More and more signals are coming from the cryptocurrency market in favor of continued growth: miners are holding backBitcoin on their wallets, ASIC deficits widened, and institutional investors' assets increased by 50% last month. Let's consider these indicators in more detail.

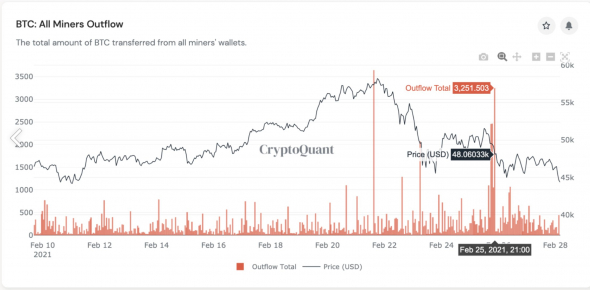

Correction of Bitcoin from $ 58 thousand occurred due tominers, as they have significantly increased sales. However, after the second price reduction to $ 45 thousand, their activity has significantly weakened. The network capacity (hash rate) continues to grow, which, together with the drop in sales volumes, indicates the desire of miners to keep a part of Bitcoin in the hope of further growth.

A sign of growing demand for cryptocurrencies isthe hype around ASICs. Bitmain last year pointed to a six-month long order queue. Recently, Innosilicon's stopped accepting new orders, and Canaan announced an agreement with Core Scientific and Hive Blockchain for the supply of 12.5 thousand machines (the total volume of pre-orders exceeded 100 thousand ASICs). The shortage of ASICs has also affected the secondary market; on Ebay, the Whatsminer M20S with a power of 68 TH/s is asking an average of $5,000.

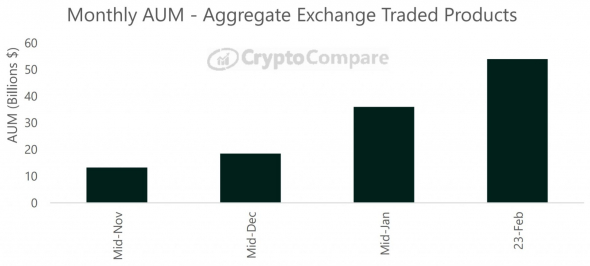

New institutional institutions are entering the marketinvestors. According to Cryptocompare, total assets under management (Assets Under Management - AUM) from mid-January to February 23 increased by 50% to $43.9 billion.

Leadership continues to be held by Grayscale, whose fund has $ 35 billion worth of Bitcoin. In its Q4 report, the company disclosed the share of institutional investors: 93% of total capital inflows.

Financial holding JPMorgan, famousa 180-degree turn on cryptocurrencies, recommends investors keep 1% of their portfolio in Bitcoin on a “risk-adjusted” basis. According to the bank's long-term forecast, the coin's value could reach $146,000.

Despite the high cost of Bitcoin, capitalcontinues to arrive in this sector of the economy. This trend, coupled with the desire of the leading players to hold on to the asset, can lead to further growth in value.

Subscribe not to miss out on a great idea!

Analytical group StormGain