What if you were told now that we are approaching another global financial crisis that willwill be even worse and longer than the worldfinancial crisis of 2008? Want to know more? What if for several decades our financial and monetary institutions have been one of the most significant factors of economic inequality throughout the world? You would be interested to understand why?

For decades, most regulations designed to strengthen our financial systems, or interest rate decisions designed to stimulate the economy, have additionally had a devastating effect on your future well-being.This process has been effective in reducing the national debt, but it has also been quietly destroying the wealth of ordinary savers like you and me.That might sound a bit implausible, right?

Inconvenient truth

Unfortunately, the truth is thatThe statements made above can actually be justified. Yes, many of us who have sufficient privileges feel the benefits of strict regulation, sound banking practices, and stable financial markets. Our money is safe, payments work, and financial institutions make us profitable offers in an attempt to win or retain as customers.

But…

There are other negative, and mostly unknown, aspects of financial systems that need to be exposed.Without an understanding of how even a well-functioning economy can (and usually will) be susceptible to untenable monetary practices, we will not be able to appreciate the real power of Bitcoin.We will continue to relegate Bitcoin to the periphery and see it only as an alternative payment system or currency that is only relevant to troubled and "developing" countries.

In this article we will look at background financialprocesses that have a detrimental effect on the well-being of citizens and, at the same time, do this for a long period of time within the framework of entire multi-billion-dollar economies. That is why the gradual decrease in your individual well-being is not immediately noticeable, and most likely will not become something shocking or especially dramatic. For each person individually - the amount lost will not be enough to incite social unrest, but, when summed up taking into account the millions of people involved in the economy, impressive numbers begin to take shape.

This is not only commission fees

Our pockets clean out not only those mostcommon annoying factors like bank dues, remittance fees, or investment costs. In a number of countries, there is a silent and accurate redistribution of wealth from ordinary investors, such as you and I, to the government and financial institutions.

This is a hidden redistribution of wealthbecomes more noticeable as inflation rises. And for this, inflation does not have to be high (in relation to historical indicators), because not only the widely advertised hyperinflation scenarios in Venezuela or Zimbabwe demonstrate how wasteful government spending and unreasonable financial decisions can cause economic damage to citizens.

Even in well-developed economies thatcharacterized by moderate growth, low interest rates and, apparently, a harmless rate of inflation - the wealth and savings of people are systematically redistributed to pay off public debt. And this happens unnoticed, so that voters do not know about it, so wasteful government spending faces minimal political consequences.

In most countries, people trust their money,Savings and economic well-being of large financial institutions and central banks. People believe that a strong regulatory environment in their country will support their efforts to survive (or even prosper) financially.

However, regulations, in the first place,designed to protect the integrity of the banking system - they also create conditions for the growth of money supply, inflation and interest rates, which quietly transfer wealth from private sector investors to public sector debtors. Therefore, the next time you think that the topic of inflation and public debt / embezzlement is boring and should not bother you, think again.

How deep is the rabbit hole?

Instinctively, many of us understand that something is wrong with the current state of things.

The following forces us to experience discomfort and a sense of injustice:

- Exorbitant fees for money transfers to your home country;

- High interest rates on our personal or business loans;

- Exorbitant payment fees, whether it is accepting a card payment or cross-border corporate payment;

- Limitations on how much money we can invest in offshore;

- The decline in the value of our investment portfolios, while asset managers, brokers or exchanges continue to thrive.

But, this rabbit hole goes far beyondthings like that. Our financial systems and legal framework were designed in such a way that money and the wealth obtained from them are treacherously transferred through the banking system - from depositors to financial institutions and repayment of public debt.

More importantly, the extent to which ithappening, astound the imagination. This article is the first in a series that will provide a factual overview of how this happens. I hope this "opens your eyes" to the realities and encourages us to search for better alternatives to what has always been considered the norm.

This and second article will cover the following topics:

- Consumers bear the brunt of the structures of modern financial institutions;

- Financial institutions receive more money from their clients than clients from them;

- Even in well-functioning, developed economies, wealth is redistributed from poor to rich.

This article will focus on the most practicedfinancial services, thereby the "irritants" to which we are accustomed and no longer pay attention to them. In the next article, we will examine how monetary institutions and systems that we trust every day contribute to the insidious and hidden transfer of wealth from the poor to the rich. All these problems make it clear why we should be open to a better money system, which will be the third article.

Financial institutions are expensive cars

There are many reasons why providing financial services to people and businesses has become so expensive - let's touch on a few.

Financial processes are fragmented and involve many intermediaries

Many of us, as a rule, do not know about alldifficulties and problems faced by companies offering any financial services. Throughout the world, real financial markets, technology platforms and systems are fragmented and fragmented to varying degrees, even in developed countries. As a result, many different service providers are often combined to collaborate to provide us with a specific service.

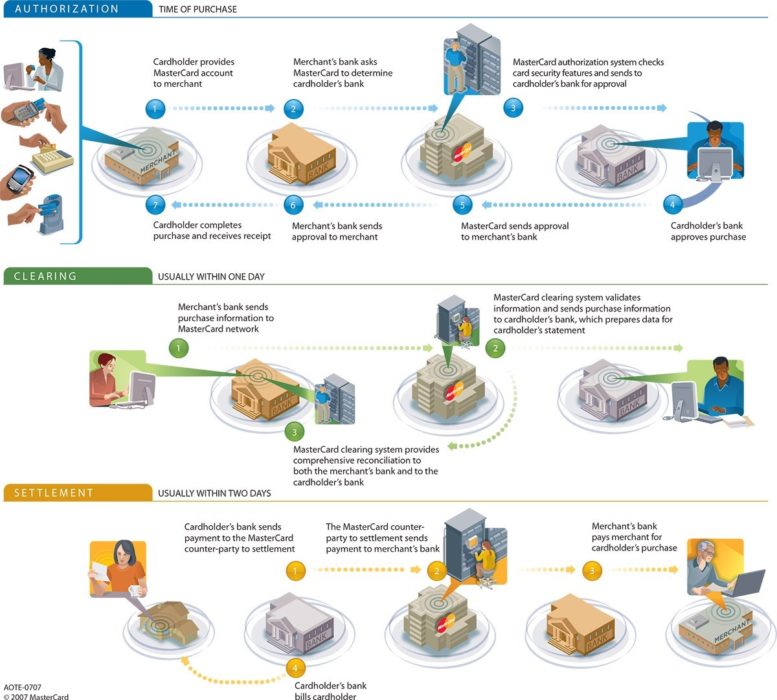

For example, so that you can implementsimple payment by card in your favorite store - there are companies that provide devices for receiving payments from your credit card.

These companies are the banks in which your store has an account, their activity is called acquiring.Such a bank is usually part of a network of payment companies such as Visa, Mastercard or Amex in order for your payment request to be forwarded to the issuing bank(your own bank), which will eventually transfer the funds from your account and contact the central bank, which handles the settlement of payment obligations between the acquiring banks and the issuing banks, which is called clearing.

This is not exhaustive information, but it’s easy to understand how all these parties and their own costs will affect the total cost of the payment.

How it works

We inevitably feel the consequences of these problems inour daily lives in the form of bank fees, insurance premiums, reduced savings or inability to invest. However, in addition to having several players, each of whom adds costs and fees to his part of the service, there are many other factors that aggravate the burden of costs that the consumer inevitably incurs.

Financial institutions forced to maintain costly infrastructure

Large banks, insurance companies, and other financial institutions usually incur huge expenses on the following things:

- A regional network of branches, in which each branch incurs expenses for personnel, premises, cash management, etc.

- A regional ATM network that incurs maintenance, cash replenishment, cash transportation and security expenses;

- Outdated legacy IT systems in most banks with many IT specialists who are involved in their maintenance and ongoing development;

- Tens or even hundreds of thousands of well-paid employees;

- Salaries of financial managers, which are usually very high.

And further, in the same spirit.

In general, traditional financial institutions are extremely expensive to operate, and these costs are recovered from fees, premiums, interest, etc.

In addition to the fact that financial systems are already expensive, the fact that they are not well integrated only increases their value.

This lack of standardized and integrated systems is the reason, for example, for the following:

- Payment for the recipient can be reflected in his bank account only after a few days;

- You cannot get a unified view ofall your investments and insurance policies owned by various institutions, without an intermediary or broker who must manually match this for you. And, of course, this intermediary will charge you for your services.

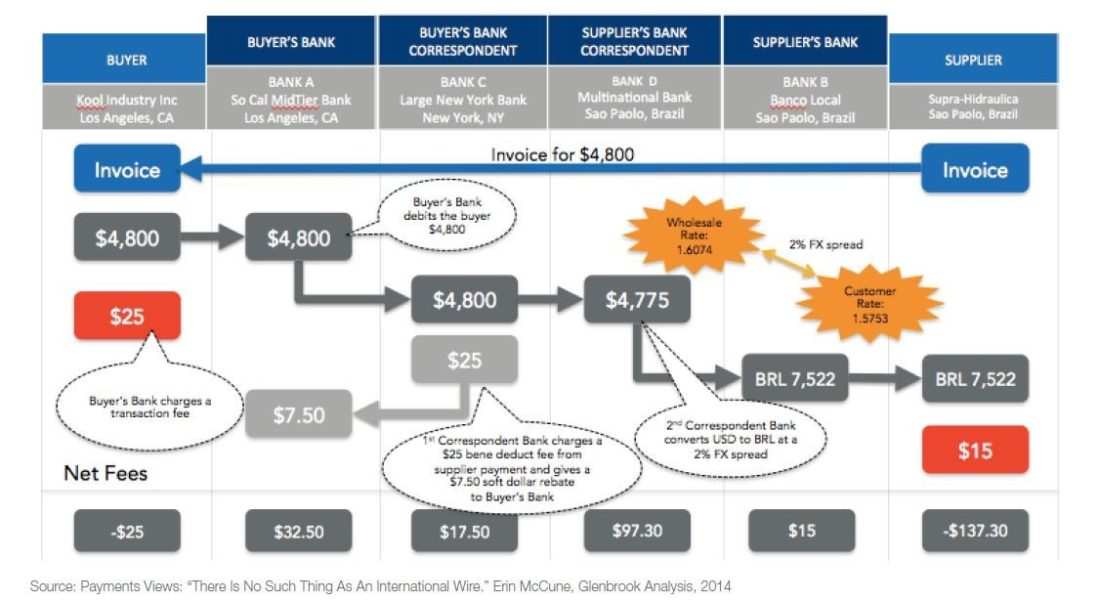

Global payment systems disconnected from domestic

Globally, lack of integrationbecomes even more pronounced. The internal payment system of individual countries is not integrated and is not focused on the simplification of cross-border payments. As a result, to facilitate cross-border payments, additional intermediaries are required, such as the SWIFT network and correspondent banks, each of which charges an additional fee.

As you go through a number of banks, the transfer amount slightly “loses weight”

Cross-border payments are just one ofexamples of the use of bitcoin. In 2018, the volume of money transfers in the world reached $ 689 billion. At the same time, the average commission for transferring $ 200 remains high - about 7%, bank transfer is the most expensive - on average 11%.

Cross-border corporate payments significantlyhigher in value. In 2018, their volume exceeded $ 21 trillion. Tariffs, which average from $ 30 to $ 40 per payment, as well as an average currency spread of 2%, make cross-border corporate / B2B payments very beneficial for financial institutions.

In cases where corporate treasurersthey rely on the receiving bank to process currency conversion - the transparency of exchange rates and conversion fees may be limited for both the sender and the recipient of a B2B transaction. Also, cross-border payments are not made in real time - settlement times of up to 5 days are not uncommon.

However, the inability of both the sender andthe recipient to effectively track the movement of funds as they pass through the correspondent banking system, as a rule, is of great concern.

Fragmented systems in the investment industry

Other examples of fragmentation of financial systems,which negatively affect the end consumers can be observed in the investment space. When managing your investments, several parties cooperate with each other, and all of them charge a fee, which, ultimately, reduces your income.

Think about the income you expect frominvestment in your retirement fund. Behind the scenes, there are quite a few participants involved in the process of managing your retirement savings, each of which charges a fee for their services.

These are the following characters:(translator's note. Information is more relevant for foreign countries)

Pension Fund Administrator– helps to direct a portion of your monthly payroll deductions to various asset managers who willmanage your funds (and hopefully increase them), your claims payouts, etc.

Asset managersInvest your monthly contributions in specific stocks and other financial instruments, usually based on a strategy in the process.In addition to their regular asset management fees – they canCharge a commission on returns if they exceed a benchmark, by the way, which investors rarely understand.

Multi-managers– also sometimes participate in the management of your investments by managing other investment managers, each of whom, in turn, managesFor this service, the multi-manager chargesadditional charges.

Financial Platform Providers– have systems and operating systemsopportunities to provide more experienced pension fund members with a wider choice of investment options. There are also fees for this service.

Pension brokers- their duty is to helpyour employer to structure your severance pay, keep in touch with the administrator of the pension fund, help educate you (the employee) on how best to increase your retirement savings, etc.

Asset Consultants– typically advise individual pension funds on investment strategies and charge a fee for this service.

And of course, there are other organizations,such as exchanges on which the actual purchase and sale of securities takes place. All these exchange and other trade related expenses are also borne by the investor.

Thus, despite the fact that the 21st century is already in the yard, the problem of opaque and exorbitant investment levies continues to exist, and this causes great disappointment.

Financial institutions benefit more from clients' money than clients themselves

There are many other implicit “problems” with ourcurrent financial system. Financial institutions receive significant profits from the commissions of their clients. Naturally, it is important for these institutions to remain profitable in relation to the services they offer. But, society has become so insensitive to the uneven distribution of income between ordinary consumers and professionals in the field of finance that it no longer notices obvious speculation.

For example, people pay banks monthlyuse of a bank account. However, they, being clients of the bank, often do not receive interest income on their bank / check / current accounts.

Meanwhile, banks use customer money togranting loans at high interest rates, from which they extract even more significant profit. Therefore, the following article will examine how banks can use their customers ’funds to provide loans to governments at below-market interest rates.

Investment-related institutions generate income regardless of market movement

An ordinary investor who invests in a mutualfund or buys quoted shares through a broker, will bear the risk of market / price movement. The broker and the exchange participating in the investment process will receive a transaction fee based on its size, even if the market falls.

Asset managers who manageinvestment portfolios for individuals or even pension funds will receive a commission of, say, 1% of the assets they manage, regardless of whether their customers' investments multiply or, on the contrary, suffer. This is another example of how the benefit for the ordinary investor is directly related to the market movement, and the asset manager’s income is not, at least in the short term, because the manager’s constant inefficiency will lead him to lose his business.

Unintended consequences of costly structures: unequal access to banking services

One of the unintended consequencesthe above costs is that not everyone can afford to have a bank account. Banks must maintain profitability, and low-cost accounts for the poor are almost always disadvantageous for them. A rough estimate is that nearly 2 billion adults worldwide do not have a bank account.

Unequal access to investment opportunities

Another unintended consequence is not everycan afford the same investment opportunity. For example, to gain access to investment opportunities abroad through your local broker, there are usually minimal amounts of investment that less affluent people cannot afford. Or, more simply put, some people cannot access the services of certain money managers unless they have a minimum amount of money to invest. Therefore, less affluent people have a limited investment choice, which does not provide the same benefits that are afforded to wealthier people.

Usually, they only have access to the following simple products:

- Collective investment - despite the fact that the funds are combined, different types of commissions strongly affect the return on investment;

- Investing in a bank deposit - unfortunately, these accounts offer interest rates that are hardly (if at all) consistent with inflation.

The following material will address the problems of economic policy and the global money management system.

Posted by: Irlon Terblanche

</p>