Recently, there have been more and more rumors about an impending financial crisis. Let's tryfigure it out really so. A lot of media “thunder” with headlines about coronavirus, strong drops in stock prices and more. Experts have been saying for a year and a half that a bullish rally in the stock market should go into correction or even recession. But without succumbing to public opinion, he will take an objective look at the situation and take a look in order.

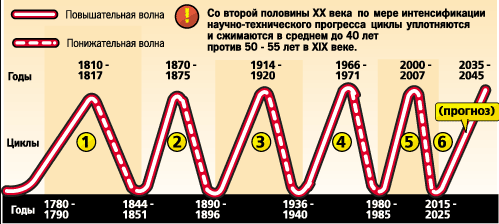

First, let's look atrecurrencecrises.By searching Google, you can see the dates of economic crises over the past 10-150 years and find out that the average between global economic crises is approximately 11 years. Since the last crisis in 2008. 12 years have already passed, which prompts the thought: “Isn’t it time?”

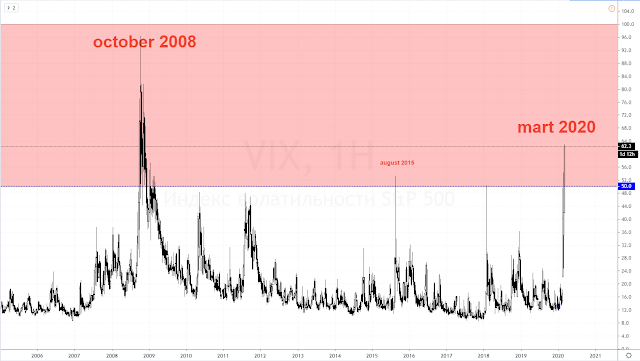

Everything seems clear about cyclicity, but let’s turn toVIX fear index, he will also tell you what is happening withoptions on the s&p500 index. A VIX reading above 50 signals increased institutional fear and also money moving out of stocks and into gold and bonds.

As you can see, the VIX fear index also saysabout entering an economic crisis and this is the second reason to think about the further growth of your business, work and other sources of income, since during a crisis income is significantly reduced, prices rise, and the pace of production and sales of products falls.

But the VIX is not everything. Let's look at the third point:broad market index S&P500. This index consists of the TOP 500 US companies andis a wonderful barometer for determining when the crisis began and when the market will only emerge from it. It so happens that the key levels that institutions look at are 10% and 20% rollbacks from historical highs. On the S&P500, the historical maximum was around 3400, which means 3400-10% = 3060 and 3400-20% = 2720. A rollback from 3400 to 3060 is just a mini-correction for large players. In the range of 3060 to 2720, with a favorable economic background, there is a good opportunity to buy additional shares of companies that have fallen in price, and with an unfavorable background, like this time, it is a reason to start recording small drawdowns for now. But below 2720, wholesale sales of shares by institutional analysts begin, which provokes an even greater fall in the stock market.

Now below 2720 - crisis and exit onlyabove this value will be a signal to the end of the crisis, although from the point of view of technical analysis, the reversal will occur at about 50% of historical maximums or 3400-50% = 1700.

The fourth point will beinterest rate FEDand watching her, or rather,changes in it will be an important barometer. After an emergency meeting on March 3, 2020, the interest rate was sharply reduced beyond the plan by as much as 0.5% to the level of 1.25%, which is twice as much as usual. The conclusion from this decline is that the United States is afraid of “going down” along with the entire economic system. On the one hand, the reduction measures taken should provoke taking out cheaper loans for the development of production and the economy as a whole. I would also like to mention that the interest rate will also be revised on March 18, 2020 and there is a huge probability of a reduction to as much as 0.25%.

Everything seems to be correct. But if you look at the dynamics of changes in the interest rate, the price dynamics of the s&p500 index and VIX, you will notice a simple relationship. And very obvious.

I think there are no unnecessary words. Everything has become very clear and I can “congratulate” everyone on the outbreak of the economic crisis. What can you ask? Getting ready. To what? To the bankruptcy of companies, reduced production, rising prices and unemployment. Well and the most important thing. How to avoid this? If the market is after March 18, 2020 If it remains below 2720, then it is important to shorten all stock indexes, buy gold and other consequences. But how to do it right and how not to “wander like a kitten”, then you need to improve your financial literacy and work on proven strategies. I propose one of these strategies in my training course.

With respect to all of you.

- Artem Yaskiv -