Bitcoin grew by 40% over the month to a significant level of $50,000 without high speculator activity, amid a falltrading volumes and low level of the number of transactions. Are these signs of an impending correction?

Image Source: Cryptocurrency ExchangeStormGain

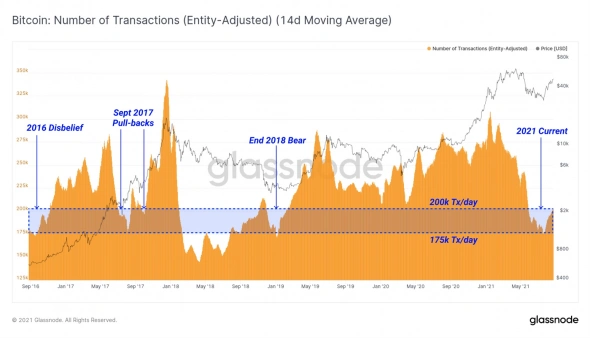

Bitcoin transactions are in the vicinity of five-year lows, which was last seen with the price dropping 85% from the 2017 highs.

Image Source:glassnode.com

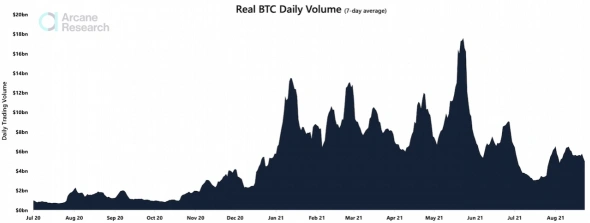

Along with the number of transactions, trading volume also decreased, which Arcana Research sees as a bearish signal: the price increase is not confirmed by widespread interest.

Image Source:research.arcane.no

However, there are several objective reasons for this.First, the number of transactions has decreased due to pressure from Chinese regulators: some exchanges change registrations, others refuse funds from Chinese citizens, and miners were completely banned from working in a number of provinces. Secondly, the world's largest cryptocurrency exchange Binance has taken up arms in many countries. Due to regulatory pressure, the exchange lowered the leverage from 1: 100 to 1:20. This led to a natural decrease in trade turnover.

At the same time, the indicator of "fear and greed" speaks ofoptimism in the market, reaching the level of October last year. This is also evidenced by the SOPR ratio (the ratio of profit to spent funds): most traders again profit from the sale of their coins.

Image Source:coinmetrics.io

While traders took a breather and did notare very active, institutional investors continue to hunt for Bitcoin. Thus, MicroStrategy on Tuesday bought $177 million worth of coins at an average price of $45 thousand per Bitcoin and now owns a total of 108,992 BTC. And Citigroup, following Goldman Sachs, has filed with regulators to gain access to Bitcoin futures on the CME.

Now online activity does not indicate an approachcorrections: the drop in volumes is due to growing regulatory pressure and a decrease in the share of leveraged funds in trade, while hodlers and institutional investors continue to increase their reserves.

Analytical group StormGain