Market overview onSeptember 16, 2019

# SP500

Last week for the SP500 index ended higher and closed inarea 3010. U.S. consumer sentiment on Friday surpassed forecasts. According to preliminary estimates, Michigan University consumer sentiment in the U.S. rose to 92 in September 2019 from 89.8 in the previous month and above the market consensus forecast of 90.9. Also, the consumer expectations index rose to 82.4 in September from 79.9 in the previous month; and the indicator of current economic conditions rose to 106.9 from 105.3. Inflation expectations for the coming year rose to a four-month high of 2.8 percent in September from 2.7 percent in August; while the 5-year forecast fell to 2.3 percent from 2.6 percent.

“Consumer sentiment showed a smallrebound from a sharp fall in August, marking the third lowest level since Trump’s election. Despite the fact that growth occurred both in current and expected economic conditions, the rebound in early September was not widespread by age or income subgroups, as it only fell among consumers under the age of 45 and among households with incomes at the top thirds - these two groups account for about half of all expenses. Data shows that consumers expect the Fed to cut interest rates next week with a net decline in interest rates more often than they are currently expected than ever since the depths of the Great Recession in February 2009. These expectations are likely to reduce the impact of spending on a quarter point reduction in the rate, but if the rates remain unchanged, they can increase the negative reaction of consumers. Concerns about the impact of tariffs on the domestic economy also increased in early September, when 38% of all consumers became spontaneous; the United States cited the negative impact of tariffs, the highest percentage since March 2018. Those who negatively mentioned tariffs also held more negative views on the overall economic outlook, and also expected inflation and unemployment to increase next year. Although a recession is not expected next year, a revival of personal consumption is also not expected. The forecast for consumption is a slower but positive growth that will extend it for another year, ”said Richard Curtin, chief economist at Consumer Survey.

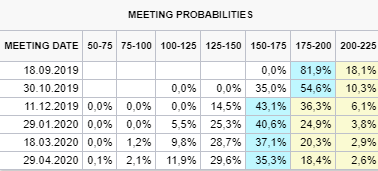

The futures market opened with a gap on Mondaydown and practically leveled out last week's movement. This is a reason to think about the coming week and the direction of the market in the coming days. On Monday and Tuesday, the market is unlikely to make any serious movements since on Wednesday, September 18, there will be a FED meeting regarding the decision to reduce the interest rate from the current level of 2.25% to 2%. The estimated interest rate for today is 1.88% and is within the price range of 1.75% - 2%. FED reports forecast a decline of 0.25 basis points with an 81.9% probability

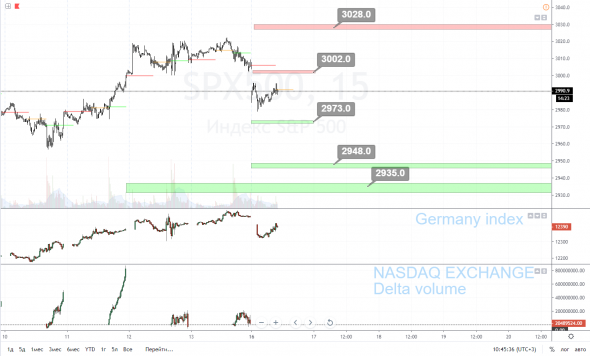

Key support / resistance levels for September 16, 2019

Monthly volatility resistance - 2975

Weekly volatility resistance - 3028

Daily volatility resistance - 3002

Daily volatility support - 2973

Weekly volatility support - 2948

Monthly volatility support - 2935

On Thursday and Friday NASDAQ Exchange Delta Volumewas in the positive zone, but this did not cause any serious upward movements, which in turn suggests further decline or at least sideways movement for today.

When comparing the cumulative delta on the futures of the DowJones 30, SP500 and NASDAQ 100 indices

the downward dynamics of the delta alongDowJones 30 index, which in turn may signal a possible decline. However, the FED meeting still does not allow large participants to enter positions in the next two days.

The recommendation for today will be a cautious sale to the nearest support levels with intraday fixing of transactions.