This week CredAnd DonAlt, mailing list authors Technical Roundup, discussing the range breakout in BTC/USD, which reachednow resistances on a high timeframe.We will also talk about the impact of this large-scale breakout on the ETH / USD rate and how to interpret the strength in the Ethereum market after the activation of EIP-1559. In the final section, we will share our understanding of the general situation in the NFT and altcoin market.

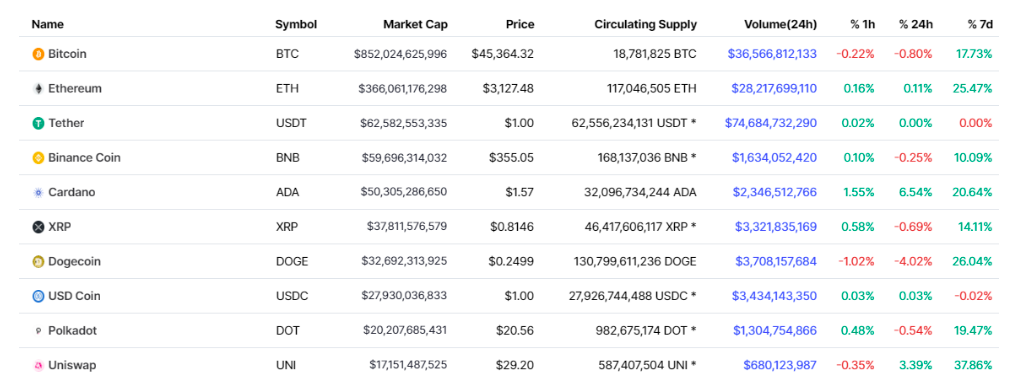

https://coinmarketcap.com/coins/views/all/

Bitcoin Breakout Reaches Resistance

Chart executed in TradingView

Chart executed in TradingView

Bitcoin/USD is in the resistance zone.This area is defined by two weekly levels: $45.2 thousand and $49.1 thousand. On the daily time frame, the structure falls approximately in the middle of this area - $46.5 thousand.

What matters is how the market ended up at this point.This move is the result of a failed support breakout (this is a bullish signal) of the 10-week range, which resulted in a very strong reversal. At the same time, the futures premium remained broadly at the same level, suggesting that the futures market and high leverage do not appear to be the main driving forces behind this momentum. It all adds up to a positive picture.

However, the opening of new longs at the level of $45-50 thousand.is unfavorable in terms of risk/return ratio. This would essentially be buying the last resistance area on the chart. If sellers show up at all, even for a small local pullback, then most likely they should enter in this area.

However, this area is also not for sales.looks favorable. Not least because futures still look relatively modest, but it should also be noted that choosing the right level is not easy. For some time the market fluctuated between $40 thousand and $50 thousand, and this range is all made up of levels. If you go short too early, you run the risk of getting your stop loss caught at the next (and better) resistance.

So what can we learn from this?

First, if the market rolls back to $ 40K., it will be a confident buy from defining support. If, during a price rollback, this level does not hold, then the thesis about a smaller maximum in the market macrostructure will strengthen, and the probability of a bearish continuation will increase significantly.

Secondly, if the market successfully trades through$50K and consolidating above this level on high timeframes, this will significantly increase the likelihood of setting new highs. If sellers don't come into play in the $45-$50k area, they probably won't show up at all. Breaking past current resistance is already too close to all-time highs, and the likelihood of finding strong resistance there is quite low.

In our understanding, this is an area for adjusting your exposure to the market. It is unattractive for opening new positions.

Ethereum defies news sell-off tradition

Chart executed in TradingView

Chart executed in TradingView

ETH / USD reacted positively to the activation of EIP-1559 and climbed above the $ 3000 mark.

ETH / BTC is still trading in a range, but the market rallied on the day the EIP-1559 was activated.

Like Bitcoin, ETH / USD has reached an area wherethe opening of new longs is unfavorable in terms of the risk / reward ratio. If sellers are going to show themselves at all, then resistance around $ 3,400 is the best (if not the only remaining) place to do so.

Significant evidence of weakness will appear if the price, having rolled back, does not find support at $2300. This is the ethereum equivalent of the $40k level in BTC/USD.

$ 3400 is quite an understandable boundary, depending onprice behavior from which you can form some expectations regarding further movements, but you also need to monitor the situation in BTC / USD. We have seen more than once how ETH / USD at the moment significantly exceeded the yield of BTC / USD - only in order to correct more sharply when bitcoin moves down.

In essence, both bitcoin and ether look likestrong, however, they are, perhaps, at the worst levels to buy. Sometimes you just need to admit that you missed a move, and even if it continues, buying exactly under resistance, generally speaking, does not imply a positive mathematical expectation.

NFT and altcoins

We still don't include NFTs and altcoins in our reviews. We do this on purpose.

With regard to NFTs, we do not have sufficientknowledge in order to write about them with confidence. We do not trade, invest in, or collect NFTs. Cred has several YATs, but this was more of a meme investment and does not correspond in any way with the common practices of issuing NFTs.

At the same time, the current situation in the NFT market seems to bewe are quite unreliable, and the best confirmation of this is the decreasing amount of effort invested in new projects. In particular, the proliferation of copycat ideas is worth noting.

The current situation reminds us of how the first peakthe DeFi market has roughly coincided with the spread of a million food-named tokens, and how Dogecoin formed a pinnacle near the peak of Shiba Inu popularity. Imitation is the best form of flattery (and a powerful signal of a market top).

However, take this opinion with a fair amountshare of skepticism. We do not participate in this market and do not really understand it. Cave people! And if the crypto market taught us anything, it is that when outside people without exposure to the market call something a bubble, then this bubble can inflate much longer than expected.

As for altcoins, they don't seem like a good bet to us right now, given that major cryptocurrencies have reached tipping points.

If the market forms a smaller high and startsdecline, then altcoins are likely to fall more than BTC or ETH. If the market breaks higher without sellers showing up, then the major cryptocurrencies are likely to outperform altcoins on a breakout.

We would take a closer look at altcoins either when consolidating after a breakout higher in major cryptocurrencies, or when the market corrects.

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>