Every time Bitcoin stumbles over another round level, we read in the comments about its imminentdeath and deflation of the bubble. Consider three recent metrics that indicate continued growth.

Mining profitability

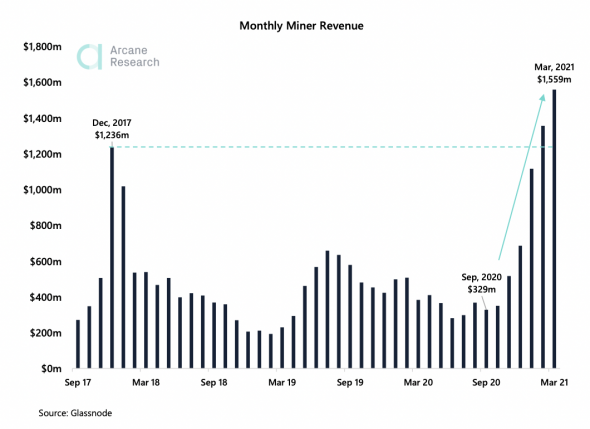

With the rise in the cost of cryptocurrencies by mininginterested in large companies and investment funds. Pools began to form to improve the efficiency of crypto mining, and the queue for ASICs stretched for six months. It would seem that the increased complexity should have hit the miners' income, but this did not happen due to the growth in the number of transactions and the cost of Bitcoin. Miners on this network earned a record combined revenue of $ 1.6 billion last month.

Increasing mining income, on the one hand,will stimulate manufacturing companies to release more efficient devices, and on the other hand, will involve new participants in the field of crypto mining. The latest predictions are provoking investors even more, for example, the CEO of the crypto exchange Kraken believes that by the end of the year Bitcoin will cost as much as one Lamborghini.

Inflow of funds

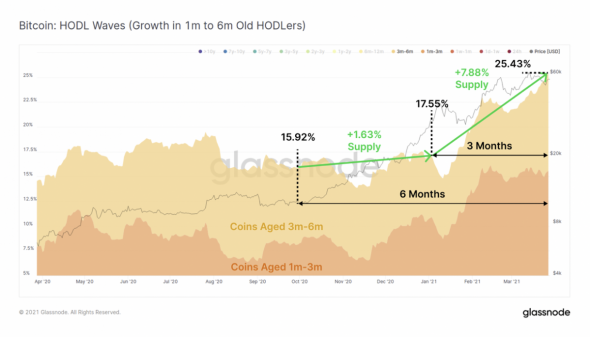

Bitcoin’s rally from $10,800 to $58,800 was driven by new players who bought up a quarter of the supply during this period, while the number of hodlers has grown fivefold over the past six months.

Many people consider Bitcoin as a savings instrument - they buy it and immediately withdraw it to cold wallets. And the more the price rises, the stronger the trend.

Big fish

In many ways, the Bitcoin rally took place thanks tothe Fed's policy and the search by investors for a new non-inflationary "safe haven". JPMorgan has already admitted that it was wrong about Bitcoin (they called cryptocurrency a scam four years ago) by listing it as a recommended investment vehicle (risk adjusted). Analysts also pointed to the connection between the decline in the value of gold and the growth of Bitcoin, which was formed due to the flow of funds into a more promising instrument. Now it's Morgan Stanley's turn to recognize cryptocurrency as an investment asset.

On March 31, the bank filed an update prospectus with the SEC12 investment portfolios, which will include cryptocurrencies through the purchase of a share in the Grayscale Bitcoin Trust and Bitcoin futures. Morgan Stanley did not make official statements about the proposal to invest in cryptocurrencies, but from an "internal note" it became known about such intentions in relation to VIP clients.

These are just two isolated examples, while inMany insurance, investment and even state pension funds have already added their Bitcoin investment portfolios. At the moment, the share of their investments is small, but according to JPMorgan calculations, if each institutional investor allocated 1% of their portfolio to Bitcoin, the price would rise to $280,000.

Do you think Bitcoin will continue to grow, or "how long does the string hang ..."? Let us know in the comments!

Analytical group StormGain