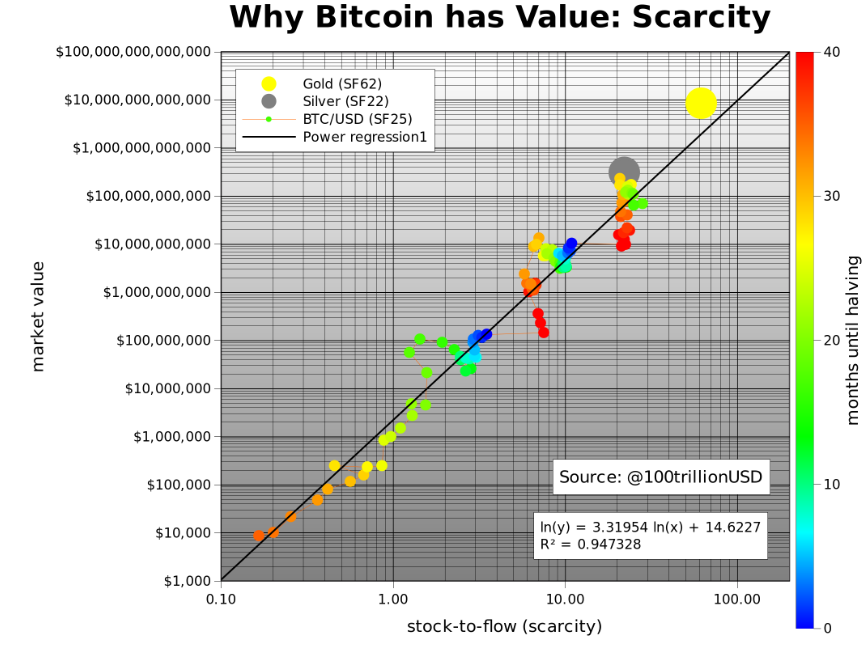

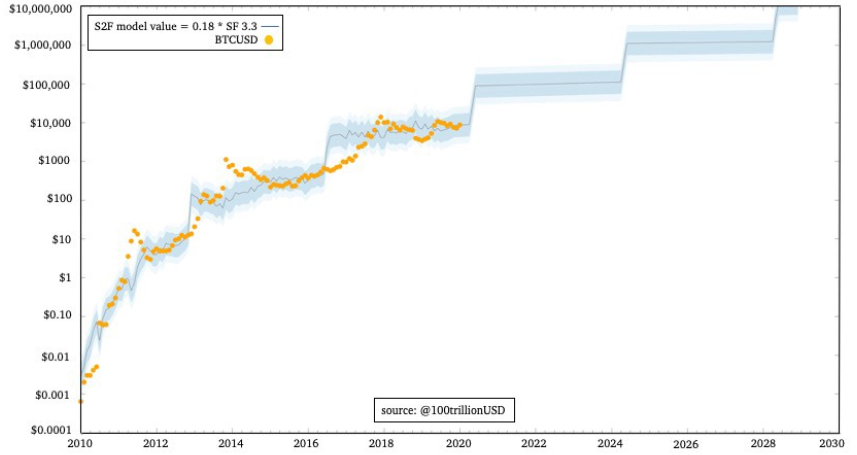

The Bitcoin Stock-to-Flow (S2F) model was published in March 2019. The model was approved by the crypto community, and manyAnalysts confirmed compatibility with the S2F model and confirmed BTC price forecasts.

However, the matter was not without criticism.This model was counterbalanced by the efficient market hypothesis (EMH). In an article entitled “Efficient Market Hypothesis and Bitcoin Stock-to-Flow Model” PlanB analyst shared his personal perspective on the S2F and EMH model, analyzing arbitrage opportunities, the risk-return model, and derivatives markets.

Stock-to-Flow model

PlanB created the S2F model for Bitcoin. This move was inspired by Nick Szabo's concept of careless scarcity, and the analysis of S2F by Syfed Ammous.

Nick Proudsta was the first to check (or ratherapproved) the S2F model, adding a cointegration analysis, thereby confirming the authenticity of the correlation. In turn, Marcel Burger tested both the S2F model and the cointegration with several statistical tests.

Effective Market Hypothesis

The efficient market hypothesis (EMH) is goodfamous theory in financial economics. EMH is based on the ideas of Friedrich Hayek and other experts. According to him, markets are information processing systems that provide the best price disclosure.

EMH is formally described by Eugene Fama (Nobel Prize 2013) and has three forms:

Most investors and economists agree that modern financial markets are quite efficient (that is, they accept the weak and moderate form of the EMH), but they reject the strong EMH.

Thus, the S2F model may be more interesting because it is based on publicly available data (S2F).

Risk and return

In practice, it can be assumed that EMH uses a risk and return model.

Some argue that Bitcoin markets are noteffective, but this is not the case. In the old days, you could buy Bitcoin on one exchange in US dollars and shortly thereafter sell it on another exchange in euros or yen and convert it back into US dollars at a profit, i.e. arbitrage. Those days are over, and there are no easy arbitrage opportunities in the Bitcoin market anymore. Therefore, it is safe to assume that the $170 billion BTC market with a daily transaction volume of $10 billion is quite efficient.

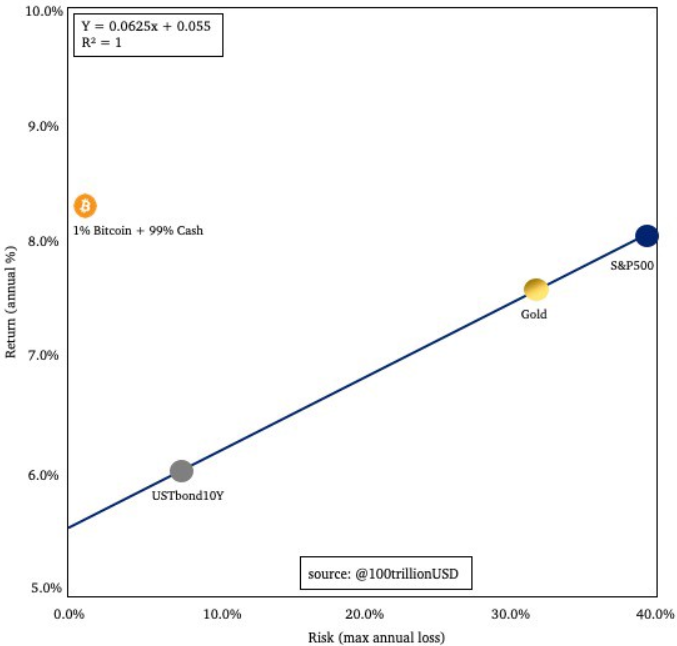

Risk and return model

In turn, EMH and the absence of arbitration leadus to the risk and return model. Harry Markowitz introduced the early risk and return model in his famous portfolio theory. In his opinion, any income depends on risks.

The following is a simplified risk and return model:

The X axis of this chart is – risk (maximum annual loss), and the Y axis – income (average annual income).

The chart shows three classic assets: bonds, gold and stocks. Bonds have the lowest risk of 8% and the lowest yield of 6%. Gold has a higher risk of 33% and a higher yield of 7.5%. Shares have the highest risk of 40% with an income of 8%.

Income can only be explained by risk, inaccording to EMH. Therefore, if an asset is located above the line, it represents an excellent investment opportunity. If an investor calculates that the risks are below market prices, and he knows exactly why the asset is above the line, then and only then should he decide to invest.

Bitcoin is literally “off the charts”:profitability 200%, risk 80%. Since the asset cannot be charted, its size was changed to 1% BTC plus 99% cash investment. This BTC investment is well above the line: 8% return, 1% risk (note that you can't lose more than 1% even if BTC drops 99% because the investment is only 1%). However, the market sees certain risks. Here is a list of some of them:

But it seems that these risks have been overpriced by the market, and BTC does provide an excellent investment opportunity, according to the S2F model.

Derivatives

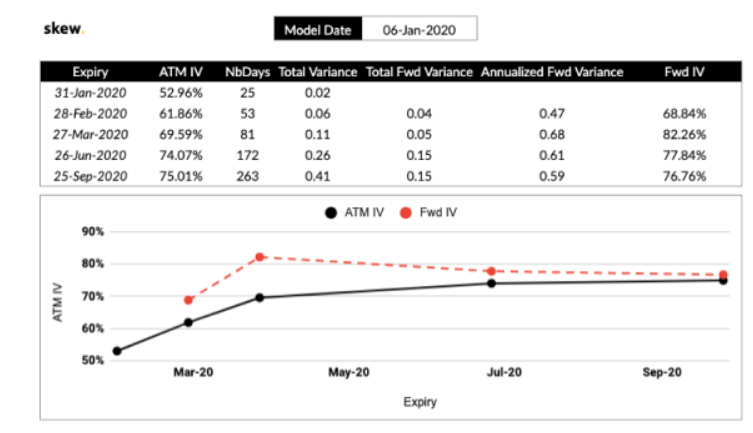

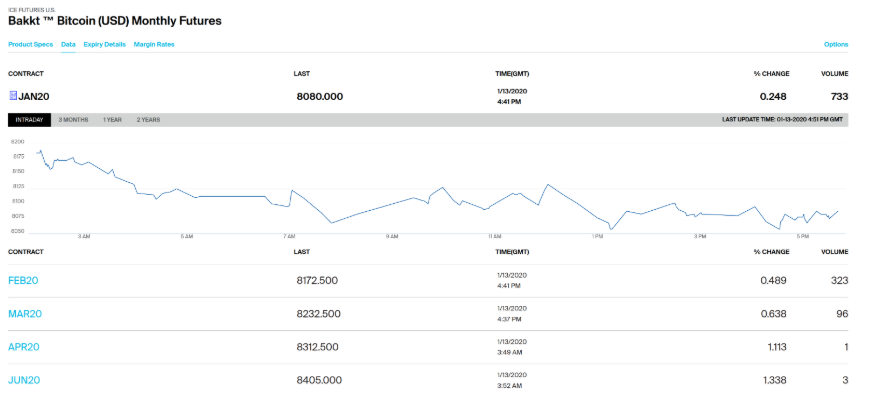

Let's look at what the derivatives markets tell us about the future. Options markets show no jump on or after the following contraction:

The same story for the futures market: slightly higher prices in the future, but without a jump in or after a halving, which indicates that nothing special will happen when halving:

This is interesting because the S2F model predicts much higher prices after the cut.

Therefore, most likely, the market is currently overestimating future risks. An efficient BTC market not only does not take into account the fundamental cost of the deficit (S2F model), but also all these risks:

In turn, most institutionsThey are afraid that the government is making Bitcoin illegal. Another risk often cited by institutional investors is – it is a new coin (government/central bank backed) that will replace Bitcoin.

Note that without all these risks, the cost of BTC would be much higher.

Over time, some of these risks will notimplemented and disappear from the list. Take, for example, the surrender of miners. If the hashrate does not decrease upon the occurrence of the upcoming halving, the risk of surrender of miners will disappear, and the price of BTC will increase, because the risk has disappeared.

In addition, there is a possibility that Bitcoin will intersect with the S2F line of traditional assets such as gold, platinum and others over the next few months.

In 3 months we will have a second S2F50+ asset. Very interesting how markets will value it?pic.twitter.com/GtzYrnPPYh

— PlanB (@100trillionUSD)February 1, 2020

Therefore, BTC markets are really quite effective, and investors at this stage simply overestimate the risks that accompany the further development of the asset.