This week, Cred and DonAlt are on the radar: a likely continuation of the uncertainty and "haircut" in the bitcoin market,ETH / USD after a successful retest of $ 4000 and ETH / BTC,ready to exit the multi-month trading range. The review is completed by the author's comment on the prospects for the current market cycle in the event of a full-scale breakout in Ethereum.

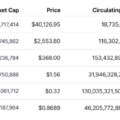

https://coinmarketcap.com/coins/views/all/

BTC: ~$55k level held

Chart executed in TradingView

Chart executed in TradingView

BTC/USD continues to trade within the weekly $55.8-60k cluster.

We said last week that it can be viewed as a range, and the market seems to agree with that.

After a short-term raid below the minimumsprevious week, the last weekly candle closed above the lower limit ($55.8K) of the range. This usually heralds a move to the high of the range ($60K).

On the daily timeframe the price recovered higherthe previously broken down level of ~$57 thousand. This is a positive sign. Short-term market structure remains bearish (absent a new higher high), but a recovery above the breakout level is constructive.

Even with some strength on the weekly and dailytimeframes, Bitcoin/USD does not look like the most attractive long trade today. First, there is technical resistance at $60k (with daily and weekly structures in the $60-63k area). Thus, the risk/reward profile for new longs does not seem attractive to us at the time of writing. Secondly, if the goal is to position the market for its strength, then Ethereum is currently demonstrating strength in a much more obvious way in both pairs.

If you step back a little from short-termlevels, the market is still bound by a range. As we will discuss further below, bitcoin / dollar does not currently own the initiative. The “best scenario” for BTC / USD today is the continuation of consolidation without losing the bottom being formed.

On the other hand, this is also, in general, not bad,as it creates the conditions for betting on the imminent breakout of ETH (before losing the entire deposit when the correlation with bitcoin jumps back to 1 on the fall).

ETH / USD is approaching record highs

Chart executed in TradingView

Chart executed in TradingView

ETH / USD continues to rise after a successful retest of the previous range ($ 4000).

On the daily timeframe, ETH came close toto restore the last of the daily support / resistance levels on the daily timeframe at $ 4480-4610. Technically, this is a reasonable area to slightly reduce the size of the position after buying on the bounce from $ 4000, but we see the prospect for a larger increase, given the situation in ETH / BTC.

A slightly slower scenario mayconsist in some consolidation between the cluster of daily resistance at $ 4480–4610 and the maximum of the weekly range at $ 4000. However, while it makes sense on paper, this setup is not to our liking, given that it involves another $ 4,000 retest. If the market is really strong, then the (already taken place) weekly retest should be enough to take the daily resistance.

Daily resistance $ 4480-4610 has also been tested earlier.

The catch is what the current levels suggestperhaps the worst risk / reward ratio for fresh longs. Take a look at the chart: the price almost hits the upper border of the structure. However, this is not the level at which we would look closely at selling, given the proximity of new highs and the ETH / BTC setup.

In summary, ETH / USD looks strong.A close below $ 4000 on a significant timeframe could be a refutation of the strength thesis. A renewal of all-time highs looks likely. However, the risk / reward ratio at the time of writing is highly questionable, given that the market is hitting exactly the daily resistance of $ 4480–4610. However, this is not the level from which we would expect a significant downward reaction. Target levels for the continuation of the trend in case of taking the mentioned resistance - round values above $ 5000.

ETH / BTC prepares to exit multi-month range

Chart executed in TradingView

Once upon a time we devoted half of our technical analysisfor ETH with USD, and the second with BTC. But then at least something meaningful stopped happening in ETH / BTC, and this situation lasted seven long months. Now, at last, this may be about to change.

ETH / BTC on the weekly timeframe is preparing to exitfrom the range in which he spent 7 months. It is now forming a larger high in a shorter short-term range, and the target level for its breakout will be at least the weekly range high of ₿0.084.

Although the ₿0.084 level is also the first logical resistance, we expect that if the current breakout is successfully completed, the market is likely to move higher.

The logic is simple:out of equilibrium after 7 months of range trading is unlikely to result in a move just 10% above the local high. Large consolidations are usually followed by large movements, so we believe that if the momentum persists, the level ₿0.084 is unlikely to be able to provide significant resistance.

In terms of significant target levels, the first of the most obvious is ₿0.1.

In summary, the market is preparing to break out of a huge range in the context of a nearly 2-year uptrend. This is an important event. We expect the trend to continue; failure of the pattern would be a disaster.

Market Cycle Comment

As it is clear from the Ethereum review, bitcoin / dollar does not currently hold the initiative in the market.

There is a world in which the crypto market moved tonew regime: everything is exclusively growing, always, and the only question is which coins or sectors are leading the trend at any given time. The structure of the crypto market has gone so far from its former BTC-centricity (through stablecoins, linear futures for alts to USD, bridges, automated market makers, and many other things) that it no longer makes sense to use Bitcoin as a barometer of risk for other cryptoassets. The market is now less correlated than ever before and the goal of the game is to bet on the correct names and sectors.

We agree that it would be great. But we do not think that the crypto market has already entered this phase.

Until the opposite is confirmed, weakness in BTC / USDon high timeframes, followed by significant gains in Ethereum and altcoins, is a sign of proximity to the top of the cycle, at least in terms of timing. And this is an important caveat, because the peak of the cycle in terms of price and in terms of time are completely different things, since a sharp parabolic move can change the entire market landscape at once.

People often pay attention to comparativelyslight correlation between BTC and altcoins during the growth period, however, this conclusion extends to the declines. From our point of view, it is quite obvious that, with the exception of a few short-term statistical outliers, the correlation of [the entire] crypto market with downward volatility in BTC / USD tends to 1.

You don't have to go far for an example.Something similar happened in April - May. Bitcoin formed a top, Ethereum doubled after that, a variety of altcoins also showed excellent growth, but everything instantly returned to 100% correlation with BTC / USD, as soon as it went down on higher timeframes.

Has the market structure changed since May so muchis it essential that now you can safely ignore such patterns? Well, maybe this time it will be different, but so far it looks less likely.

To put it simply and cynically, if it's headedEthereum general "pump" (pumping) of the crypto market before the same comprehensive "dump" (reset), then the task is to get rid of assets at the peak in ETH / USD. Point.

Are there any other ways out of this “fractal”?may appear later - for example, if the breakout in Ethereum turns out to be modest, and BTC reacts to this impulse and performs well on higher timeframes, if the futures market is effectively “reset” to basic values on a local decline and the recovery from it is convincing, or& #8230; You can imagine a bunch of positive scenarios, and we will still have time to write about them if they become relevant.

But for now, be on the lookout, as strength in Ethereum and altcoins amid bitcoin weakness has historically occurred at the end of market cycles, not at the beginning.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>