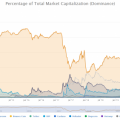

The 2020 cryptocurrency bull run has made some investors overly greedy, many of whom have forgotten thatthis is a highly volatile market. As a result of the sudden (but not the biggest) correction, all margin purchases were swept out of the market.

Image source: infographicStormGain

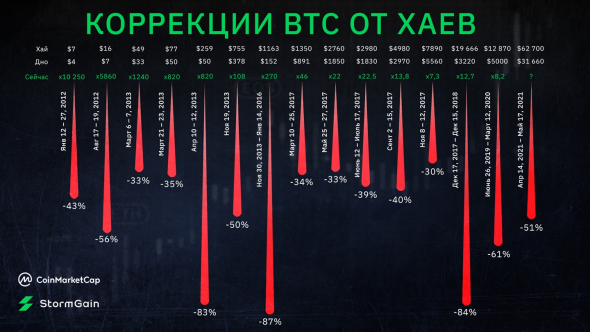

A slight panic led to a surge in volatility in Bitcoin up to 80%, and Ethereum up to 139%.

Image source: coindesk.com

In the period from February to May, Bitcoin was in a limited corridor, which many associated with the accumulation of positions before the next breakout upwards.

Image Source: StormGain Cryptocurrency Exchange

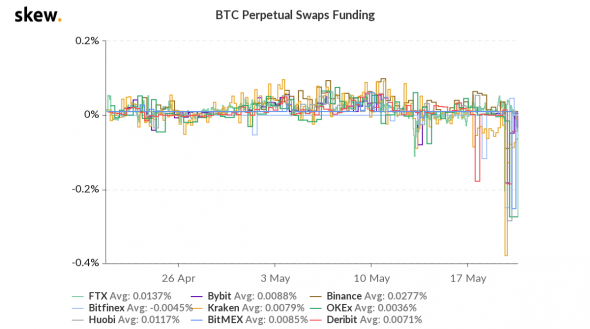

And judging by the growing funding rate, this is how it isAnd it was: the more traders buy cryptocurrency with leverage, the higher the commission for holding a position becomes. But a string of negative news, including Musk's overkill and China's tightening of policy, led to a reverse resolution: Bitcoin lost more than half of its highs and the markets dumped all margin investors.

Image Source:skew.com

At some point, swaps even becamepositive, making long-term purchases more attractive than sales, but now they are at near-zero values. Correction of cryptocurrencies knocked foam from the market, liquidating positions with leveraged funds. This reduces the network load from active speculation. So, the commission on the Ethereum network fell to $ 23, when on May 12 it reached $ 70.

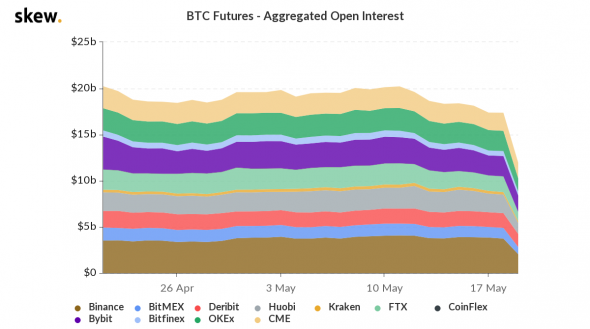

Institutional demand expressed in openinterest in Bitcoin futures decreased by $ 5 billion. For some time, this will contribute to a further decline in quotations, since large capital is less interested in ordinary traders in high volatility.

Image Source:skew.com

However, there are those who took advantage of the falling prices.The itsblockchain portal followed the transactions of one of the whales: 3,000 BTC were sold on May 9 at an average price of $58.5 thousand, and from May 15 to 19 he bought back 3,521 BTC at an average price of $44.5 thousand. Thus, the investor managed to gain $18.7 million from the fall and at the same time increase the volume of reserves by 521 BTC.

Analytical group StormGain