The May correction led to a sale of cryptocurrencies and an increase in the net influx of Bitcoin to exchanges, but in Junethe situation has stabilized: swaps have returned to normal, and whales have increased their total stocks.

Image Source: StormGain Cryptocurrency Exchange

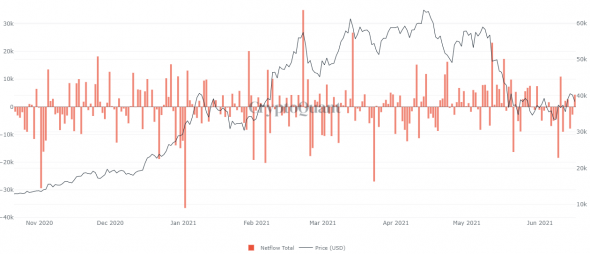

Elon Musk and the Chinese government caused 42%market decline, due to which the holders of long positions only on March 19 lost over $ 8 billion. Net inflow to the exchanges increased significantly, but already in June the outflow of Bitcoin began to dominate.

Image Source:cryptoquant.com

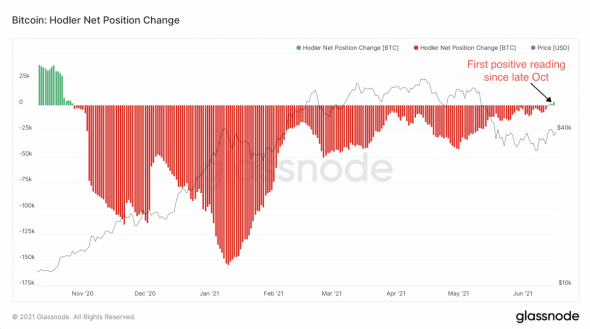

Over the last 25 days, whales (from 100 BTC to 10,000BTC) increased their total reserves by 90,000 BTC or $3.4 billion. Hodlers holding coins for at least six months began buying more than selling (net purchases) for the first time since October 2020.

Image Source:coindesk.com

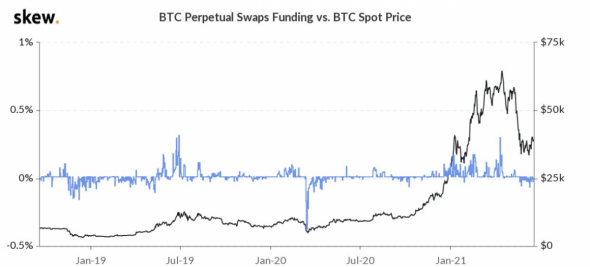

In May, the funding rate for perpetualfutures contracts were heavily inflated due to pressure from buyers using leverage. In most cases, each such surge leads to a price correction. Now the rate is back to normal, and traders do not need to overpay for holding long positions.

Image Source:skew.com

Also, the price is positively affected by the recognition of the cryptocurrency as legal tender in El Salvador and the increase in the inflation forecast for 2021 from the Fed to 3%.

Last year, a cryptocurrency rally was fueled byan influx of institutional investors seeking inflation insurance. It looks like their bet is starting to pay off. Jamie Dimon, CEO of JPMorgan, previously talked about Bitcoin's potential to replace gold as a safe haven asset. Morgan Stanley CEO James Gorman recently announced that inflation will not be transient, as the Fed expects. Probably, in the near future we will see a surge of interest in Bitcoin, since the regulator prints from $ 120 billion monthly, and the first increase in the key rate by Jerome Powell is seen not earlier than 2023.

Analytical group StormGain