Areas of resistance are very important for the market.vice versa. In addition, the breakdown of the resistance area often leads to rapid price increases.

On June 27, Ethereum encountered resistance ataround $360. A break above this level could trigger an aggressive update to new highs. Until this happens, the ETH rate may accumulate between the current price and the resistance area.

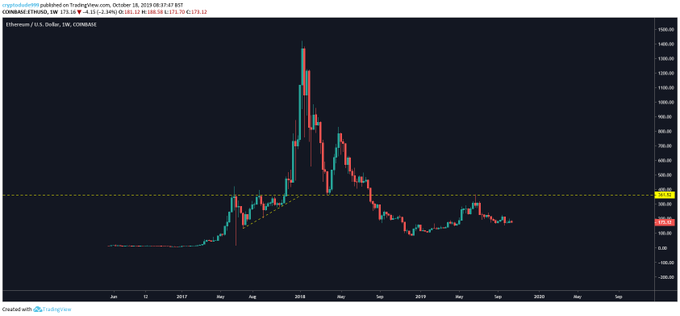

Cryptocurrency analyst @cryptodude posted inTwitter Ethereum's long-term schedule, commenting on it: "My favorite schedule." In his opinion, this schedule will be included in textbooks as a textbook example.

CryptoDude@cryptodude999$ ETH My favorite chart ever. This will go down in the textbooks and get studied in the future.

Сryptodude also highlighted an important line at $360resistance, which manifested itself in May-November 2017 and June 2019. If you look at the chart, you can assume that a breakthrough of this line could lead to price dynamics similar to those observed in 2017. Let's analyze this probability.

Ethereum: area of resistance

So, the weekly Ethereum chart demonstrates that the $ 360 area played a resistance role between May and November 2017.

Subsequently, in April 2018, she supported the price, but then the ETH rate made a bearish breakthrough.

However, this year, on June 27, the same area again showed itself as resistance, outlining new highs in 2019.

And yet, there is one big difference between the two price movements.

During 2017, ETH moved along the lineupward support, which continued until the bullish breakout. Meanwhile, in 2019, the support line held for several months, and then the price made its bearish breakthrough, which turned this line into resistance, from which the price rolled back south. This is a fairly common occurrence after a bearish breakout, and it is often an indication of the potential for further decline.

Analysis of the daily chart shows that the Ethereum rate is trading inside a descending wedge, quickly approaching the expected completion of this model.

Continued at https://beincrypto.ru/esli-by-tolko-ethereum-prorvalsya-vyshe-360/