We continue our series of articles devoted to the analysis of the characteristics of the world's first and largest cryptocurrencyBitcoin In the first, second and third parts of the series, we tried to compare and contrast Bitcoin with the existing, but, apparently, not very successful device of the economy and money. Today, let's try to analyze the real costs of the main cryptocurrency for electricity. Is it really that much energy is spent today on BTC mining that would be enough to supply an average-sized city?

</p>Table of contents

Suddenly - Part 1: Bitcoin, not blockchain

Suddenly - Part 2: Here's what Bitcoin decides

Suddenly, Part 3: Bitcoin Isn't So Slow

To be continued…

How many times have you heard the safety instructionsbefore a normal flight in a passenger plane? You probably know it by heart, but before each take-off, the crew instructs passengers traveling with children that they must first put on an oxygen mask on themselves and only then on the children. This is against instinct, but is the most sensible decision. First you need to make sure that you yourself can breathe to help the child.

The same principle applies to the coordinating function of money in the economy and the resources needed to protect that function.It is possible to formulate the instruction of the aircraft crew in a more philosophical way:“Make sure the money supply is safe so thatit was possible to continue coordinating the activity of millions of people building super-complex aircraft, thanks to which one could generally think about the problem of flight safety ”.

We will come back to this, but you cannot understandjustification of the amount of energy consumed by Bitcoin without comprehending the fundamental role that money plays in coordinating economic activity and all that we take for granted. What is money? How do they work? How should they work? What is their function in society? Without understanding these issues, it is impossible to comprehend the magnitude of the problem that Bitcoin is trying to solve. And without understanding the problem, the costs of solving it will always seem unjustified.

Concerned observers constantly sound the alarmdue to the amount of energy consumed by the Bitcoin network. This concern is based on the idea that the energy consumed by the Bitcoin network could be used more productively, or that it is simply bad for the environment. This ignores the critical importance of Bitcoin energy consumption. In the long run, perhaps there is no more important use of energy than ensuring the integrity of the money network - in this case, the Bitcoin network. But this does not prevent those who do not understand the essence of the problem from sounding the alarm.

“The fundamentally wasteful nature of Bitcoin mining means that you can't wait for a simple technological solution.” - The Guardian

“In the context of climate change, raging forest fires and hurricane-breaking records, it’s worth asking yourself uncomfortable questions about the environmental impact of Bitcoin.” - Vice Media

Bitcoin Energy Consumption

Recall that Bitcoin's security is provided by a decentralized network of nodes(computers running the Bitcoin protocol on them)The economic nodes of the network generate, validate, and broadcasttransactions, as well as confirm and broadcast Bitcoin blocks(consecutive transaction groups). Mining nodes, in addition to similar functions,also perform the function of proof of work by generating and computing blocks and passing them to the rest of the network. Performing this work, miners check the history and “clear” current transactions, which then all other nodes check for validity. This is similar to the clearing function of the Federal Reserve Bank of New York, only occurs on a fully decentralized basis every 10 minutes (on average).

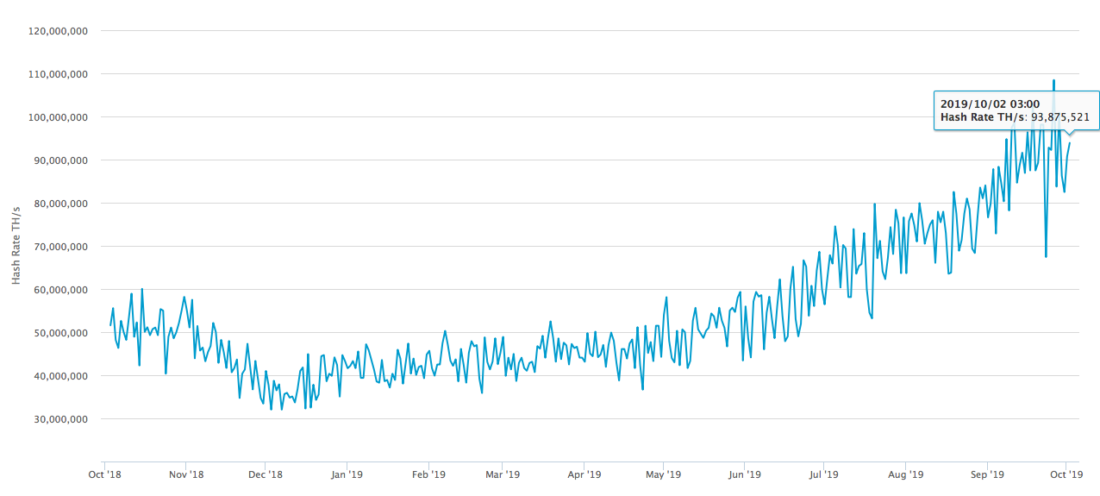

Doing this job requires a huge amount of computing power provided by miners from all over the world, working around the clock and seven days a week.Specifically, at the current computing power of about 95 exahashes/sec, the Bitcoin network consumesapproximately 7-8 GW of electricity, the cost of which is~ $ 9 million per day (or ~ $ 3.3 billion per year)at a price of 5 cents per 1 kWh (rough estimate).That's a lot of energy, but it protectsand supports the Bitcoin network.

How can you justify so much spendingenergy? And how much will Bitcoin consume when a billion people use it? Is the dollar functioning poorly? That's just the point, that is bad. These resources go to solve a problem that most do not understand, which complicates the justification of associated costs. To reassure ecologists and fighters for social justice, we often contrast a number of facts:

- A significant part of the energy consumed by Bitcoin is generated from renewable resources.

- Bitcoin promotes innovation in renewable energy.

- Bitcoin consumes energy that would otherwise be squandered or released into the atmosphere.

- Bitcoin only consumes as much energy as a free market can afford at a free market price.

- Bitcoin consumes energy resources, the development of which would otherwise be unprofitable.

- The nature of Bitcoin's energy demand will improve the efficiency of energy networks.

These aspects help to list the reasonswhy is the opinion that the consumption of Bitcoin energy necessarily wasteful or bad for the environment, in practice is untenable. Nevertheless, such costs cannot be justified without understanding the extent of the monetary problem that Bitcoin is trying to solve. Bitcoin represents a solution to the systemic problems of our old money mechanisms, and its functioning depends on energy consumption. Economic stability depends on the function of money, and Bitcoin provides a more solid monetary system. That is why there is no more important long-term use of energy than securing the Bitcoin network. Therefore, instead of considering individual counterarguments to the mainstream view, it is better to focus on the fundamental problem: the problem of money and global quantitative easing.

Money function

illustrations: BitNews

The problem of money is enormous, although most of itdo not recognize. Most people feel it in their daily lives, but cannot determine the root cause. They work more and more, they are burdened with debt and are still barely making ends meet. There must be some solution, but in order to find it, you must first see and understand the problem. And the problem is connected with our money, and its influence permeates the whole society.

Without going into the details of what money is(read “A Brief History of Money” or Nick Szabo's article “The History of the Origin of Money”), can be given a simplified description of their function in society.Money is a product that promotes economic coordination of parties that would otherwise have no basis for coordinationPut simply, it is a commodity that allows society to function, and it also allows us to accumulate capital that improves our lives and takes different forms for different people.It is said that money is the root of all evil, but Hayek inThe Road to Slaverymore adequately describes them as agents of freedom.

“Money is one of the greatest instruments of freedom ever invented by man.” – F.A. Hayek “The Road to Serfdom”

More specifically, money is a commodity that makespossible specialization and division of labor. They allow individuals to pursue their own interests. With their help, individuals inform the world of their preferences, whether at work or in leisure, which creates a “spectrum of choice” that we take for granted. Our modern economy is built on the foundation of freedom provided by money, but the end result is a very complex and specialized system.

To simplify the concept, Milton Friedmanexplains how no one can independently create a regular graphite pencil. He talks about the required tree, about the saw needed to cut it, about the steel from which the saw is made, about the iron ore from which steel is made, about graphite, about the rubber from which the rubber is made, about the brass ring, about the yellow paint , about glue, etc. He explains how the manufacture of a conventional pencil requires the coordination and cooperation of thousands of people who speak different languages, profess different religions and, possibly, even hate each other. He also explains that their cooperation is possible thanks to the price system and economic product, which we call money.

Abstracting from the pencil, think now aboutthe complexity of the modern economy. From cars to airplanes, the Internet, mobile phones and even your local supermarket. Modern supply chains are so complex and specialized that the coordination of millions of people is required to fulfill these basic functions. The organization of all this activity, on which global commerce rests, is possible only thanks to the function of money.

Case Study: Venezuela

illustrations: BitNews

Venezuela provides an illustrative example of the most importantthe role of money in economic coordination and the dysfunction arising from the failure of a monetary commodity. Venezuela is one of the richest oil countries in the world, but the Venezuelan currency has recently experienced hyperinflation. With the depreciation of the currency, the basic economic functions were disrupted so much that it was not easy to buy food or get medical help. This is a full-blown humanitarian crisis, rooted in the fact that Venezuela no longer has a stable currency to coordinate economic activity and produce goods needed for trade in the global economy.

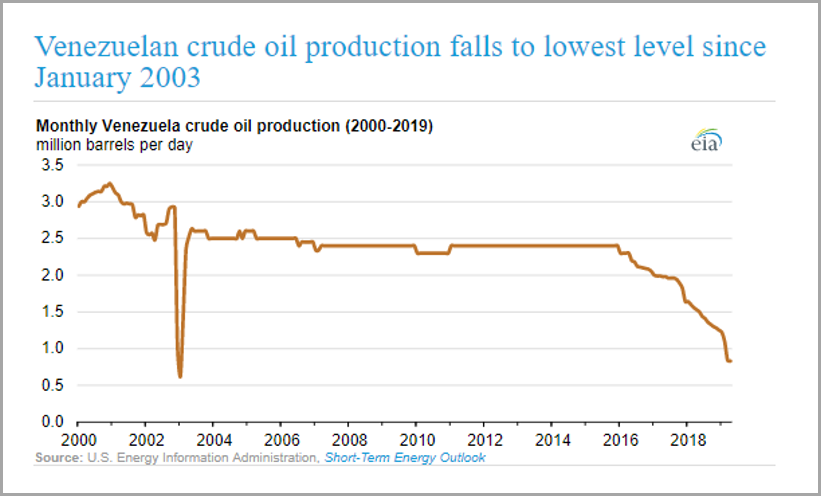

How does this relate to Bitcoin and energy consumption?Venezuela is a country rich in energy and oilwas and remains its main export product, or rather a commodity that it needs to produce in order to trade. And despite this, Venezuelan oil production is falling.

Venezuela is no longer able to importtechnology or coordinate the resources needed to extract its main trading currency (oil). This caused a significant deterioration in the local economy, affecting the ability to produce electricity for national power grids, which led to prolonged outages and interruptions in the supply of water and the provision of medical services.

The catastrophic situation in Venezuela is a consequenceeconomic deterioration caused by hyperinflation of an unstable currency. Monetary depreciation distorts currency pricing mechanisms, which creates economic imbalances. As economic coordination deteriorates, complex supply chains are disrupted, leading to a decline in the supply of real goods.(e.g. products on store shelves, oil production, etc.)and creates an imbalance of supply and demand.As more and more money is created, real goods become scarce relative to the money supply, leading to a breakdown in the function of money. People are not motivated to hold currency as real goods become more and more scarce, and prefer to get rid of it as quickly as possible by buying essential goods, which leads to hyperinflation of the currency. Thus, monetary manipulation leads to a deterioration in the economy.

Relevance for developed countries

Residents of developed countries who feel comfortable looking at Venezuela may think:“This will not happen here”. But the most basic principles are ignored. The market structure of Venezuelan bolivar or Argentine peso is identical to the structure of the dollar, euro or yen. Perhaps the Federal Reserve System (FRS), the European Central Bank (ECB) and the Bank of Japan manage stability better (for now), but this does not change the fact that the basis of all fiat currency systems is the same.

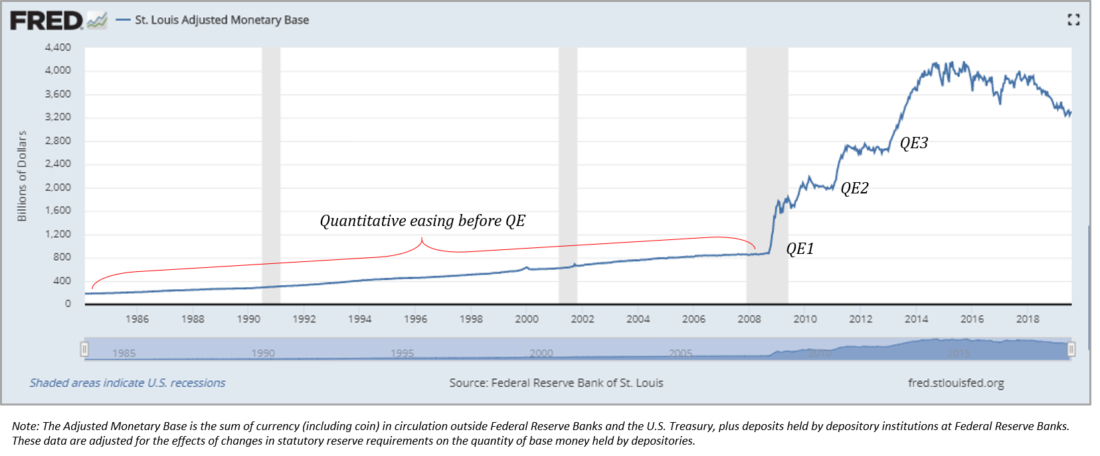

: Federal Reserve Bank of St. Lewis

If you consider the example of the United States, the Fed increasedthe monetary base from $ 180 billion in 1984 to $ 4.2 trillion at its peak after the third round of quantitative easing, i.e. 23 times. Due to the nature of the Fed’s credit economy, the economic distortion caused by this depreciation was gradual (see here) until a financial crisis suddenly ensued. And due to the large-scale quantitative easing needed to “ease” the crisis, the United States went even further in the same direction. If you think that Western countries are not in a precarious situation or have not the same financial reasons as in Venezuela, then I would, with all due respect, point to zero patients: the Fed, the ECB and the Bank of Japan. Faith in these institutions is often blind to basic principles and common sense, but read the following words from the Fed economist after the financial crisis, when the Fed was in the process of creating $ 3.6 trillion in quantitative easing:

“I would like to emphasize that I think we have big gaps in understanding the interaction of the financial sector and the real economy.” - David Wilcox, Fed Economist (August 2011)

An unbiased view of history demonstratesthe bad character of those entrusted with the central control of our economies. Despite acknowledging large gaps in understanding the consequences of their actions on the real economy, the response has been to continue the same policies, only on a larger scale, expecting a different outcome - this is, by definition, insanity. We are faced with a choice of two sharply contrasting options:a) the centrally planned currency, by default losing value;orb) a decentralized currency with a fixed supply.The second option has costs in the form of energy consumption, but its positive consequence will be long-term economic stability.

Economic stability through energy consumption

Future economic stability –the fundamental reason why there cannot be a more important source of demand for energy consumption than the security of the Bitcoin monetary system, especially when alternatives(fiat currency and gold)have structural flaws.If we wait for signs of hyperinflation, then we have already lost. However, Venezuela is not just an example of what happens as a result of hyperinflation, but also clear evidence of the importance of energy production to the functioning of society. Energy is required for everything we consume in everyday life. Coordinating the consumption of this energy depends on the reliability and stability of the money we use.

Ignore your morning coffee for a moment and think about the most basic needs:clean water, hygiene, medicine, healthcare, etc.Coordinating resources to meet thesebasic needs depends on the functioning monetary system. When the monetary system breaks down, social coordination and even the social structure itself begins to break down. If the basis of all trade is energy, and if we need money to coordinate trade, then the first and best use of energy is to protect the monetary system. First you need to put on an oxygen mask and only then take care of others. First you need to secure the trading foundation and only then focus on all derivatives.

Concerns over Bitcoin's consumptionenergies distract attention from the main thing. This is not about sacrificing electricity that could light up homes. We won't have the electricity to light these houses without a reliable monetary system that coordinates economic activity and organizes resources. In practice, Bitcoin will not compete for those resources that provide the basic production and consumption functions of the economy(this is not a zero sum game) Instead, Bitcoin's function as a monetary system will be to ensure that these energy needs continue to be met.

It will be bad for society if other countriesThey will repeat the economic and humanitarian catastrophe of Venezuela, where reliable satisfaction of medical and social needs is impossible. And the point is not to describe the harsh picture of the anti-utopian future, but to convey the importance and interconnectedness of monetary and energy functions in a complex, specialized economy.

“If even one case can be preventedhyperinflation like what happened in Venezuela, Bitcoin's energy consumption will be the best deal in the history of mankind." – Seyfedin Ammous, The Bitcoin Standard Research Bulletin

Bitcoin is a backupa switch of the current architecture of the global financial system, which will soon become its main engine. Even without considering the systemic risks that our financial system is currently suffering from, Bitcoin is initially a more solid monetary system. And the safety of this system is ensured by the production and consumption of energy. It is not necessary to believe that the dollar is waiting for the fate of the Venezuelan bolivar to recognize the significance and interdependence of the monetary function and the production of energy resources that ensure the satisfaction of basic economic needs. And the risks inherent in even the likelihood of hyperinflation are so negatively asymmetric that the energy costs of Bitcoin are relatively small.

Bitcoin will consume as much energyresources, how much is needed to ensure the security of its monetary network, and the main driver is the demand for BTC as a currency. The more people appreciate the long-term stability provided by Bitcoin, the more it will consume energy. Ultimately, this consumption will guarantee continued satisfaction of all other energy consumption needs. That is why there is no more important long-term use of energy than securing the Bitcoin network. At stake is economic stability and freedom provided by a stable monetary system - this is a true justification for the amount of energy that Bitcoin should and will consume.

Everything else is just a distraction.

Do not forget to read BitNews, - we still have a lot of interesting thoughts ahead.

</p>