An analyst at PlanB, known for developing the stock-to-flow (S2F) statistical model for Bitcoin (BTC), claims that the leading cryptocurrency has entered the next stage of its market cycle.

S2F ratio is calculated as currentthe offer of an asset divided by the new issue over a specified period of time and is used to determine its deficiency or excess. Typically, it applies to commodities such as gold, which has the highest S2F ratio, which indicates the limited availability of new revenue compared to an existing offer.

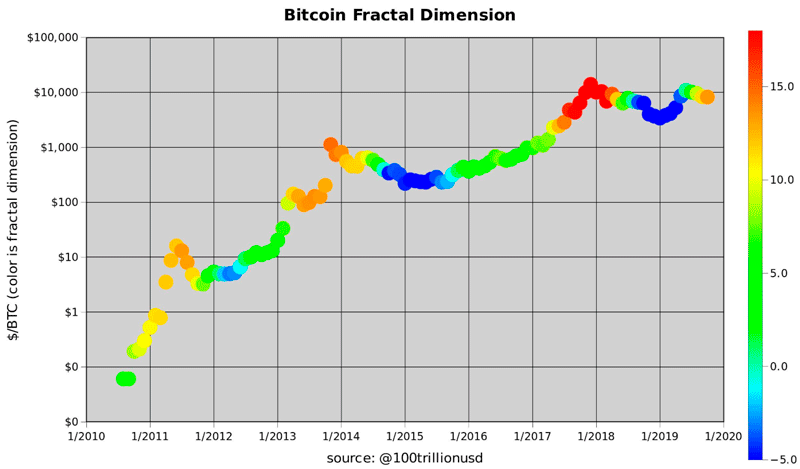

“The fractal dimension of Bitcoin indicates that we are entering a new phase - on the chart it is marked in red and orange,– writes PlanB.

Although it may not seem like that now, I am looking forward to moving over the next 6-12 months. ”

Fractal dimension reflects the ratio of twoquantities where a change in one of them entails a proportional change in the other, regardless of the initial values. In other words, in the S2F model, the behavior of bitcoin at a price of $ 10,000 will be similar to movements at a rate of $ 10.

“This is one of the possible models on the basis of which investors can evaluate bitcoin,– developer Pierre Rochard said in a conversation with BlockTV.

The higher the ratio, the lower the pressure of sellers when trading on a daily basis. ”

At the same time, Roshar admits that in the historical context, the price of the main cryptocurrency tends to deviate from the model both up and down.

“If you are trying to embed bitcoin in yourportfolio and think about whether you are overpaying or buying at the right time, then the model can become a significant indicator for you. Probably the best time to buy was in December, and now the model shows the correspondence of the course. If you want to buy, please, if you do not want, then you will not be mistaken either ”- he added.

Earlier this week big German analystsBayernLB Bank published its own study on the basis of the same model, in which it was concluded that the price of bitcoin, if the model matches, could rise to $ 90,000 against the upcoming halving in 2020.

“If in May 2020, the S2F ratio of bitcoinfits into this model, a dizzying price of $ 90,000 is formed. It will also mean that the upcoming halving was hardly reflected in the current bitcoin price of about $ 8,000 (according to the model, the price should be about $ 7,500) ”They claim.