is the deterioration of the underlying economic structure. Bitcoin is designed to fix this, but you should not expect a smooth and painless transition to it from a system overloaded with the imbalance that has accumulated over decades.

Bitcoin creates a system that makes it possibleundistorted economic activity, which is achieved using a fixed money supply, ultimately driven by a market consensus mechanism. It is thanks to this consensus mechanism that Bitcoin does not need the conscious control of central bankers and instead relies on the distributed knowledge of all market participants. He is also completely voluntary. If you like your financial system, you can stay in it (at least for now). Nevertheless, monetary systems converge to one means, so if the critical mass converges on Bitcoin as the most reliable long-term means of saving, there may be less choice in the future. As people increasingly prefer Bitcoin, the problems of the existing system will only become more obvious, which is likely to accelerate the need for quantitative easing. The greater the propensity to store wealth in Bitcoin, the less will be the demand for storing wealth in assets that support the existing system. In fact, an increasingly massive transition to bitcoin will directly affect the systemic credit momentum, which will accelerate the need for the old system to rely on quantitative easing to support itself.

Bitcoin is a tricky way to get around the economicFed system directly due to the old system. And an intermediate consequence of the transition to Bitcoin could well be macroeconomic volatility. Bitcoin may be mistakenly blamed for the troubles of the old system, but withdrawal syndrome is always a painful but necessary process. A party from Jackson Hole may not like this, but on the other side there will be positive consequences. In addition, now everything is in the hands of the free market.

Don't forget to stay tuned as this is just the second part of our larger series.

</p>