The passing week was remembered by a sudden fall andBitcoin's unexpected return above $ 7,000, the arbitrariness of Binance Singapore and a record investment in Ripple. Read about these and other events in the traditional Sunday digest.

Bitcoin price: rise from depth and familiar flat

Over the past week, the first cryptocurrency managed to fall into the region a little above $ 6400 and suddenly “emerge” to the familiar level of $ 7000.

Four-hour BTC / USD chart from TradingView

However, shortly after the upward correction, volumes began to fall sharply, and the price clamped sideways.

According to technician Josh Rager,Digital gold is still in the downtrend, and for a potential price reversal, you need to overcome the $ 7950-8000 area. On the other hand, a fall in prices below the previous local minimum (~ $ 6400) will open the door to the level of $ 5300, where significant volumes of purchase are concentrated.

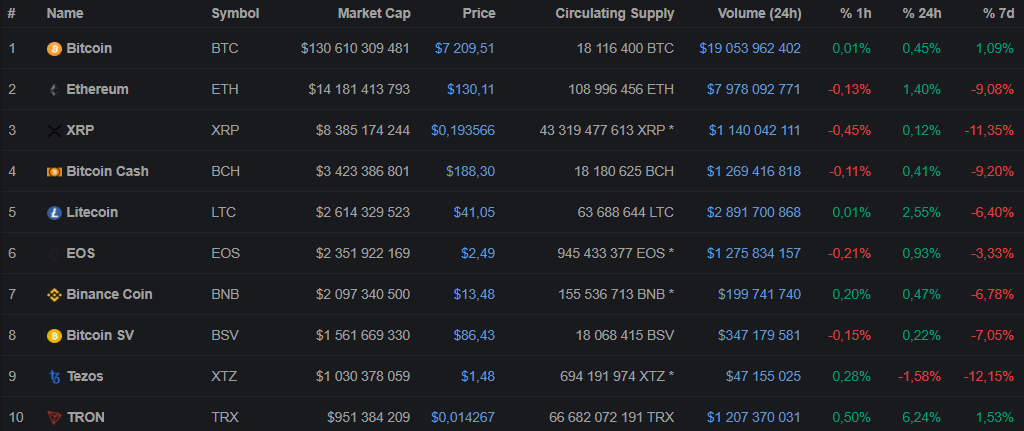

At the end of the week, the top ten CoinMarketCap looks like this:

As you can see, the majority of highly liquid assets in seven days fell slightly in price.

Binance vs privacy

The Singapore branch of the Binance exchange unpleasantly surprised the crypto community by blocking the withdrawal of funds to the Wasabi privacy-oriented wallet.

A Catxolotl user encountered a problem who received a message from the exchange, “Withdrawal suspended due to risk management” and a request to provide documents on his occupation and income.

Chief Developer Wasabi Wallet Adam ‘nopara73’Fichor called the actions of the popular exchange "a terrible and first of a kind precedent." According to him, it is noteworthy that the company six months ago was going to invest in its product.

Soon the head of Binance Changpeng Zhao prettycommented extensively on what happened. According to him, many users do not fully understand the ins and outs of regulating the cryptocurrency industry, including in terms of procedures such as KYC and AML, and how they apply to various types of exchanges.

Zhao also recalled the existence of specialized analytical services that both exchanges and regulators work with:

“In the world of fiat, banks require information onorigin of funds, address of residence, etc. In the world of cryptocurrencies, service providers analyze on-chain transactions and assign various risk assessments to various transactions. Most regulators require exchanges to use the services of such third-party service providers. Many users do not understand this and blame the exchange. ”

According to him, the Binance brand is used by severalregulated fiat exchanges, including Binance Singapore, Binance.US, Binance Jersey, etc. All of them operate independently of the global Binance.com platform and are subject to regulatory rules in their respective jurisdictions.

Cryptocurrencies 2020

US Congressman Paul Gosar proposed a bill that would allow the separation of digital currency regulation between several departments.

The document assumes the division of crypto assets into three categories: directly cryptocurrencies, cryptocurrency exchange goods and cryptocurrency securities.

Regulation of assets falling into the firstcategory, they want to entrust the Financial Crime Prevention Networks (FinCEN), the second - Commodities for derivatives trading (CFTC), and the third - the Commission on Securities and Exchange (SEC).

The authors of the bill called on the US Treasury Secretary through FinCEN to establish rules for tracking cryptocurrency transactions similar to those in force for financial institutions.

Ripple Record Investment

It is possible that huge investments helpRipple's XRP token is kept afloat. So, the other day a California company closed the Series C financing round, following which it raised a record $ 200 million, which raised its capitalization to $ 10 billion.

Ripple will use the raised funds to attract banks and money transfer operators to use the XRP token in international transactions.

Echo of the departed PlusToken

On Thursday, Whale Alert, a popular crypto-community Twitter account, announced the transfer to an unknown address of 789,525 ETH (about $ 105 million) from a wallet associated with the PlusToken cryptocurrency pyramid.

Earlier, the analytical company Chainalysis came tothe conclusion that PlusToken's assets have been and will continue to exert pressure on the market, so the move of such a large amount has raised concerns about a possible sale.

Matteo Leibovitz, an analyst at The Block, described the alleged scheme for the scammers: buying short positions in Ethereum futures, crashing the spot price and closing profitable contracts.

Billionaires and Bitcoin

The head of the investment company Pulte Capital Partners Bill Pulte did not miss the opportunity to buy some more bitcoins on the drawdown. Previously, the heir to the construction empire bought 11 BTC for $ 78 thousand.

The main advantage of Bitcoin Pulte callsthe ability to send a coin to anywhere in the world without intermediaries. Also, the billionaire is interested in cryptocurrency charitable contributions to various humanitarian structures.

It is known that Pulte is well acquainted with the head of Twitter, Jack Dorsey, who is also a bitcoin investor.

In the future with optimism?

The leaders of the three crypto exchanges in South Korea - Bithumb, Korbit and Hanbitco are confident that the conditions on the digital asset market next year will be more favorable.

In particular, exchange representatives expect an even greater influx of institutional investors.

“Based on internal research,Institutional investors around the world included crypto assets in their portfolios in 2019 for testing, and the results were satisfactory. In 2020, institutional people will go beyond testing and create a new wave of demand for cryptocurrencies. ”“- Seithil Moon, Director of New Business and Partnerships at Bithumb, said.

Korbit believes that in addition to the institutionalmillennials are gradually entering the market, while Hanbitco noted an improvement in the regulation of the digital currency market in South Korea and a decrease in legal uncertainty.

Our YouTube

This week, Ton Weiss talked about whether Bitcoin will please investors after a halving and what the “weather” will be like in the short term.

Bitcoin Core developer Jimmy Song discussed with Max Caydun the rationality of the Bitcoin maximalist approach.

... and the cryptoeconomist and founder of Room77, George Platzer, spoke about the impact of darknet markets on the massive spread of cryptocurrencies.