The past week was full of bright events - after the statement of the head of the People's Republic of China, digital gold suddenlyreturned to September marks, trading volumes at Bakkt reached a historic high, and Ethereum developers decided on the date of Istanbul hard fork.

$ 10,000 Retest

Unexpectedly for many, on the night of October 26, the price of bitcoin increased by almost 40%, reaching the September mark.

TradingView Bitstamp Daily BTC / USD Chart

As you can see on the chart, the upward price movementsupported by significant trading volumes. Finally, the milestone was also reached in the form of a moving average with a period of 200, which for a long time acted as a resistance. This line runs just below the $ 9,000 mark and is likely to act as a support level now.

Note that the last time an equally long way in a comparable period of time, the price went only two times, back in 2010-2011.

</p>The daily price range was almost $ 3000:

</p>Naturally, during such a strong movement, it could not do without mass liquidations on BitMEX (~ $ 400 million), which only strengthened the price impulse.

</p>Now the price of BTC continues to grow, albeit not at as fast a pace as before. At the same time, bitcoin critics do not miss the opportunity to leave an angry comment at the time of correction.

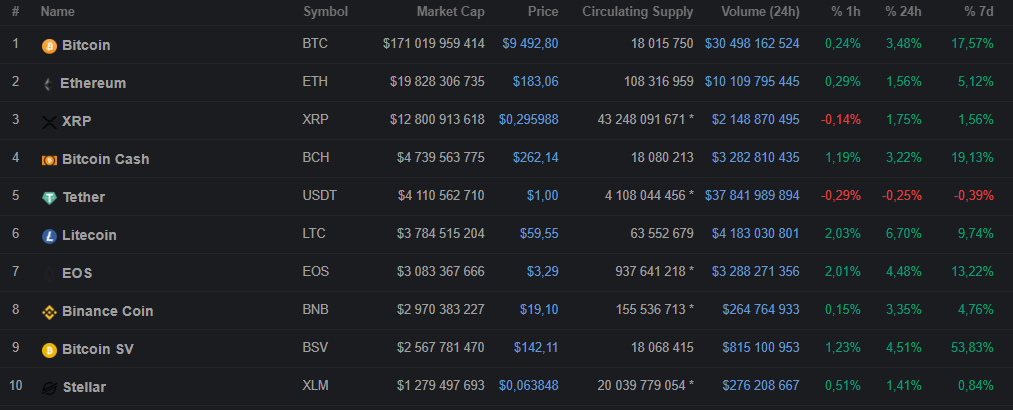

</p>Altcoins also showed some growth throughout the week. In particular, the top ten CoinMarketCap looks like this:

Current market capitalization is $ 250 billion, Bitcoin dominance index is 68.3%.

Blockchain Greetings from the Middle Kingdom

It is possible that the market sentimentSignificantly influenced by the statement of President Xi Jinping on the need to introduce a blockchain for the innovative development of industry and key technologies.

Chinese leader stressed that China is capable oftake a leading position in the world in the field of blockchain and drew attention to the need for its integration into the real economy and related information technologies such as artificial intelligence, Big Data and the Internet of things.

Almost immediately after Jinping’s speechThe All-China Assembly of People's Representatives, the Parliament of the PRC, approved the law on cryptography. The document standardizes cryptographic applications and the public / private key management process.

</p>Special cryptography will be addressedagency subordinate to the leadership of the Chinese Communist Party. Primitive Ventures managing partner Dovi Wang also announced the release of a blockchain application for PDAs. In her opinion, all this is preparing for the launch of the digital renminbi.

It is noteworthy that after the speech of the leader of China, the numberWeChat searches for the word "bitcoin" more than doubled. At the same time, the number of requests for the word "blockchain" increased by almost 12 times.

Record volumes at Bakkt

Another pleasant surprise forThe crypto community has seen a rapid increase in trading volumes on the Bakkt delivery futures exchange. Thus, against the backdrop of the rapid growth of BTC, the daily turnover of this regulated platform amounted to 1183 contracts (>$10 million).

</p>This volume is almost two times higher than the previous Bakkt record, which was recorded against the backdrop of the collapse of bitcoin.

It also turned out recently that Bakkt was already December 9th.will launch bitcoin options, ahead of its competitor - the CME exchange. Settlement of options based on monthly delivery futures will be possible in cash or physical delivery of cryptocurrency (one contract - 1 BTC).

Zuckerberg's speech to the US Congress

On Wednesday, October 23, Facebook head Mark Zuckerberg announced that Facebook will cease membership in the Libra association if a digital currency project is launched without regulatory approval.

“If in the end we do not get permission, we will not be part of the Association”, - said the creator of the world's largest social network.

Zuckerberg noted that Libra is not intended forcompetition with sovereign currencies and will cooperate with the Federal Reserve System and other central banks so that the project does not create problems for monetary policy.

“We see a lot of cryptocurrencies. We are trying to create a safe, secure and regulated alternative. As a large company, we will not begin to create something unregulated or decentralized. I can’t speak for the whole Association, but I give you a promise on behalf of Facebook ”- he added.

Hard fork Istanbul is just around the corner

Ethereum developers have planned to activate Istanbul hard fork in the main network to block # 9 056 000.

Miners will get it tentatively on December 4. In case of unforeseen circumstances, the hard fork will be postponed to January 8.

In this case, the developers believe that nothingshould prevent timely activation. They also approved the EIP 2124 upgrade, which allows users to determine which chain the majority supports.

Also recently, Ethereum founder Vitalik Buterin put forward a number of ideas to address some of the obstacles to the development of the Ethereum 2.0 ecosystem, which is scheduled to launch in the first quarter of 2020.

According to the calculations of Colleen Myers from the Brooklyn startup ConsenSys, after the launch of Ethereum 2.0, validators will be able to expect 4.6% -10.3% per annum of remuneration for staking.

And again Bitfinex in the spotlight

This week it became known that the PolishPolice arrested Crypto Capital President Ivan Manuel Molina Lee, who is accused of participating in a drug cartel and money laundering through the Bitfinex Bitcoin exchange.

Soon, Bitfinex released a statement calling itself a victim of fraud by the Panamanian company Crypto Capital.

“Crypto Capital handled somefunds on behalf of and on behalf of Bitfinex for several years. During this time, Bitfinex relied on various information from Molina and Josef [another person involved in the Crypto Capital case], which turned out to be false. ”, - representatives of the exchange explained.

In particular, they say in Bitfinex, Crypto CapitalI constantly tried to portray myself as an honest organization, strictly following legal norms and having significant experience in interacting with banks. This was done to convince the exchange of the processing ability to process its operations.

Representatives of the exchange stressed that they wouldto seek a return of funds to stakeholders and that all assumptions about Bitfinex involvement in illegal activities are completely untrue.

Bills on the regulation of cryptocurrencies in Ukraine

In Ukraine, introduced bills ontaxation of operations with cryptocurrencies and combating money laundering with the help of digital assets, as well as amendments to the document “On public electronic registries” aimed at introducing blockchain. The documents were prepared by the inter-factional deputy association Blockchain4Ukraine together with the Ministry of Digital Affairs, BRDO and other market participants.

The first bill amends the law “Onprevention and counteraction to the legalization (laundering) of proceeds of crime, the financing of terrorism and the financing of the proliferation of weapons of mass destruction. ” It involves the implementation of AML / CFT procedures in accordance with FATF requirements.

According to the document, operations with digital assetsworth more than 30 thousand hryvnias (about $ 1200 at the time of writing) should be accompanied by the provision of information about the seller and the buyer, including personal data (for individuals) or information about the organization (for legal entities) and wallet addresses.

The second bill relates to the taxation of transactions with crypto assets. Note that its discussion has been going on for several years.

The document separates the concepts of “token asset” and"Cryptoactive". Asset token assumes ownership. Transactions with such assets will be taxed according to the rules applicable to property or non-property objects that are assigned to the token.

The bill on asset tokenization was promised to be submitted within two weeks.

Our Youtube

This week we talked with the developer Gleb Naumenko under the heading “Bitcoinization”

…. also with the CEO of the Xena Exchange Anton Kravchenko.