The story of Bitfinex and Tether has not left the front pages of the world's leading media since 2017, and many journalists announcedThe management of these companies is on a real hunt.Today we already know that the problems of the Bitfinex cryptocurrency exchange are primarily related to the loss of $851 million back in August last year. And the Panamanian company is supposedly to blame for thisCrypto Capital. Is it so? HowCryptoCapital is associated with the notoriousMossackFonseca and "ParadisePapers"? What role do group members play here?SunlotHolding, which tried to absolutely legally obtain the right to the “stolen” money fromMtGox? Continuing the first part of the [Dark_Block] series, we will continue our descent into the depths of the notorious rabbit hole and try to pull out the most well-fed rabbits from there.

</p>[Dark_Block] materials receivedby the editors of Bitnovosti.com from an anonymous author. Therefore, the position and some statements of the anonymous person may differ from the opinion of the editors themselves and the proofreading author who took these articles for processing.

To begin with, let's take a step-by-step look at what happened in the past few months in the Bitfinex and Tether cases, and what caused such widespread public dissonance.

According to some reports, as early as August 2018years, Bitfinex started having problems getting money from their payment processor - Crypto Capital Corp. The inability or unwillingness of Panamanian “friends” to return funds meant for Bitfinex only one thing - a fiasco. Therefore, despite the fact that customers started complaining about problems with the withdrawal of money at the beginning of October, the management of the exchange denied rumors of its own insolvency to the very end and called them speculations based on malicious intent.

***

On October 9, it became known that $ 100 million Tether tokens disappeared. Rumor has it that Deltec Bank allowed Bitfinex to withdraw $ 100 million from Tether's reserves.

***

On October 15, 2018, Bitfinex allegedly alreadydesperately asked Crypto Capital to return their funds. At least $100 million... In turn, Crypto Capital stated that the money was confiscated by the authorities of Poland, the USA, Great Britain and Portugal.

***

In November 2018, a transfer was made to Bitfinex accounts from the same bank from Tether accounts at Deltec Bank. Transfer amount - $ 625 million

In exchange, Bitfinex made a transfer from itsA USDT account opened with Crypto Capital to a Tether account in the same Crypto Capital. The size of the transfer is $ 625 million. USDT. In fact, tokens just moved on Crypto Capital accounts.

Naturally, the problem is that Bitfinex is notcan receive funds from Crypto Capital, and, in fact, it turns out that part of the missing money of $ 851 million was simply taken from Tether's reserves. As you can see, part of the reserves still existed.

***

In November, on the initiative of the US Department of Justice, an investigation was conducted into Tether's involvement in manipulating the price of bitcoins.

***

On February 21, 2019, Bitfinex lawyer reportedAttorneys at the General Prosecutor’s Office that Bitfinex intends to “take out a loan” in the amount of $ 600 to $ 700 million from reserve funds supporting Tether. Although, in fact, this was already done in November 2018

***

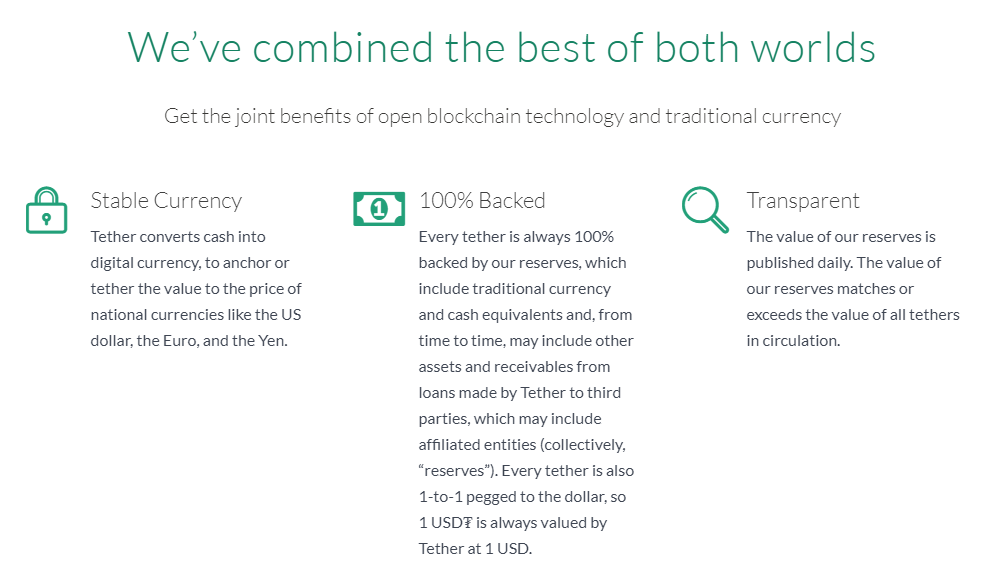

On February 27, 2019, Tether changed the wording of the guarantor of its tokens from"one to one"on the:

"EveryUSDT is 100% backed by our reserves,including fiat currencies, cash equivalents, and, from time to time, assets and income from loans issued by us to third parties, including affiliates. "

***

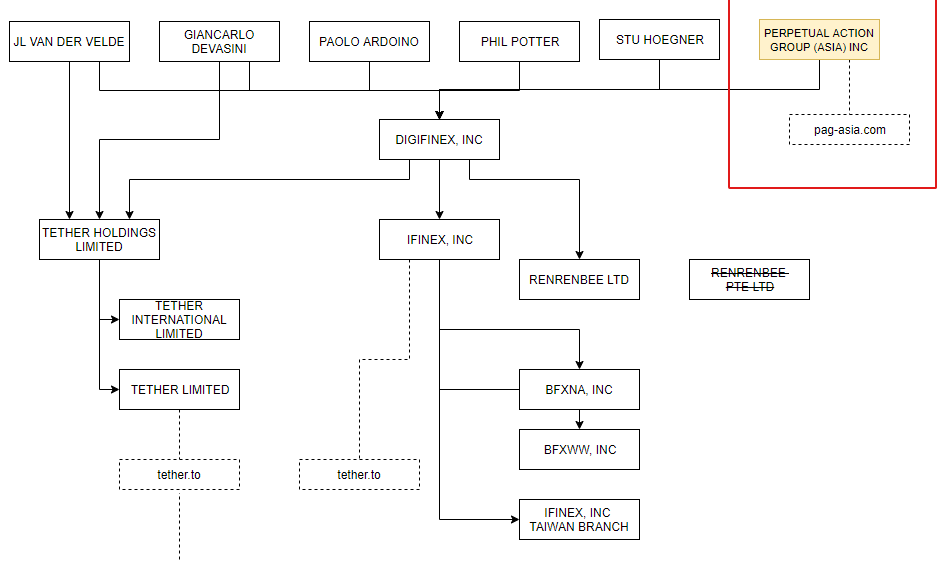

March 27, 2019 Bitfinex and Tether are stillsigned a formal agreement on a credit line of $ 900 million. The parties to the signed contract are members of the same team managing Tether, Bitfinex, iFinex, Digfinex and other elements of this structure.

***

April 25, 2019 Attorney GeneralNew York - Letizia James blames Bitfinex for losing $ 851 million and trying to cover them with Tether reserves. In response, Bitfinex said the allegations were erroneous, and the New York Attorney General acted "in bad faith."

https://iapps.courts.state.ny.us/fbem/DocumentDisplayServlet?documentId=vIexA1b0spKOnK_PLUS_ZUGTJ3A==&system=prod

On April 30, 2019, it became known that the US Department of Justice confiscated part of the allegedly “missing” $ 851 million from Crypto Capital. More than that, Bitfinex was unable to deny the obvious.

***

On charges of involvement in multiple financial crimes, including those related to Bitfinex accounts, two persons affiliated with Crypto Capital were arrested.

Epilogue

Bitfinex: “OUR BUSINESS IS BEYOND YOUR INTERESTS”

Before all subsequent information will be presented to readers, it’s worth drawing a line under what is already well known:

- Bitfinex and Tether are a carefully planned international fraud, behind which there are notorious crooks.

- Until recently, Bitfinex was the base exchange on the cryptocurrency market, and the main trading is everywhere in the pair BTC / USDT [Tether].

- Bitfinex and Tether bank accounts linked todummy fraudsters convicted of dirty money from Colombian and Mexican drug cartels, as well as other criminal activities.

About 73% of all Bitcoin transactions are made using Tether tokens

https://www.cryptocompare.com/coins/btc/analysis/USD

Not so long ago, it was claimed that Tether is coveredfiat currency 1: 1. Now, when the company recognized that not all tokens were backed up with a real cache, their security began to amount to no more than 74%, and that, only, according to the Bitfinex general adviser, Stuart Hogner.

https://archive.fo/qYBQ7

It turns out that the critic Bitfinex`ed, which many openly called a psycho, was somewhat right. And what have the “crazy” critics not been mistaken yet?

After all, do not forget several important facts about which the mainstream media, savoring the moral and physical breakdown of Bitfinex, do not mention it again:

- Officially, Realcoin, now Tether, was founded by a rather dubious character and famous billionaire - Brock Pierce, as well as his associate Craig Sellars (crypto_shaman)

- Craig Sellars, until a certain time, was the technical director of Bitfinex and Mastercoin

Today, these people have distanced themselves in advance from projects and absolutely do not want to have anything to do with what is happening with Bitfinex and Tether.

Brock Pierce and Craig Sellars - the core of Mastercoin [Omni]

Brock Pierce has such projects asDigital Entertainment Network [DEN], Internet Gaming Entertainment [IGE] (aka Affinity Media / IMI Exchange), BIT ANGELS, AngelList SindicateKnCMiner, Bitropolis, GoCoin,Tether [Realcoin], Block.one/EOS, as well as Blockchain Capital, through which he, together with partners, invested in dozens more blockchain companies.

In 2014, Brock Pierce, despite the protest of manymembers of the Bitcoin community, took the post of Chairman of the Bitcoin Foundation. This unique person and simply iconic character definitely deserves a separate article.

Therefore, now we will consider only one explicit connection that brought together people who at first glance are not directly related to Bitfinex and Tether, but where Brock Pierce plays a key role.

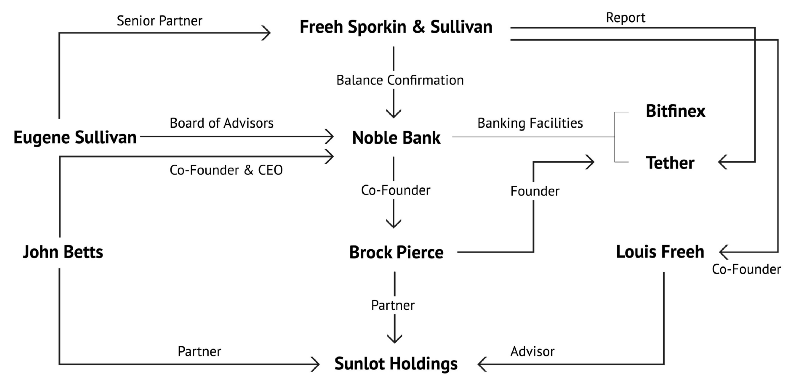

Sunlot Holdings - Noble Bank International

It is known that from 2017 to the end of 2018Bitfinex used the services of a “bank,” or rather a startup that provides banking services, Noble Bank International, a subsidiary of Noble Markets. The company was under the jurisdiction of Puerto Rico, which the BitMEX cryptocurrency exchange repeatedly mentioned in its investigations. In March 2015, Noble Markets announced its cooperation with the major exchange NASDAQ.

This image is not a real photo - it was made by the Nasdaq media team for marketing purposes. They tried very hard

Founder of Noble Markets, which receivedInvestments from major investors such as Blockchain Capital (Brock Pierce) and Tally Capital are a certain John Betts, whose name casts off our memories five years ago:

On March 28, 2014, a Tokyo court received a document from a certain group of investors who called themselves"SunlotHoldingsLimited ». The essence of the document was to preserve the Bitcoin exchangeMtgox, and partial compensation for damage to users. In fact, it was proposed to buy the exchange as is, receiving rights to the stolen bitcoins. The ransom amount was ridiculously symbolic - 1BTC.

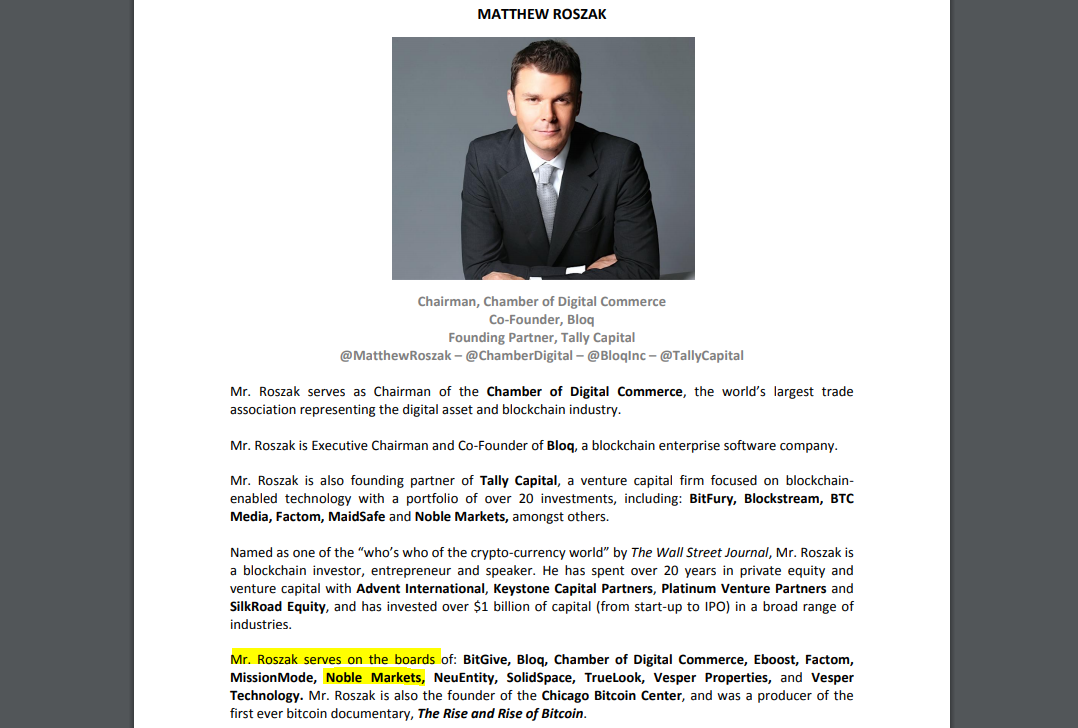

The Sunlot Holdings group, registered in Cyprus, consisted, inter alia, ofBrock Pierce(Crypto Currency Partners/Blockchain Capital),William Quigley(Clearstone Venture Partners),Matthew Rozac(SilkRoad Equity), Jonathan Yantis (IGE) andJohn Betts(Noble Bank International).

Also, to "optimize the recovery process"mtGox, the following companies were involved: Sitrick and Company, Grant Soonton, Endeavor Strategic Communications (Andrew Breitbart), Freeh Group International Solutions (Louis Frih - former FBI Director) and Perseus Telecom.

John Betts and Louis Friech - Sunlot Holdings

Many people know that in June 2018 the legalcompany Freeh Spolkin & Sullivan LLP (FSS) audited Tether's accounts and confirmed that Tether Limited had even more dollars ($2.55 billion) in its bank accounts than needed to back the issued USDT tokens (2.54 billion).

Co-founder Freeh Spolkin & Sullivan LLP(FSS) is former FBI Director Louis Freeh, who was part of the investment group Sunlot Holdings Limited. His colleague, Judge Eugene Sullivan, partner at Freeh Spolkin & Sullivan, concurrently served on the advisory board of Noble Bank International.

The relationship looked something like this:

The Bitfinex`ed user who drew this diagram is crazy, it is dangerous to trust his arguments. You can go crazy yourself

But, even more interesting - billionaire Matthew Rozac, who was also a member of Sunlot Holdings, and took an honorable place on the board of directors of Noble Markets [Noble Bank International]:

https://docs.house.gov/meetings/IF/IF17/20160316/104677/HHRG-114-IF17-TTF-RoszakM-20160316.pdf

Matthew Roszak – Bitcoin MemberFoundation and partner in SilkRoad Equity LLC (a private equity fund in Illinois, USA, which has invested more than $5 billion in various companies). SilkRoad Equity's principals collectively have more than 60 years of investment and operating experience across a wide range of industries and have acquired more than 200 companies worldwide. SilkRoad Equity has also distinguished itself in philanthropic activities, in particular by supporting the Clinton Foundation.

Co-founder of the Chicago Blockchain Center (CBC) andBloq - Matt Rozac participated in the ICO Mastercoin, Factom and Maidsafe. He acts as a partner of the Blockchain Capital fund and is a co-founder of the Tally Capital fund, which invested in 20 startups, including Coinbase, Kraken, BTCC, BitFury, BitGo, Block.One, Blockstream, Robocoin, Xapo, etc.

But, in fact, the Tally Capital fund owes its appearance to the famousPolishChicago business tycoon Andrew "Flip" Filipowski, who also founded SilkRoad Equity:

Andrew Flip Phillipowski and Matthew Rosak

Thus, the hidden direct connection between Bitfinex, Tether, Noble Bank, Freeh Group and Sunlot Holdings is quite obvious, and in view of the availability of official documents, this cannot be denied.

Interesting fact:

Noble Bank (Puerto Rico), Deltec Bank (Bahamas) and Sackville Bank (Cayman), working with Bitfinex, used the same main bank - Bank of New York Mellon

In principle, these are not quite traditional banks. These are companies that provide banking services, using a “real bank” as a custodian. In fact, these are offshore gaskets between the exchange and the banking system.

Bank of New York Mellon - a large New York bank historically belonged to the family of the now deceased crypto-billionaire Matthew Mallon, who died of a drug overdose in April 2018.

A major investor in Ripple was among theparticipants in the famous meeting of the rich "cryptans" - Satoshi Roundtable, along with characters such as Brock Pierce, John Betts, Reeve Collins, Ira Miller, Craig Sellars, Michael Turpin, Roger Ver, Eric Voorhees, etc. Having earned as much as $ 2 billion on Ripple, Mallon, of course, was not an insider. It was just luck.

Clean hands are the key to your safety

So what of this? Does the relationship between Bitfinex and Sunlot Holdings somehow connect them with mtGox? Of course not. But, the facts are more than remarkable.

Therefore, we turn to no less interesting relations with the already well-known company - Crypto Capital, which is officially represented by an extremely strange person of uncertain nationality.

"Ivan Raspberry" - The Riddle Man

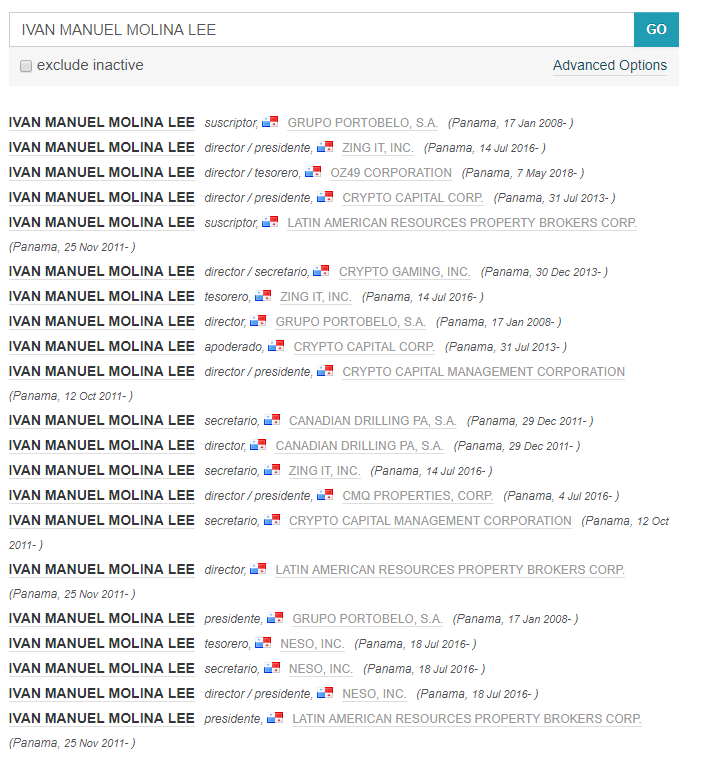

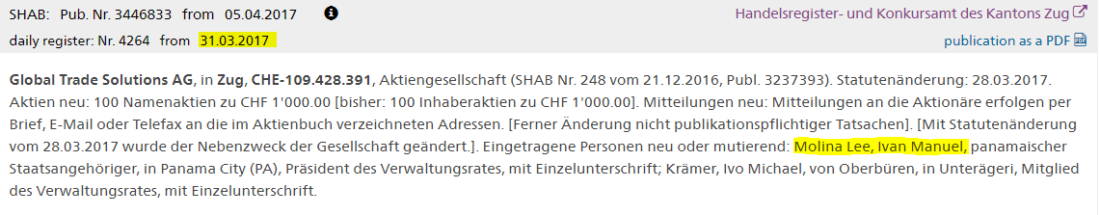

Ivan Manuel Molina Lee, just a good person withCanadian citizenship, character without face. Ivan, officially residing in Panama, is the lucky owner of dozens of shell companies and, importantly, is the most important and most “real director” of an extremely promising and reliable “bank” - Crypto Capital:

https://opencorporates.com/officers?q=IVAN MANUEL MOLINA LEE

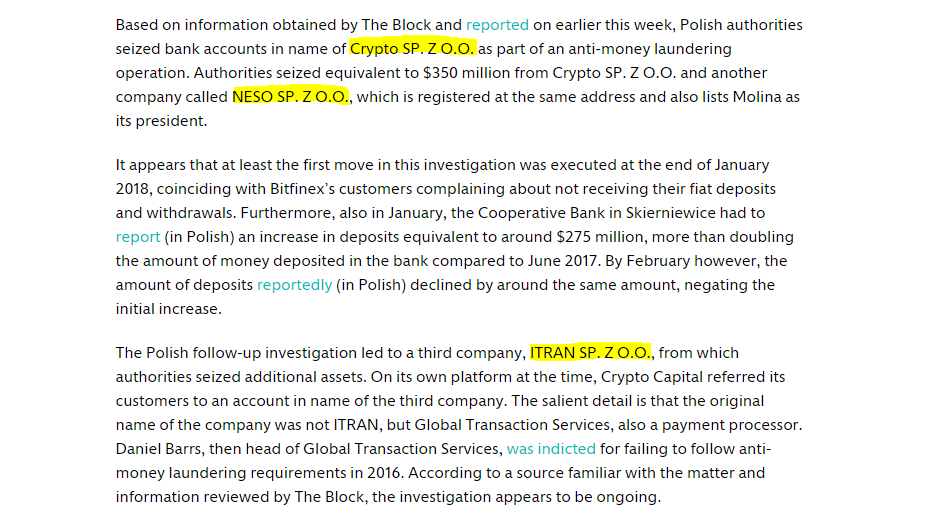

Ivan gained popularity after the raid of the Polish authorities in March 2018, when several accounts were arrested, apparently belonging to Crypto Capital and its affiliated companies:

https://www.tvp.info/36692986/kolumbijskie-kartele-praly-setki-milionow-przez-spolki-z-pruszkowa-i-okolic

According to the authorities of Poland - this moneyassociated with Mexican and Colombian drug cartels, as well as the “large cryptocurrency exchange”. They added that one of the account holders is a Canadian of Panamanian descent.

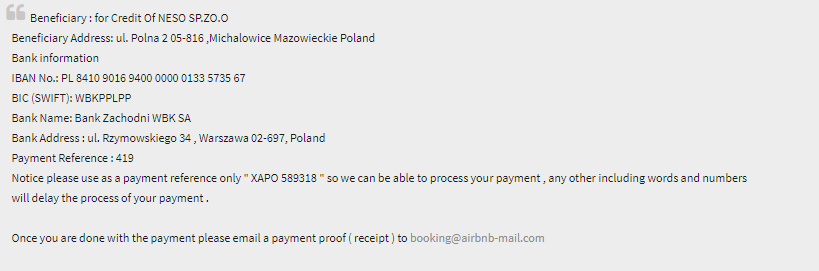

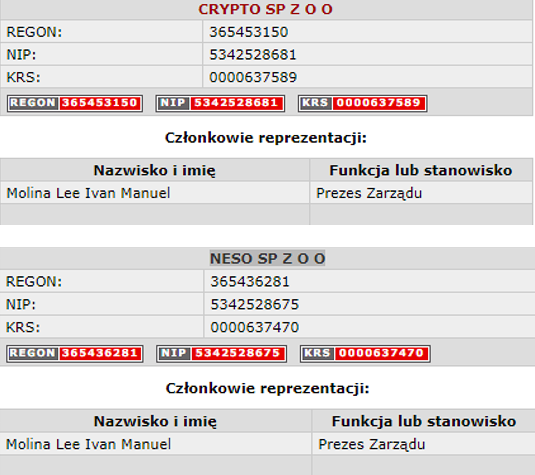

In total, at least $ 345 million was withdrawn, while the accounts of three interconnected companies in two Polish banks were lit up:

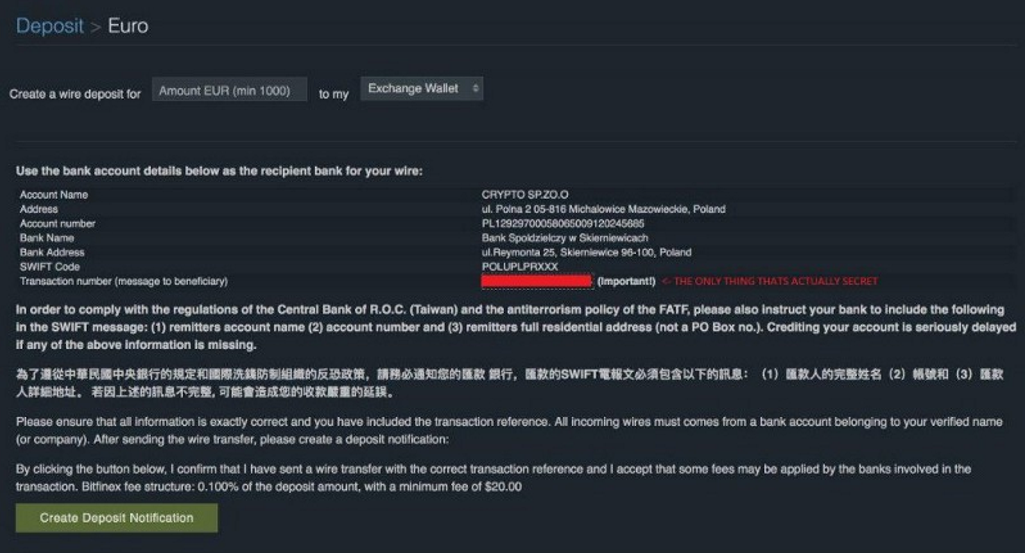

- Crypto SP Z.O.O, Poland - Bank Spółdzielczy w Skierniewicach

- NESO SP. Z.O.O, Poland – Bank Spółdzielczy w Skierniewicach

- iTran SP Z.O.O, Poland - Bank Zachodni WBK

Additionally, it is known that NESO SP. Z OO also had a bank account in Bank Zachodni WBK:

Information about the names of companies and banks is taken from The Block resource:

https://www.theblockcrypto.com/2019/05/08/the-bitfinex-ieo-how-did-we-get-here/

https://www.theblockcrypto.com/2019/04/30/no-bitfinexs-seized-850-million-is-not-likely-to-be-unfrozen-within-weeks/ (closed content)

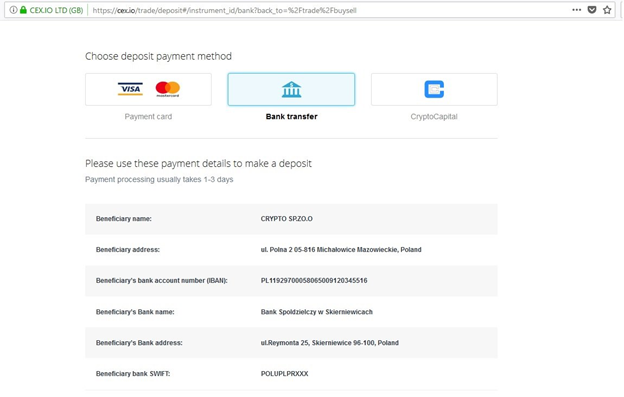

It is authentically known that the Bitfinex and CEX.IO exchanges used bank accounts owned by Crypto Capital Corp's subsidiary Crypto SP Z.O.O:

The owner of companies registered in Pruszkow is Crypto SP Z.O.O and NESO SP. Z.O.O is Ivan Manuel Molina Lee:

http://www.krs-online.com.pl/crypto-sp-z-o-o-krs-7233285.html

http://www.krs-online.com.pl/neso-sp-z-o-o-krs-7172363.html

ITran SP Z.O.O (formerly Global Transaction Services SP.Z.O.O) with a bank account in Bank Zachodni WBK is owned by Briton James Mallabern. But, we will return to this character later.

http://www.krs-online.com.pl/msig-4400-15381.html

http://www.krs-online.com.pl/itran-sp-z-o-o-krs-1094440.html

Funny, the ill-fated Mt.Gox also had a bank account at Bank Zachodni WBK:

MTGOX POLAND INC. SP. Z.O.O

IBAN: PL59109023980000000117595694

BIC: WBKPPLPP

BANK NAME: BANK ZACHODNI WBK SA

BANK ADDRESS: RYNEK 9/11

COUNTRY: POLAND

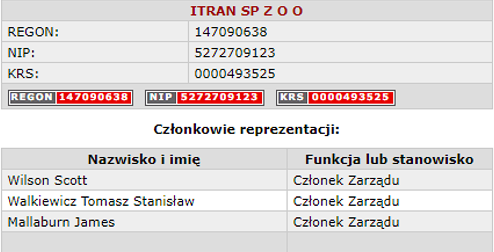

And part of the stolen funds was sent specifically to the hot Bitfinex wallet:

Coincidence, and no more. Let's continue.

Crypto Capital and all, all, all

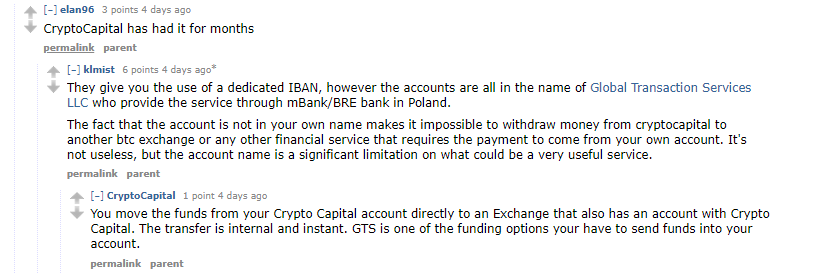

Of.site: https://cryptocapital.co/

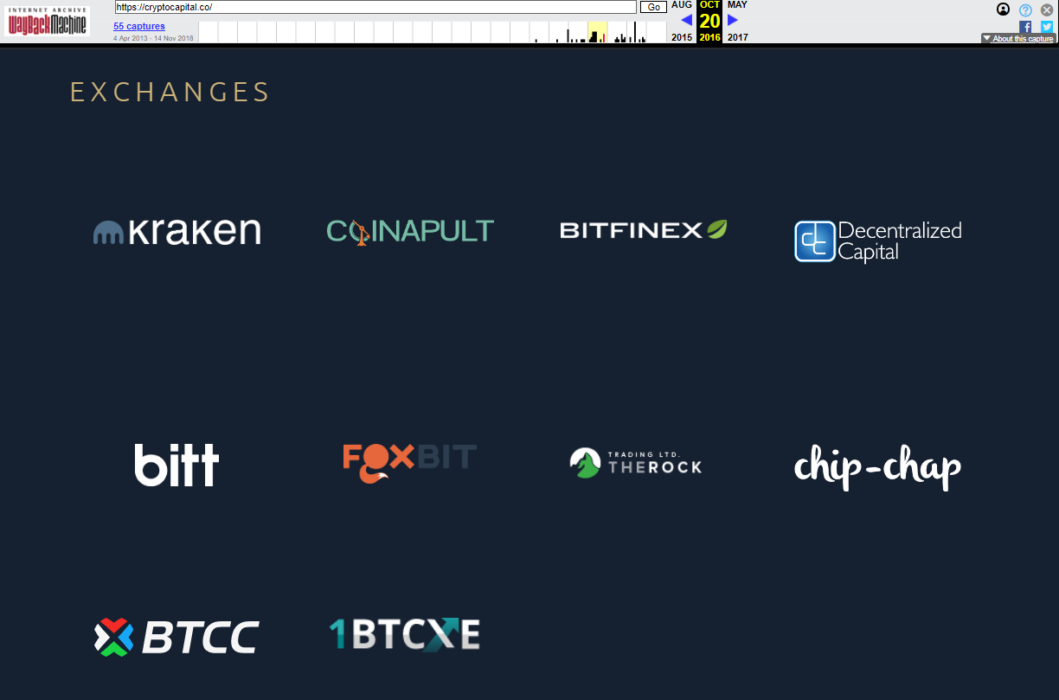

Crypto Capital is a kind of “centralbank for cryptocurrencies”, a bridge to the world of fiat money. A payment processing company that served both ordinary clients and the largest cryptocurrency exchanges, such asBTCC, Kraken, BitMEX,BitfinexandQuadrigaCX [RIP]. What a twist! The plot is becoming more interesting and twisted.

If we look today, we will see only fourcustomers, and where is Bitfinex? After the last problems, they disappeared from the list. In particular, from the list of exchanges, on the basis of which CoinMarketCap displays the weighted average rate of bitcoin. Therefore, we go back to the past in 2016:

https://web.archive.org/web/20161020174743/https://cryptocapital.co/

A little back:

How many familiar faces, right?

Coinapult: The Axis of Evil

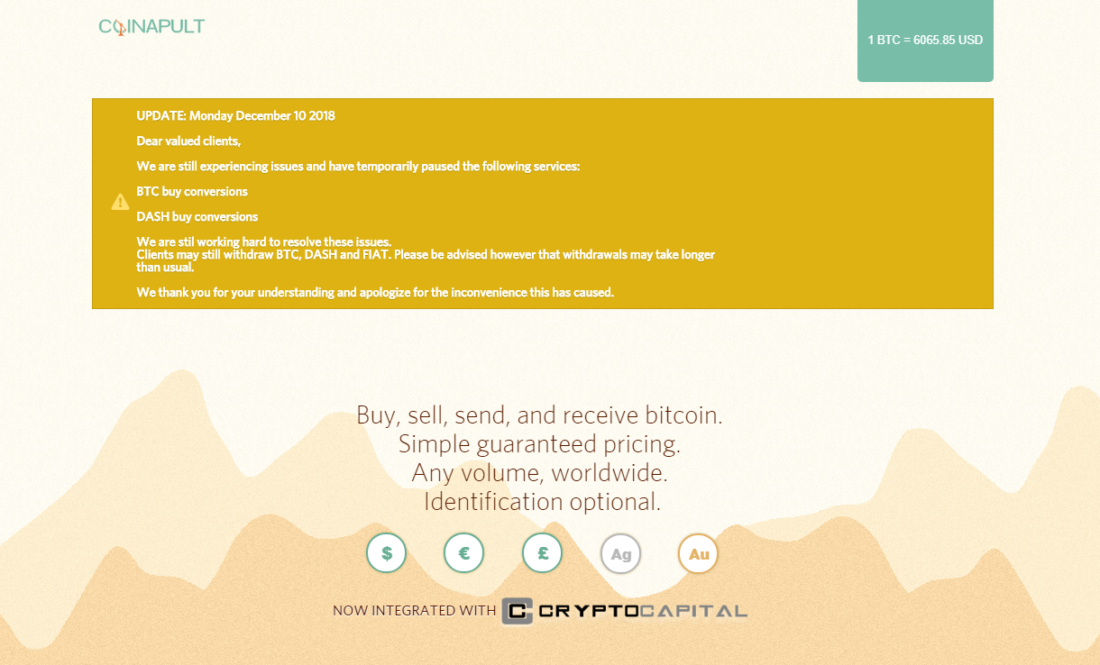

Since February 10, 2018, the service is clearly experiencing certain problems

Of.site: https://coinapult.com/

Apparently, the Panamanian service Coinapultplayed an extremely significant role for Crypto Capital, being a kind of technological core. First, the wallet allowed you to send bitcoins by e-mail and SMS, and then turned into a kind of exchange. True, the course was taken directly with Bitfinex. An interesting feature of the service is the dubious Coinapult Locks function, which allows you to fix the value of the cryptocurrency against the dollar or even gold. How exactly is not specified, but, presumably, Tether tokens are used for this. In May 2015, Coinapult announced its full integration with Crypto Capital.

The service itself was founded in 2012 by well-known entrepreneurs Eric Voorhees and Ira Miller, and received development funds from major investors such as Barry Zilbert and Roger Ver.

Interesting fact:

In September 2018, reporters from a respectedThe Wall Street Journal said that as much as $ 9 billion was laundered through the ShapeShift exchanger, owned by Eric Voorhees. Sensation was provided. Eric denies this in every way, claiming that, in fact, the amount was 4 times less. Natural modesty, what can you do ...

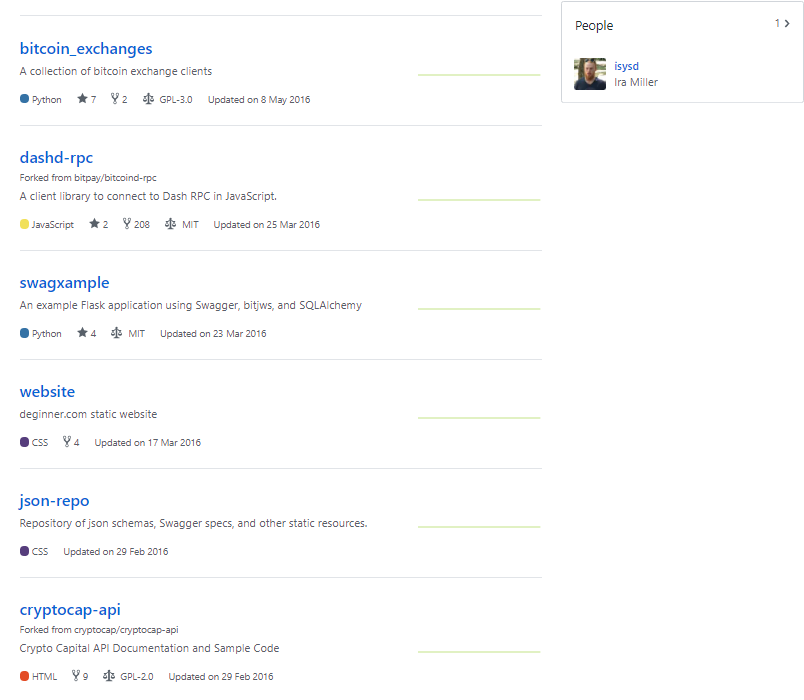

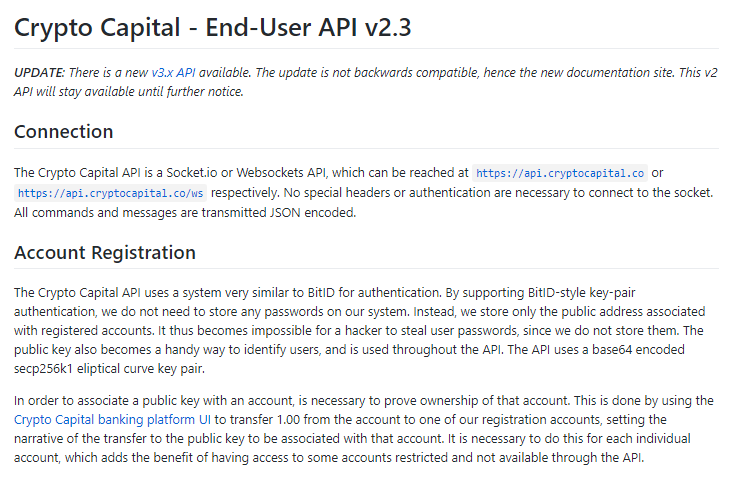

In today's most notable situationthe detail is that the API Crypto Capital was developed by none other than Ira Miller himself, Eric's faithful friend, with whom they left the unfriendly USA and went to Panama to conquer the ocean of endless offshore opportunities:

https://github.com/deginner

And despite the fact that Ira officially left Coinapult back in 2015, he worked on the Crypto Capital API until February 2016:

https://github.com/deginner/cryptocap-api

https://api.cryptocapital.co/v4

Additionally, Ira Miller has developed software for super secure Bitcoin machines, which is extremely pleasing:

https://lamassu.is/

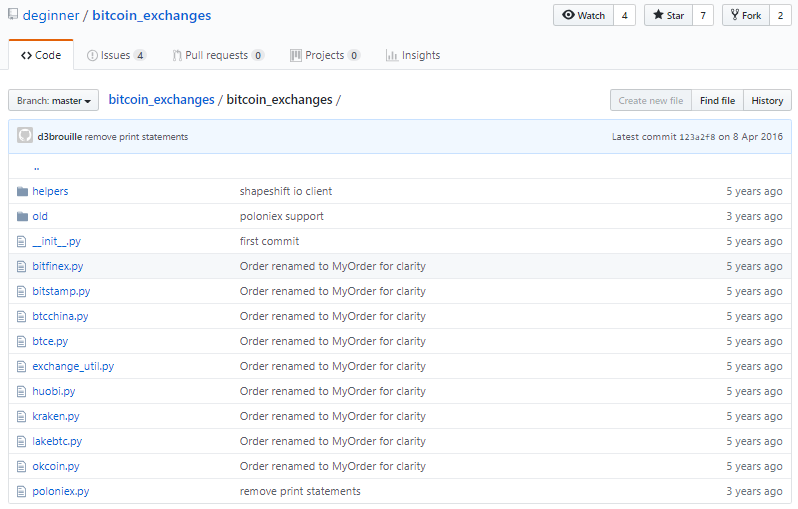

Miller is a very prolific developer, he created clients for the most popular cryptocurrency exchanges and exchangers:

https://github.com/deginner/bitcoin_exchanges/tree/master/bitcoin_exchanges

ThisBitfinexBitstamp,Btcchina,Huobi,Kraken,Poloniex, ShapeShiftetc. Incredibly impressive sight ...

Later, Coinapult further integrated with Mycelium wallets,Safelloand the DASH cryptocurrency.

There is no news in all this - it has long been described in these articles:

How the Tether Distribution System (USDT) Works - Part 1

How the Tether Distribution System (USDT) Works - Part 2

And in these:

1 part

2 part

I thank the authors for the done titanicwork. You also need to thank Nathaniel Popper for his wonderful book - Digital Gold. The incredible history of Bitcoin ”, which describes in detail the relationship of such characters as Charlie Shrem, Roger Ver, Eric Voorhees, Ira Miller, Barry Zilbert, as well as their projects:

This is really an unreal story!

Download from OZON

Just download it and don’t forget to buy it on OZON!

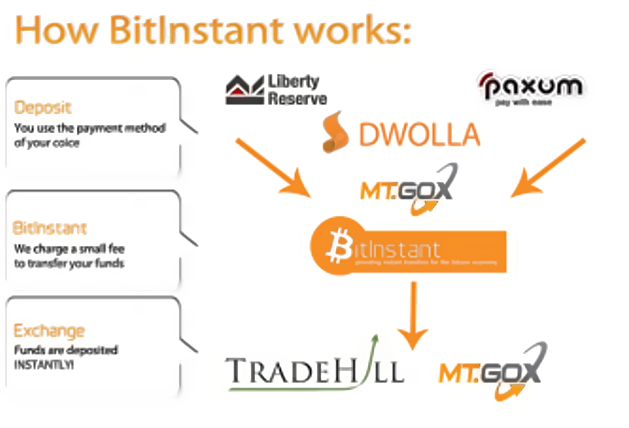

The book has one important detail thatfor some reason, most investigating authors are overlooked - this is the oldest and now defunct Bitinstant exchange, with which, in fact, the Coinapult climb began:

Yes, it's Charlie Shrem, Eric Voorhees and Ira Miller - the main composition of Bitinstant. Almost.

Fourth Element - Roger Ver

Yes, that's right - this is the same drinker in good company:

Further - no comment.

Who are we to argue with Satoshi Nakamoto himself - what should Bitcoin be like?

Roger Ver has invested in Bitcoin startups such as Ripple, Blockchain.info, Bitpay, CoinLab, Coinapult, Zcash, ShapeShift and Purse.

Also, Roger not only invested in Bitinstant and was directly involved in its work, but also helped the Safello project, a wallet with which Coinapult is integrated.

Roger loves to help his friends,for example, classmate Jesse Powell - the owner of the Kraken exchange or colleague Emil Oldenburg - the chief editor of Bitcoin.com and the founder of the same Safello wallet.

Emil also does not remain in debt and helped prove the involvement of Alexander Vinnik in the hacking of MtGox:

Employees of the Japanese startup Wiz Technologies [WizSec]: Kim Nilson (left), Jason Moris (center), Emil Oldenburg (right)

Jason Maurice is the very kind guy who, at one time, helped Roger Ver protect himself from an evil hacker.

So it turns out that Roger Ver and histhe team helped conduct an investigation and go on the trail of Alexander Vinnik. And why did Roger Ver need this? Yes - the mysterious paths of St. Nakamoto ...

He probably also lost money on MtGox and asked his friends to find them.

One important element is missing

Interesting fact:

FounderBitinstant – Charlie Shrem served two years for laundering dirty money fromSilkRoad

But, now everything is absolutely wonderful for him, and he is engaged in the development of new projects.

Another Notable Crypto Capital Partneris the Canadian cryptocurrency exchange QuadrigaCX, which in recent months has become a close focus of attention for many world media. QuadrigaCX was founded back in 2013 by two well-known scammers: Omar Dhanani, aka Michael Patrin, as well as his old friend and accomplice - Gerald Cotten, aka “Scepter”.

Omar Dhanani, arrested in 2004 by a member of the ShadowCrew hacker group and Michael Patrin (aka Omar Patrin), founder of Midas Gold, VFS Network and QuadrigaCX, are the same person

At the end of 2018, it became known that GeraldCotten allegedly died in India from a very rare disease at the very dawn of his strength, and most importantly, he took with him to the grave the private keys to the wallets where the clients' money was stored.

Michael Patrin and Gerald Cotten are the founders of QuadrigaCX, as well as active participants in HYIP forums such as TalkGold, MoneyMakerGroup, and BlackHatWorld. Worked together, at least since 2008

The past of the founders of the exchange, and the poor reputation of the platform itself made many doubt the official version of what happened. But, this is another story.

Today no one denies that Crypto Capitalinvolved in various financial crimes and outright fraud. The New York City Prosecutor's Office requires Bitfinex and Tether to comply with elementary regulatory requirements, and all media outlets are vying to publish details of the high-profile case.

History of the foundation and development of Crypto Capital

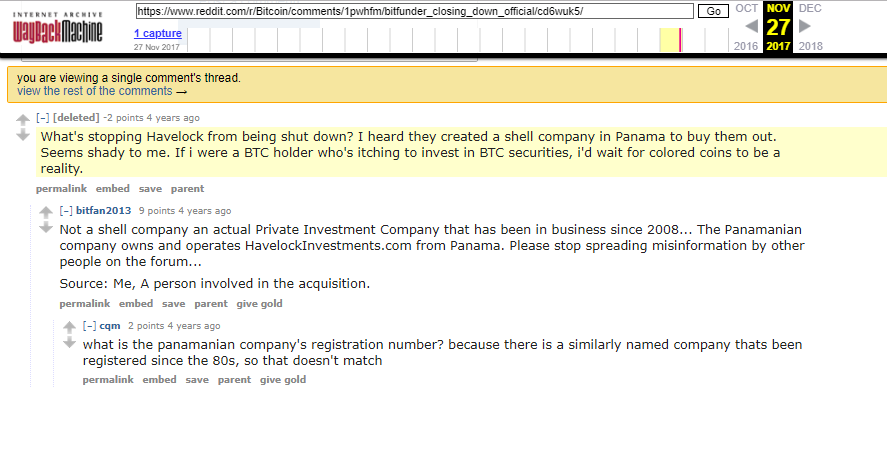

For the first time, the idea of creating Crypto Capital wasvoiced at the Reddit forum in 2013 by a certain Bitfan2013 user. An anonymous person, who, according to him, together with his family met on the board of directors of four banks (in which he did not indicate), suggested creating a “real fiat bank” in the Panamanian offshore for the entire cryptocurrency community.

https://web.archive.org/web/20171127225229/https://www.reddit.com/r/Bitcoin/comments/1pwhfm/bitfunder_closing_down_official/cd6wuk5/

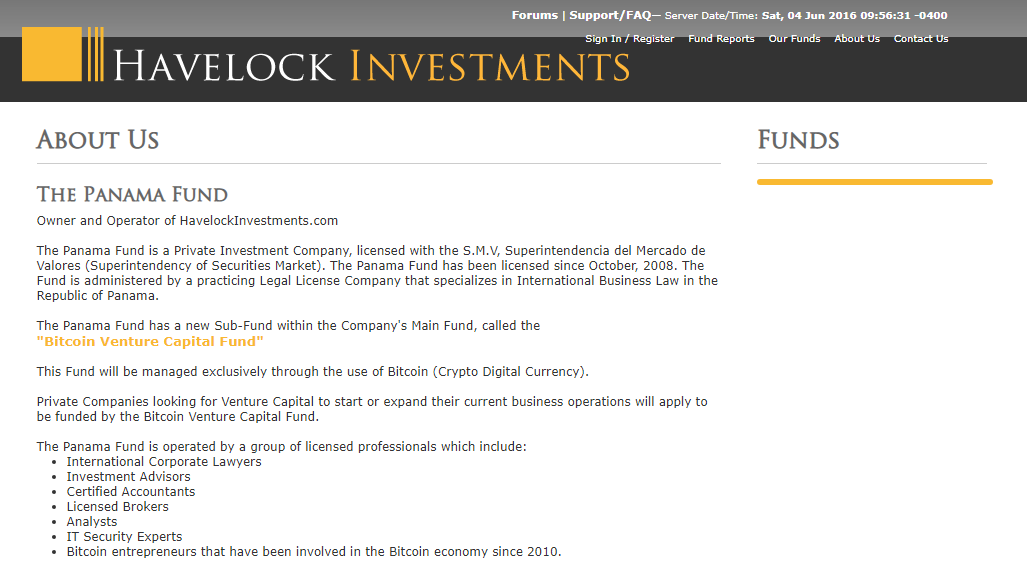

And, indeed, soon on the Havelock platformInvestments appeared shares of the Panamanian company Crypto Financial (CFIG), which would later be renamed Crypto Capital Corp. The emergence of such an office was quite natural, in conditions where traditional banks did not wantopenwork with cryptocurrencies.

Officially, the Havelock Investments platform is owned by Panama Fund, S.A. and its website is still working, as well as the Crypto Capital website:

https://www.havelockinvestments.com/aboutus.php

A lot of IPOs (open sale of shares) were held on this site, for example, for such fraudulent projects as Neo and Bee and ASICMINER / AMHash.

Interesting fact:

Online casino promotionsSatoshiDice previously owned by the ownerShapeShift - Eric Voorhees, sold on the Havelock Investments platform

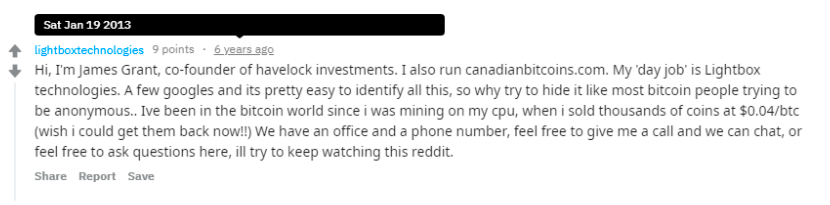

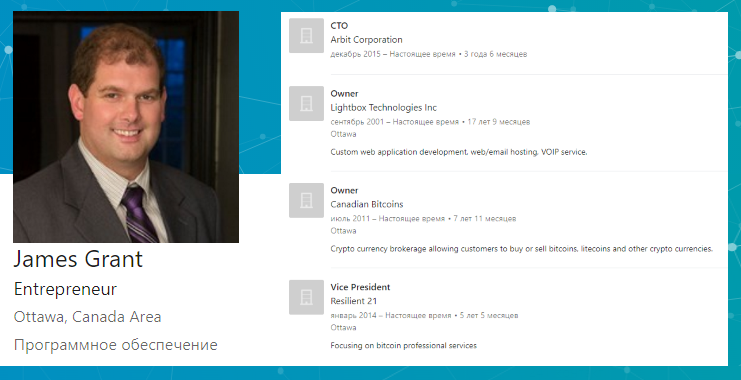

One of the famous co-founders of Havelock Investments is James Grant, the owner of Lightbox Technologies and the Canadian exchange Canadianbitcoins.com:

https://www.reddit.com/r/Bitcoin/comments/16tpt0/who_is_havelock_investments_and_who_has_vetted/

https://ca.linkedin.com/in/jamesgrantottawa

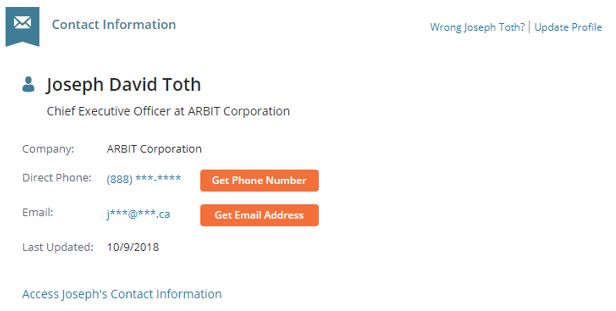

Additionally, James is a technicalDirector of the company Arbit Corporation, which worked in the field of bitcoin-machines. Arbit is owned by Joseph Thot, aka Joseph David - former owner of the now defunct Canadian CaVirtex exchange:

https://www.zoominfo.com/p/Joseph-Toth/-995673091

It is known that this man with two names managed the HYIP project - Hedge for Profit, until 2008, and CaVirtex itself closed under rather strange circumstances:

https://siliconangle.com/2015/02/17/bitcoin-exchange-cavirtex-shutting-down-after-being-hacked/

https://www.reddit.com/r/Bitcoin/comments/2w7f4z/cavirtex_shutting_down/

https://bitcointalk.org/index.php?topic=325980.0

Later, the CaVirtex brand was purchased by the Coinsetter exchange, which, in turn, was acquired by the famous exchangeKraken:

Fact:

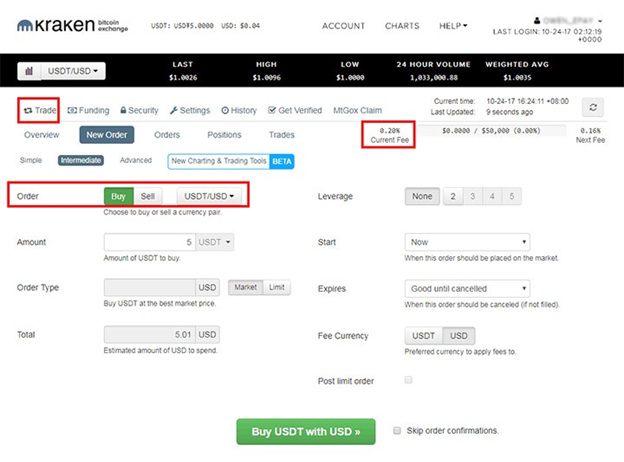

Direct exchange of USDT for dollars, up to a certain time, was only available on one exchange – Kraken:

On November 1, 2013, Havelock Investments was acquired by Panama Fund, S.A., but the team remained the same:

https://www.havelockinvestments.com/20131101-announcement.php

Therefore, there is reason to believe that the changethe owner was more than symbolic. It is possible that in fact, Havelock Investments and Panama Fund, S.A., as well as projects related to them, are part of one structure, which is managed by seasoned swindlers.

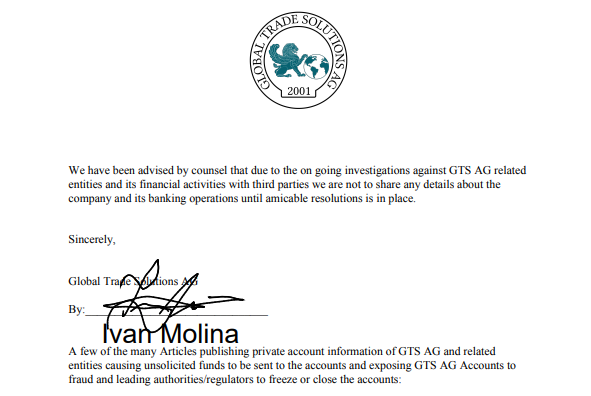

Global Trade Solutions A.G

https://amyhcastor.files.wordpress.com/2019/04/global-trade-solutions.pdf

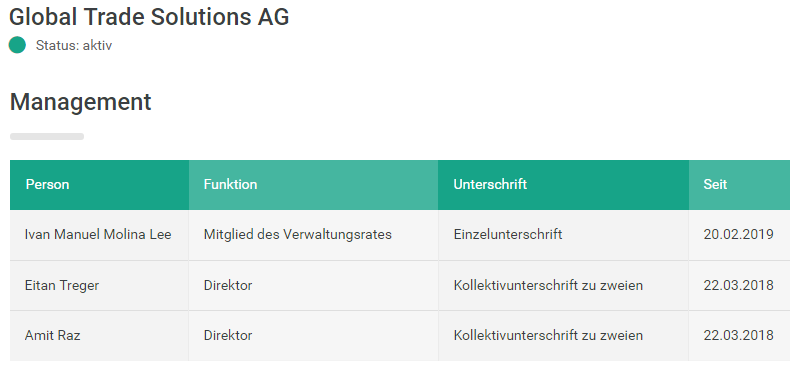

Today, the parent company Crypto Capital Corp is the Swiss Global Trade Solutions A.G., whose management includes Eitan Treger, Amit Raz and Ivan Manuel Molina Lee:

https://www.easymonitoring.ch/handelsregister/global-trade-solutions-ag-661270

Previously, the company was called Semacon AG Software Engineering, and was founded back in 2001. Although Ivan himself took office only at the beginning of 2017:

https://www.zefix.ch/en/search/entity/list/firm/661270

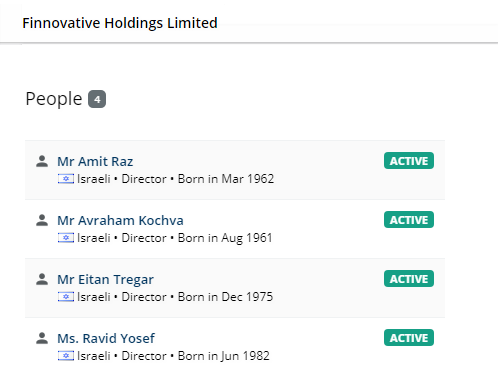

Additionally, Eitan Treger and Amit Raz are directors of Finnovative Holdings Limited, along with citizen Ravid Yosef, already a well-known accomplice of Reggie Fuller:

https://suite.endole.co.uk/insight/company/11771457-finnovative-holdings-limited

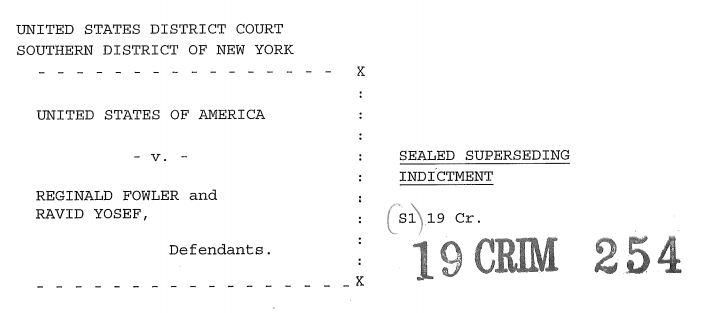

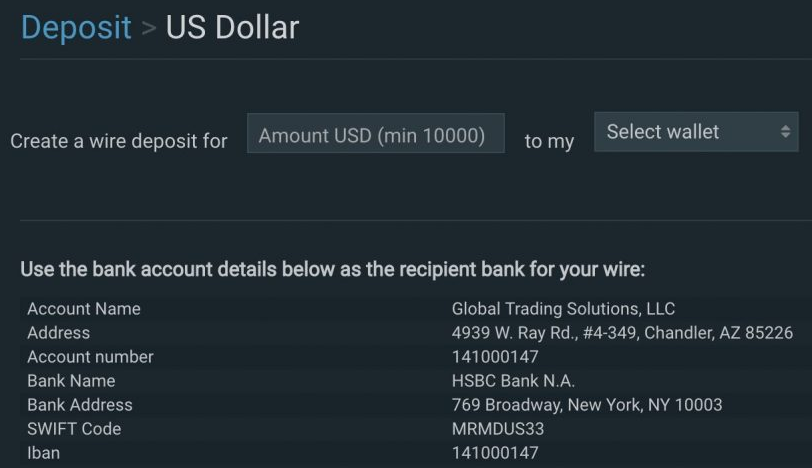

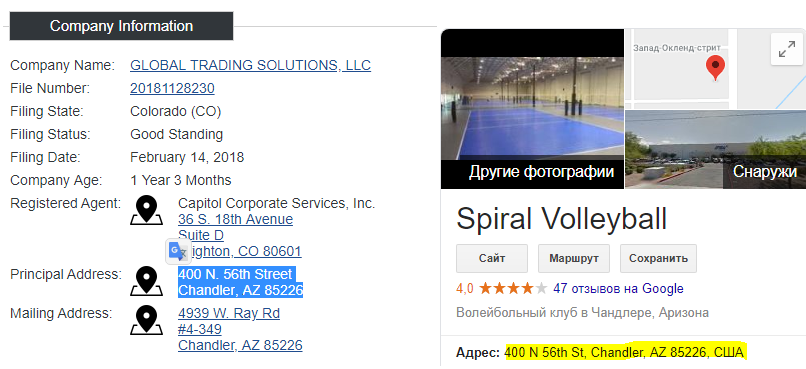

Global Trading Solution, LLC

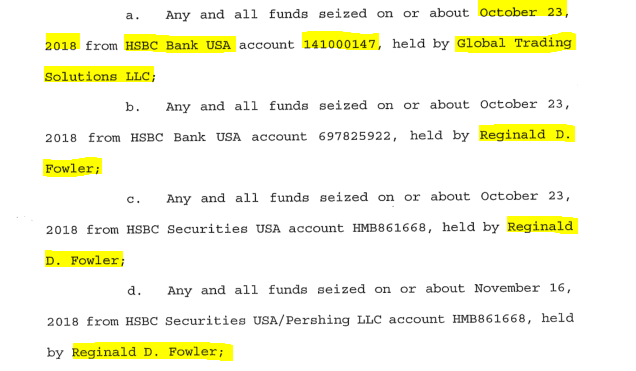

April 30, 2019 it became known that duringInvestigations against Bitfinex and Tether detained a well-known businessman and former footballer - Reginald Fuller. His accomplice, Ravid Yosef, is still at large and her whereabouts are unknown.

https: // www.justice.gov/ usao-ndga/ pr/ business-owner-indicted-failing-establish-effective-anti-money-laundering-program

Fuller and Yosef are accused of opening manyaccounts for working with cryptocurrency exchanges, in particular, on behalf of Global Trading Solutions, LLC, a company associated with Crypto Capital. According to the prosecutor, the total volume of transactions amounted to at least several hundred million dollars. In other words, gentlemen provided “shadow banking” services.

Reginald Fuller and Ravid Yosef

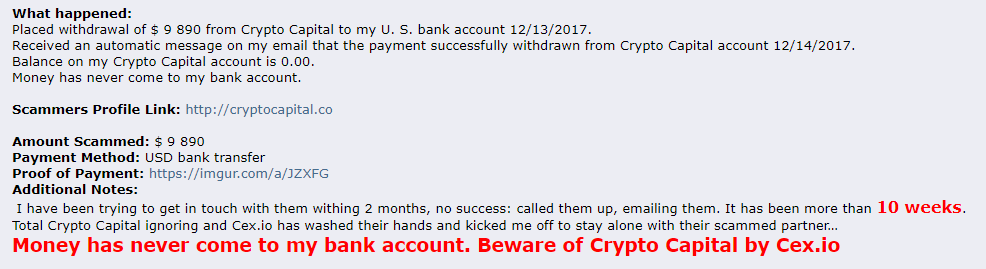

Everything would be fine if Crypto Capital hadn’t deceived ordinary customers:

https://bitcointalk.org/index.php?topic=1683368.msg40051264#msg40051264

Charges were filed on April 11, 2019years, so the mainstream media received information with a clear delay. Fuller’s accounts were frozen even earlier - in October 2018, just at the time when the exchange once again lit up its relations with other companies:

On October 6, 2019, it became known that Bitfinex is working with HSBC through Global Trading Solutions, LLC.

Interesting fact:

HSBC Holdings plc is one of the largest financialconglomerates headquartered in London. A subsidiary of The Hongkong and Shanghai Banking Corporation, it is Hong Kong's largest bank, which was founded in 1865 to finance trade between China and Europe.

Since 2005, there have been allegations against HSBCcharges of money laundering for Mexican and Colombian drug cartels, as well as terrorists. Based on the results of the investigation, the bank paid a fine of $1.92 billion in 2012.

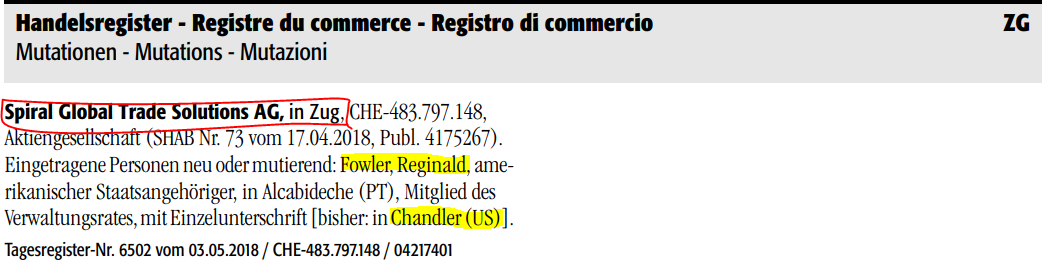

Many immediately suggested that Global Trading Solutions, LLC and the parent company Crypto Capital Corp - Global Trade Solutions AG are connected.

And that turned out to be true:

https://www.moneyhouse.ch/de/company/spiral-global-trade-solutions-ag-21093240791

https://www.shab.ch/shabforms/servlet/Search?EID=7&DOCID=4217401

As you know, in the past, Reggie Fuller headed the companySpiral Inc, which he founded back in 1989. Therefore, the direct relationship between Global Trading Solutions, LLC, Global Trade Solutions AG and Crypto Capital Corp no longer leaves any doubt, because:

https://www.bizapedia.com/co/global-trading-solutions-llc.html

So what do we have? A muddy type from Panama who has not been charged, Reggie Fuller, who for some reason decided to "merge" the girl, whose whereabouts are unknown. This is not enough. We continue.

Who is behind Crypto Capital?

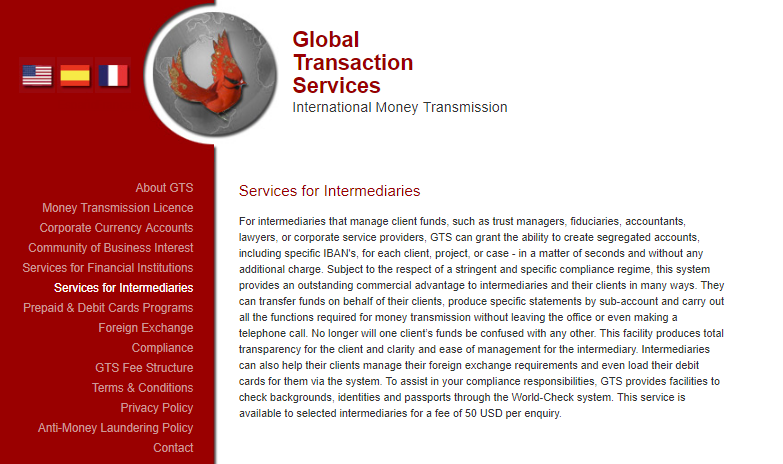

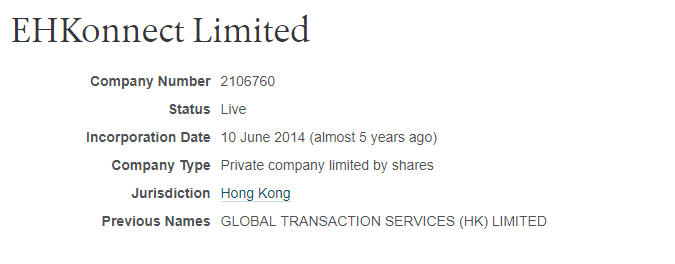

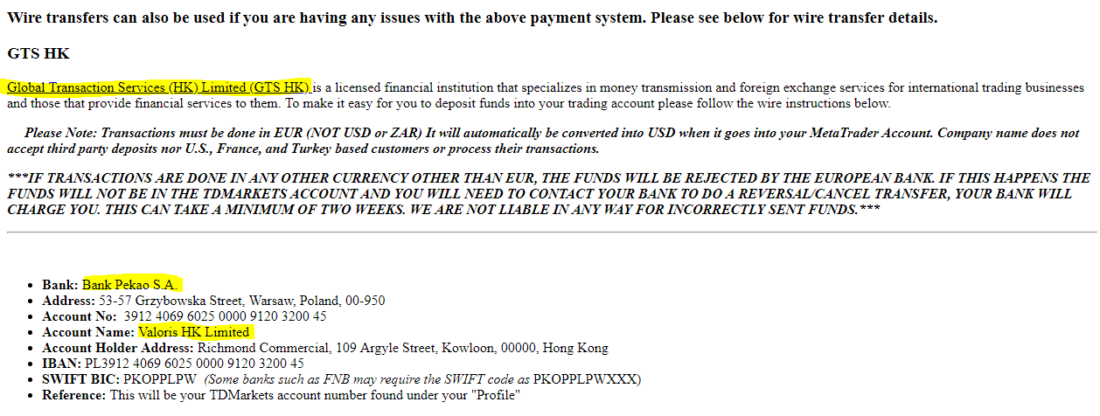

This is where the fun begins. Global Transaction Services (HK) until a certain time was an intermediary between Crypto Capital and various banks, in particular Polish:

https://web.archive.org/web/20141029090613/http://gtsus.net/services-for-intermediaries

https://web.archive.org/web/20141119093002/http://www.reddit.com/r/Bitcoin/comments/2m9z6w/australian_bank_refuse_to_sent_money_to_bitstamp

http://cryptocapitalcorp.blogspot.com/2015/10/crypto-capital-corp-scammers.html

Global Transaction Services Company Structure:

GTS UK > GTS LLC > GTS HK

So who is the owner of Global Transaction Services (UK)? Among the directors were Daniel Barrs and James Mullaburn:

https://opencorporates.com/companies/gb/07867696

Father and son: Daniel Barrs Sr. and Daniel Barrs Jr. sat down for financial fraud back in 2015:

https://www.itv.com/news/meridian/2015-04-22/four-men-jailed-following-multi-million-pound-investigation/

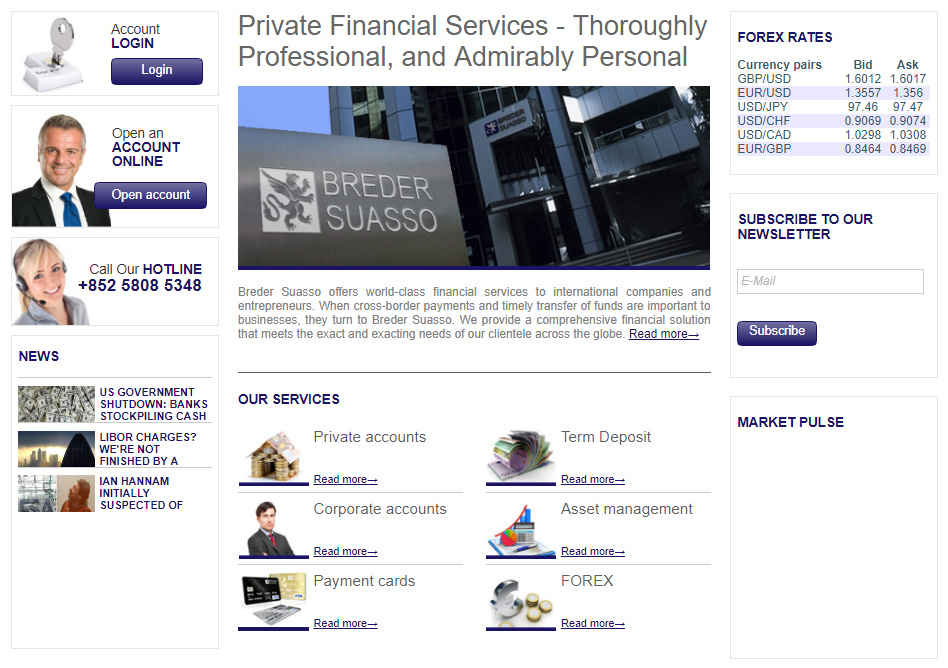

After that, Global Transaction Services ceased to exist, and a year later it closed, associated with it, extremely famous in certain circles - the company Breder Suasso:

Crypto Capital and New Zealand “bank” BrederSuasso was a common shell company - Global Transaction Services, LLC, on behalf of which they opened accounts with Polish banks such as Bank Spółdzielczy, Bank Pekao and mBank, a former Brebank:

https://www.bizjournals.com/atlanta/news/2016/05/13/global-transaction-services-head-indicted-for.html

https://gsl.org/ru/press-center/press/история-о-банке-breder-suasso/

At the same time, there is no doubt that both companies belonged to the same group of people:

https://opencorporates.com/companies/us_ga/14020795

https://opencorporates.com/companies/us_ga/09025812

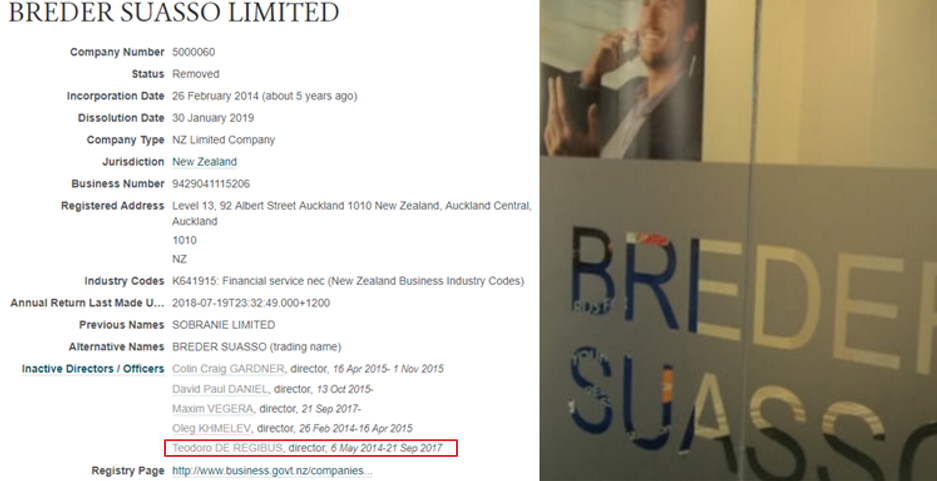

Among the directors of Breder Suasso, you can see the name of Teodoro De Regibus:

https://opencorporates.com/companies/nz/5000060

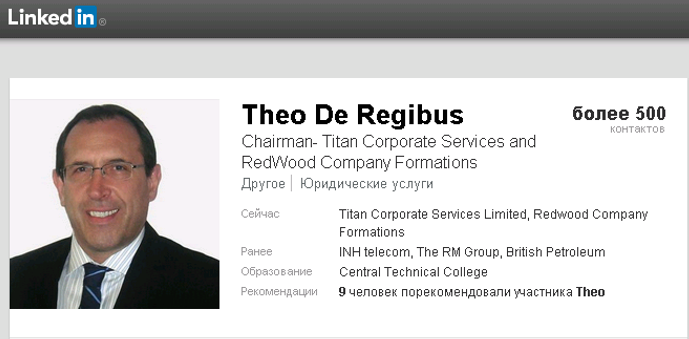

British Theo was the sole shareholderBreder Suasso Limited, and the sole director of the British company Breder. Living in Mauritius, he managed Titan Corporate Services Ltd, a company providing similar corporate services.

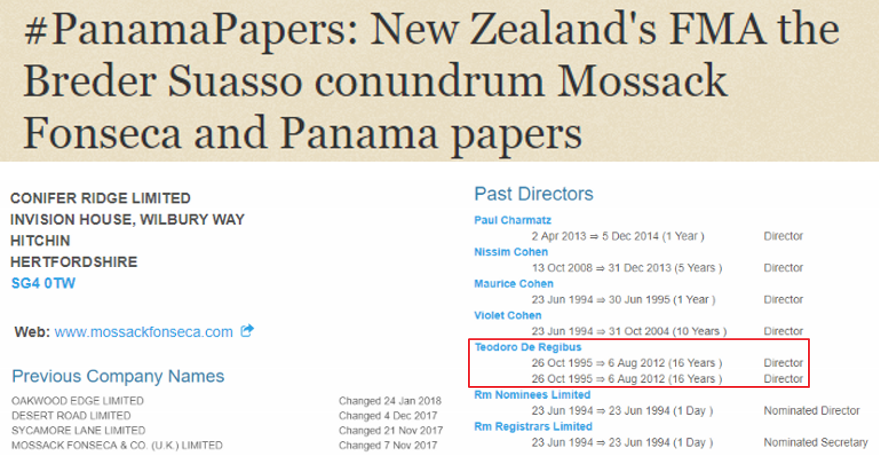

But, most importantly, for at least 16 years, he served on the board of directors of Mossack Fonseca & Co UK and its UK subsidiary RM Company Services:

https://www.companiesintheuk.co.uk/ltd/conifer-ridge

https://www.companiesintheuk.co.uk/directors/conifer-ridge

Yes, this is the same Panamanian company thathelped oligarchs, dictators and outright mafiosi hide their money offshore. Before the publication of the famous Panama Papers, Mossack Fonseca occupied a leading position in the offshore industry and represented more than 300,000 companies, having started its work back in 1977.

And most importantly, today Global Transaction Services (HK) has not disappeared. They just changed their name to EHKonnect Limited:

https://opencorporates.com/companies/hk/2106760

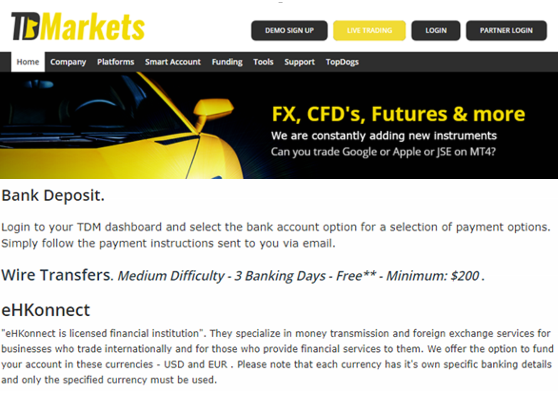

Their site is functioning well and continues to provide banking services, for example, to platforms such as TD Markets, which offer to get rich in binary options trading:

https://www.tdmarkets.com/deposits

Previously, TD Markets, owned by TDM Holdings Inc, used Global Transaction Services (HK):

https://web.archive.org/web/20161103205257/http://www.tdmarkets.com/deposits

Pay attention to the name of the account? Yes, this is another Valoris HK Ltd company, which also provided banking services:

https://web.archive.org/web/20160308221136/http://www.valorisonline.eu/index.html

With the name Valoris HK is connected and another, now notExisting binary options broker - Magnum Options. The site along with several other brands such as Traderush, Boss Capital and 10Trade were run by Rushmore Marketing in Tel Aviv. Today sites with such names do not work, but is this really a problem for their owners?

Bitfinex is going to solve all its problems by conducting a private IEO, an analogue of ICO. An extremely familiar situation - only the numbers are many times larger.

https://www.bitfinex.com/wp-2019-05.pdf

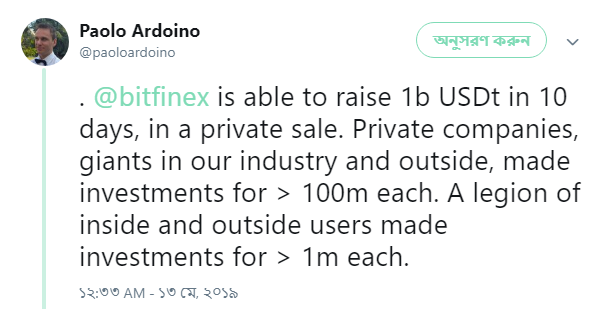

May 13, 2019 Bitfinex CTO -Paulo Arduino said on Twitter that in 10 days private giants and a legion of users transferred the necessary $ 1 billion for an unhappy exchange. An unprecedented case of human kindness and mercy ...

Interesting fact:

Token Name "LEO" is very similar to the name of the Panamaniancompany - LEO K, SA, whose main shareholder is the famous lawyer Javier Martin De Sedas, who is also the main shareholder of NESO, Inc, the parent company of NESO SP. Z.O.O, owned by the already painfully familiar Ivan Malina [Ivan Manuel Molina Lee]. No comments.

Prologue

After the lawsuit of the New York prosecutor, on the Bitfinex exchange, a panicky sale of Tether tokens for bitcoins began, as Fiat gateways, of course, did not work. The Bitcoin exchange rate has begun to grow.

P.S. Alex Jones never said that. These are the words of a boy who has never held more than $ 1000 in his hands. It is strange that even he understands this. And many do not, continuing to defend outright scammers.

***

Eh ... Sometimes I get to the bottom of the truth - I want tobury it back. Although there is no truth - and it is true. Therefore, forget about all this and live quietly on. Well, why do you need all this? Look, the rate has almost doubled. But other people's money, and even more so lost forever, is by no means your concern. Or have you already lost yours here? Well then, welcome to this wonderful world of alternative finance.