SP500

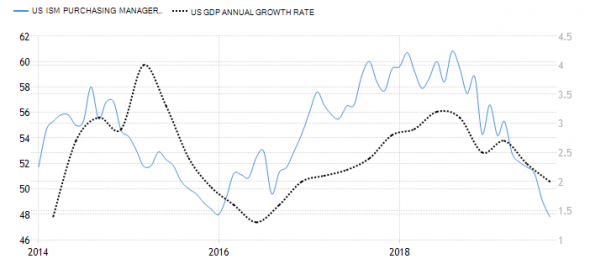

The day before yesterday, October 30, it was announced that the US interest rate would be cut from 2% to 1.75%, which supported the stock marketmarket from premature fall. However, today, November 1, data on the manufacturing sector will be published, which are likely to be worse than the previous ones and, accordingly, will negatively affect both the US stock market and the SP500 index itself. The September indicator is PMI (ism) 47.8 and according to forecasts it will be reduced to 47.2 in October, and this will affect the annual GDP growth rate and will lead to a decrease in this indicator in the future.

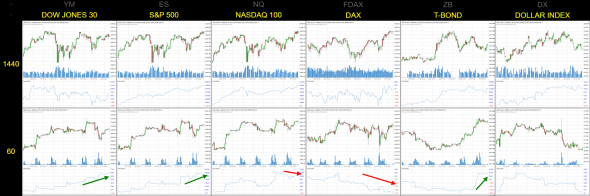

Analysis of futures for SP500, NASDAQ andDowJones on the hourly timeframe is mixed. The DowJones and SP500 indices are upward, while the tech companies NASDAQ index began to decline as the DAX index, and the delta growth in T-BOND treasury bonds reinforces the indices decline.

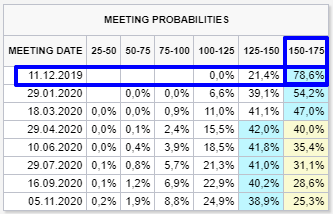

The next interest rate announcement will be 11December 2019 and the likelihood of a decline is currently little obvious. According to FED data, the probability of remaining in the range of 1.75% - 1.5% is 78.6% today.

The estimated interest rate based on US 30 day bonds is 1.55%, which is within the 1.75%-1.5% range.

In terms of technical analysis, the SP500 indexfor several days in a row shows that the intention to continue the upward trend is unlikely, since in the region of 3045 there is a monthly resistance calculated on the basis of volatility. Also, according to data from the stock exchanges for 3 days, there is a negative trend in stocks and sales begin to outweigh purchases. Using this, you can look for deals to lower the SP500 index.

Key areas on November 1, 2019

Daily volatility resistance zone - 3046.4

Daily volatility support zone — 3030.0

Weekly volatility resistance zone — 3046.8

Weekly volatility support zone — 2994.8

Monthly volatility resistance zone — 3092.0

Monthly volatility support zone — 2982.0

If you do not understand the principle of analysis published in this review, then you can contact me or leave a comment