During a major correction in the crypto market, the behavior of retail and institutional players differs. Exceptionthe current fall of Bitcoin by 36% from the historical maximum has also disappeared.

Elon Musk's variability was superimposed onan overheated market that tripled in the first 4 months of 2021. At the same time, Tesla did not sell the rest of the coins (according to Musk's assurances), but the refusal to accept BTC as payment provoked a slight panic in the market.

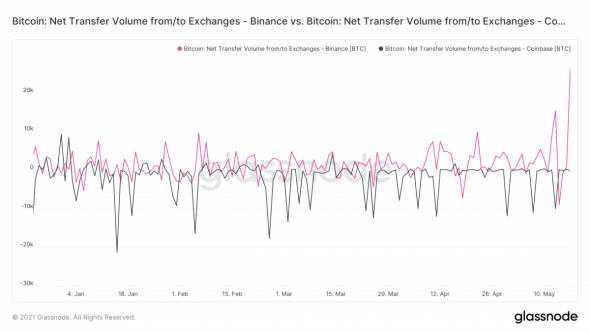

As in the previous year, following the relativelywith a major drop, retail players began to transfer bitcoins from wallets to exchanges for sale. At the same time, institutional investors buy cryptocurrency at discounted prices. The difference in player behavior is noticeable due to the differences in target audiences of crypto exchanges. Binance is predominantly traded by private traders, while Coinbase is dominated by institutional players.

Image source: glassnode.com

On May 17, Binance recorded a net inflow ofvolume of 26 thousand BTC, at the same time Coinbase recorded a net outflow of 146 BTC. Likewise, the big players bought back the fall in March 2020.

The CEO doesn’t lag behind his colleagues eitherMicroStrategy company Michael Saylor, who on May 18 announced the purchase of 229 BTC ($10 million) at a price of $43,663/BTC. The company's total balance exceeds 92,000 BTC ($2.3 billion).

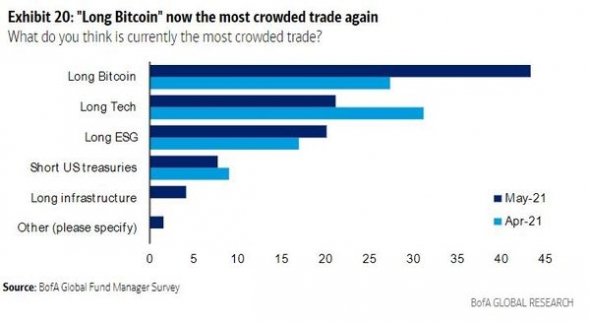

Meanwhile, a different approach is demonstrated byanalysts. Thus, Carter Worth from Cornerstone Macro predicts a collapse to $29,000, which corresponds to the traditional deep drawdown of the coin of 55% of the achieved ATH (All Time High). Bank of America surveyed 194 investment fund managers and recorded increased interest in Bitcoin as a long-term investment.

Image Source:cointelegraph.com

There is also a third category of investors whodo not choose between buying or selling Bitcoin, but investing in the most promising altcoin - Ethereum. At the moment, its capitalization is 45% of Bitcoin.

Image Source: StormGain Cryptocurrency Exchange

The founder of Ark Invest believes thatInstitutional investors underestimate Ethereum, which is why her fund bought $ 21 million worth of Ethereum Trust Grayscale in the first quarter. The choice was right, as Ethereum Trust Grayscale is up 179% this year, while Grayscale BTC Trust is up only 1.7%.

When do you think the Bitcoin correction will end? Let us know in the comments!

Analytical group StormGain