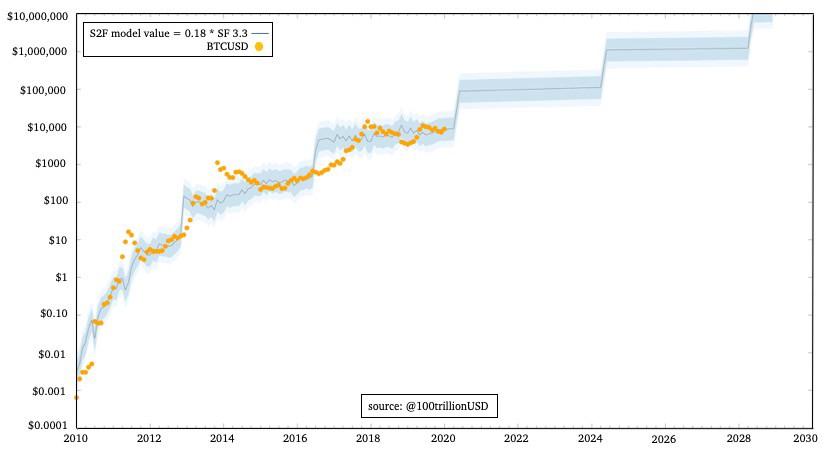

The Stock-to-Flow (S2F) model for Bitcoin was first published in March 2019 and was well received.adopted by bitcoiners and investors. Many analysts verified the co-integrated S2F model and confirmed Bitcoin price forecasts [1, 2 (eng.), 3 (eng., PDF)].

The S2F model, however, also has its share of criticism.earned. The best argument against it is based on the hypothesis of an effective market (hereinafter referred to as GER). The meaning of this counterargument is that, since the model is based only on publicly available information (S2F, Bitcoin's supply volume trajectory), therefore, the result of this analysis and all relevant conclusions should already be included in the price.

In this article, the author of the original publication onThe S2F-model shares its opinion about this model and the hypothesis of an effective market, analyzes the opportunities for arbitrage, the risk and return model, as well as derivatives markets.

Stock-to-Flow Model

S2F model was published as an evaluation modelBitcoin, inspired by Nick Szabo's concept of falsified deficiency and S2F analysis by Sayfiddin Ammus. S2F is a measure of scarcity. The power-law relationship between S2F and the price of bitcoin over time reflects the fundamental pattern of the complex dynamic system of bitcoin network effects described by Trace Meyer.

The S2F model is a power function built on the basismenstruationdata for the period from October 2009 to February 2019, BTC price = 0.4 * S2F ^3 (where S2F = 1 / inflation rate). A later model based onper annumdata from 2009 to 2019, gives higher predictions: BTC price = 0.18 * S2F ^3.3

Nick @phraudsta was the first to verify first (orbetter to say «not falsified») S2F model and added cointegration analysis to it, showing that the correlation is probably not spurious. Marcel Burger verified both the S2F model and cointegration using several additional statistical tests. Manuel Andersch was the first institutional investor (BayernLB) to test the S2F model and cointegration.

Effective Market Hypothesis

GER - well known in the economics of financehypothesis based on the ideas of Friedrich Hayek (Nobel Prize Laureate from 1974) and others. According to Hayek, markets are systems that process information and provide the best possible pricing.

GER is formally described (English, PDF) by Eugene Fam (2013 Nobel Prize) and is known in three versions:

- Weak GER: historical price data are already accounted for in the market value and cannot be used for profit. Technical analysis and time series analysis do not work.

- Semi-strong GER: News publications in media sources such as MSNBC, Bloomberg, WSJ, or research companies are already market value sensitive and cannot be used for profit. Fundamental analysis does not work.

- Strong GER: even insider information cannot be used to make a profit, sinceallthe information is already included in the market value.

Most investors and economists agree that modern financial markets are quite efficient (i.e., they recognize a weak and semi-strong GER), but do not recognize a strong GER.

According to the ERT, the S2F model should already be factored into market value, since it is based on public data (S2F).

Risks and Profitability

To be honest, in all my 20+ years as an institutional investor managing multi-billion dollar (euro) balance sheets, I have never used the ERR directly. In practice wetake into accountGER andapplyrisk and return model.

Taking GER

Some argue that bitcoin marketsineffective, but I do not agree with this. In previous years, you could buy bitcoin on one exchange for dollars, immediately sell it on another exchange for euros or yens and convert them back into dollars with profit - arbitration was possible. These times are a thing of the past (prices here are on 01/13/2020, 20:00 GMT):

BTCUSD = 8100

BTCEUR = 7300

BTCUSD / BTCEUR = 8100/7300 = 1.11

EURUSD = 1.11

BTCJPY = 885,000

BTCJPY / BTCUSD = 885,000 / 8100 = 109

USDJPY = 109

Maybe with powerful computers, fastCommunication lines and algorithms for high-frequency trading can still make money on this, but there are no more simple possibilities for arbitration.

It can be confidently argued that the $ 150-billion-dollar bitcoin market with a daily volume of $ 10 billion is quite effective.

Risk and return model

GER recognition does not mean impossibility of earningin the markets. You just have to fully accept the associated risks. GER, coupled with a lack of arbitrage opportunities, brings us to risk and return models.

Harry Markowitz (1990 Nobel Prize) in his famous portfolio theory introduced a minimal risk model. William Sharp (1990 Nobel Prize) published his well-known capital asset pricing model. From the point of view of Markowitz and Sharpe, any profitability can be explained by risk.

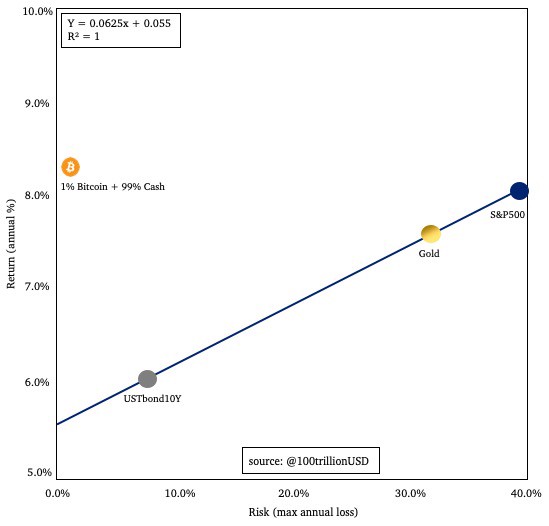

This is a simplified model of risk and profitability, without correlation or exotic mathematical calculations:

Bonds, gold, stocks: data for 1955–2019 Bitcoin: data for 2009–2019

This schedule is very important to understand, so let's pay more attention to it.

The X axis on this chart is risk (maximum annual loss), and the Y axis is profitability (average annual income).

The chart shows three classic assets: bonds, gold and stocks. Bonds have the lowest risk ratio of 8%, but also the lowest yield of 6%. Gold has a higher risk ratio of 33% and a higher return of 7.5%. Shares have the highest risk ratio of 40% and at the same time the highest yield of 8%.

The key point is that, inAccording to the hypothesis of an effective market, profitability can be explained by risk alone. If you come across an asset above the line, at first glance it might seem that this is a great investment opportunity. However, a more appropriate reaction from the point of view of the ERT and in the absence of arbitration opportunities would be that it is too good to be true. Most likely, we are missing out on some risks (or we have calculated them incorrectly) and we should check whether we can return this asset to the line. It is not easy to quantify risk (volatility), as well as the level of expertise of specialists in exchange analysis in financial organizations. If the investor has calculated that the risk is below the market price, and if he understands exactly why the asset is currently below the line, then and only then can he decide on an investment in this asset.

Bitcoin's position literally «doesn't fit ongraphics». Profitability 200%, risk 80%. Since I couldn't plot it on this graph that way, I recalculated the numbers for a 1% Bitcoin investment and a 99% cash investment. Even this investment in Bitcoin is well above the line: 8% return, 1% risk (note that in this case you cannot lose more than 1% even if the price of Bitcoin falls by 99%, because you are only investing 1%). And if so, then my first reaction was this: the market sees risks that are not in the available data. Here is a list of some possible risks:

- Bitcoin Crash Risk

- The risk that governments outlaw Bitcoin and harass its developers

- The risk of fatal software errors

- Exchange Hacking Risk

- 51% attack risk from centralized miners

- The risk that the business of miners will go into a death spiral after another halving

- Hard fork risk

In terms of GER and risk and return models,All these risks must be taken into account in price data. But this is not so. According to the GER and the risk and return formula used to construct the schedule, 1% of the risk should give 5.5% + 6.2% * 1% = 5.6% of the return. Whereas historical data show that for 1% + 99% in money, the yield was 8% over the past 11 years.

It seems that the market overestimated these risks, and that Bitcoin was indeed a great investment opportunity, in full accordance with the S2F model.

Derivatives Markets

Let's see what derivatives markets can tell us about the future.

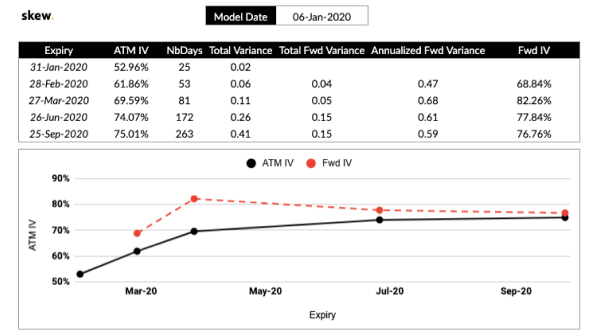

There is no jump in the option markets during or after the next halving:

: https://twitter.com/skewdotcom

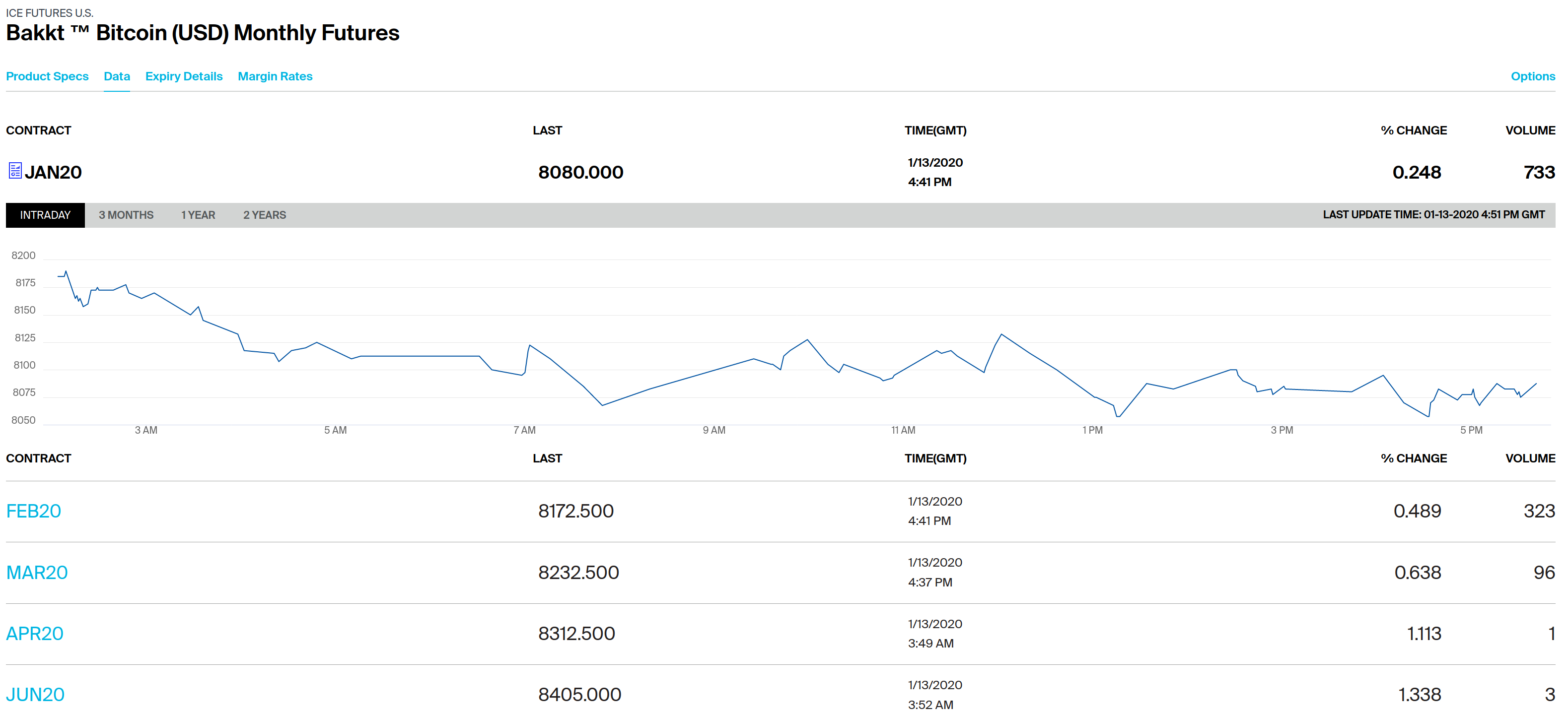

The same applies to the futures market: the mood is rather optimistic, with slightly higher prices in the future, but without a sharp increase in the approximate period of halving or after it:

: https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures/data?marketId=6137544.

This is interesting because the Stock-to-Flow model predicts much higher prices after halving. How can this be interpreted?

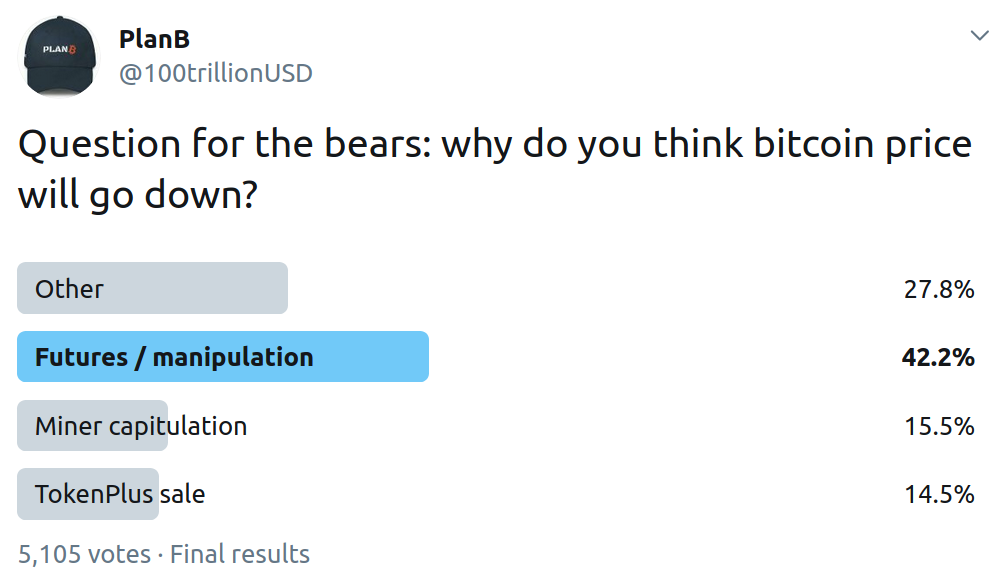

I think the simple answer is thatthe market today overestimates future risks, as it has done in the past 11 years. An effective bitcoin market not only does not take into account the fundamental value of scarcity (S2F model), but also lays down all these risks in the price:

- 42% of investors view Bitcoin futures as the biggest risk (whales and governments are manipulating the price of Bitcoin through «paper Bitcoin», spoofing and wash trades).

- 16% are still afraid of the surrender of miners after halving.

- 15% are afraid of pressure from the sale due to regular cases of fraud.

- From conversations with institutional investors, I know that what scares them the most is that the government can outlaw Bitcoin.

- Another risk that is often mentionedinstitutional investors, this is the emergence of a «new Bitcoin», a new (government or central bank issued) currency that will replace Bitcoin.

Please note that without all these perceived risks, the market price of bitcoin would be much higher and, possibly, would be consistent with the S2F model.

Over time, some of these risks are not realized anddisappear from the list. Take, for example, the risk of surrender of miners. I do not consider its likelihood of its realization to be of any significance, but 15% of investors obviously think differently. If the hashrate does not decrease after the next halving, the risk of surrender of miners will lose its relevance for investors, and the price of bitcoin will rise.

Conclusion

The Stock-to-Flow, S2F) Bitcoin model was introduced in March 2019.

The efficient market hypothesis implies that S2F and the forecast model based on this coefficient are already taken into account by the market, because the S2F model is built on the basis of public data on S2F

Today's bitcoin markets are indeed quite effective, as they do not provide simple arbitrage opportunities.

However, a comparison of historical market databonds, gold, stocks and bitcoin shows that participants in the bitcoin markets tend to overestimate the risks associated with them. Bitcoin's profitability did not match the risk, but in many respects corresponded to the S2F model. Bitcoin options and futures markets do not yet show signs of a price increase around or after the next halving. Perhaps the markets are still overestimating future risks.

My conclusion is that bitcoin marketsreally effective enough, and the forecast of the S2F-model is also already laid down in the market price, but at the same time, the markets systematically overestimate the risks. Therefore, I prefer to use the S2F model for forecasting bitcoin prices rather than the classic risk and return models.

So I accept the efficient market hypothesis,and whereinI would pick up that bitcoin from the picture at the beginning of the article.

</p>