In major cryptocurrencies, support levels are again being worked out on higher timeframes.This week, Cred andDonAlt, authors of the Technical Roundup,discuss a rebound from the lower end of the range in BTC / USD and a similar setup in ETH / USD. From altcoins, consider the rebound and resistance approach in the DeFi index. To conclude the review with a little discussion of why a Bitcoin-led recovery in the cryptocurrency market is preferable to an altcoin-driven recovery.

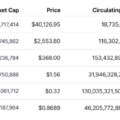

https://coinmarketcap.com/coins/views/all/

Bitcoin: bears are out of work again on the weekly timeframe

Chart executed in TradingView

Chart executed in TradingView

Another week, another close above the lower limit ($32.3K) of the weekly range.

The crab market continues. Weekly support remains intact, with the price currently hovering around the midpoint of the $32.3K-$38.2K range.

We have added the middle of the range ($34.8) to the chartas a daily level. It has already been tested once, and a close above this level creates a larger high on the daily time frame and signals that the market has accepted a rise above the middle of the range. Both of these factors indicate the likelihood of a movement to its upper limit ($38.2 thousand).

The market has made a real effort tobreak through the support of $30 thousand. This was also evident from the long-term negative funding of perpetual swaps on BTC/USD, which indicates aggressive sales that keep the swap price below the index price. However, the downward breakout did not take place, and now the market is moving in the opposite direction.

When a lot of effort fails, it is usually followed by movement in the opposite direction. This is exactly what we are seeing now in the bitcoin / dollar pair.

Fundamental narratives have not fundamentally changed, but the market is now much better at taking bad news than it was quite recently. This is a positive sign.

When it comes to trading ideas, we haveThere are a couple potential ones. First, an aggressive pullback to the lower end of the range could create a reasonable “rebound now or never” setup. The opportunity to make a deal close to the level of invalidation of an idea is a privilege, even when the situation is uncomfortable. The second potential setup is to buy in anticipation of a bullish continuation from the middle of the range ($34.8K) to the upper limit ($38.2K). While this makes sense structurally, entering a position in the middle of a move looks much less attractive than at the edges of a range. Passable, but overall not something we would place a significant bet on.

Ethereum: Potential Range Recovery

Chart executed in TradingView

Chart executed in TradingView

Ethereum held weekly support in both pairs.

In ETH / BTC, the week closed above the lower border(₿0.055) range. On the daily timeframe, after a small bounce, the price is at the resistance, but the support on the higher timeframe remains in effect. We'll talk about the implications of this in the next section.

As for ETH / USD, the rate is very close toto "confirm" the setup on the daily timeframe at the weekly support level. Last week we wrote about weekly support for $ 1800-1940 and that the daily close above the daily cluster ($ 1940-1960) above it would be good confirmation that weekly support is doing its job.

The last day candle broke the resistanceand closed at $ 2,166, which could be good confirmation of a bullish retracement of the range, and the next resistance is in the $ 2,750-2,900 area.

To summarize, ETH / BTC looks fine as long asfulfills the support of ₿0.055. ETH / USD looks good considering the recovery above the $ 1940-1960 cluster, but now it is important to hold this level as support for a possible retest.

DeFi index rebound

Chart executed in TradingView

The crypto market is growing and altcoins have not been left out.

In fact, altcoins (which is quitepredictably) rebounded stronger than Bitcoin. This is the normal relationship between BTC and altcoins, in which altcoins are essentially traded as “leveraged bitcoin,” meaning they fall harder when bitcoin declines and rally more when bitcoin rallies (with some exceptions and caveats).

In terms of relative strength, the rebound is notoutperformed the rest of the market. The DeFi Index more or less follows Ethereum's fluctuations (albeit based on smaller-cap assets) and is performing worse than the FTX Altcoin Index based on high-cap altcoins at the time of writing.

While the composition of the DeFi index is somewhat outdated, it is still trading fairly cleanly from a TA perspective.

An all-market rally pushed the index up to daily resistance at $ 7,140. This line served as support before the last downside breakout. And the weekly level of $ 7,400 also coincides with this area.

If the ~$7,000-$7,500 area is impulsively retraced, it would pave the way for a move to the opposite side of the range at $11.1K.

As with many other setups, the bestthe opportunity for a long opens up when the resistance is broken, and not on the approach to it from below (especially when there is so much space ahead that still needs to be occupied).

DonAlt on Altcoin Led Recovery

For the supposed pessimist and eternal bear, DonAlt has an unhealthy tendency to press the green button.

He recently bought BTC at around $33k before shorting the position at ~$34.5k, giving Cred some mocking memes.

But more interesting here is the argument by which DonAltreinforced this shortening of the BTC long. It was that ether and other altcoins-driven bounces are more risky than Bitcoin-led bounces. In other words, the rise in the BTC rate, accompanied by the rise in the bitcoin dominance index, is the best evidence of a trend reversal.

This is a conservative point of view, but it makes sense to treat it with attention.

Given the lack of a compelling case fordissociating altcoins from BTC, bitcoin remains the cryptosphere's main haven asset (obviously, with the exception of stablecoins). Accordingly, the health of the crypto market largely depends on the good performance of bitcoin with the subsequent flow of capital from bitcoin to other riskier assets (i.e. altcoins).

As the market kindly reminded us just before the crash, weak BTC + strong (junk) altcoins = very precarious situation, most likely based on retail speculation.

In other words, for a more reliable trend reversal, it is optimal that first the reversal occurs in bitcoin at the expense of altcoins (BTC price up + bitcoin dominance up).

While the rally driven by altcoins israther, a symptom of continued speculation on the part of smaller players, as opposed to a market entry of real strength. This situation is somewhat reminiscent of 2018, when altcoins entertained us plebeians, while bitcoin pulled the market down.

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>