Summing up the results of the outgoing week in the bitcoin industry, let's recall how the events in the confrontation developedTelegram and SEC, the launch of a new cryptocurrency tool on Nasdaq, the closure of the largest darknet market with child pornography and other important events.

Bitcoin price

According to the results of the outgoing week, the first cryptocurrency fell in price by almost 5%, and it is still difficult to predict what factors may unleash the trend in the near future.

As you can see in the chart below, if Bitcoin was trading slightly below $ 8,500 last Sunday, as of the evening of October 20, its weighted average rate dropped to around $ 8,000.

However, many investors are stillpositively look at the prospects of “digital gold” and express confidence in its growth in the long term. So, the managing partner of Exante brokerage company Alexei Kirienko believes that bitcoin will outlast many banks and should be in the portfolio of each investor.

"For many investors, not having bitcoin in their portfolio is a bigger risk than having it.We need at least 3%.Now there are risks in the world that were absent before.In connection with geopolitical conflicts, in connection with the fact that some of your activities, which you now consider absolutely correct, at some pointmay seem illegal to some," Kiriyenko said.

Other leading cryptocurrencies for the most partalso left at the end of the week in the red zone, although a number of assets, including XRP, Bitcoin SV, Stellar and Monero, showed positive dynamics, adding an average of 3 to 4%.

We also note the impressive growth of 0x (ZRX), which, pending the release of version 3.0 of the protocol, grew by almost 25% over the past week.

SEC vs. Telegram: court adjourned to February 2020

New York court adjourned SEC trialvs Telegram Group Inc. and TON Issuer Inc. February 18-19, 2020. Up to this point, defendants are prohibited from distributing or selling Gram cryptocurrency.

October 11 SEC announced receipt of a temporaryGram distribution ban. The jurisdiction of the department was provided by 39 American investors who purchased coins for $ 424.5 million. According to the SEC, Gram tokens are a security and as such fall under special regulation.

Telegram also agreed to transfer the launch toApril 30 and offered dissenting investors to return 77% of the invested funds. However, the defendants do not consider Gram securities. The companies asked the court to lift the temporary ban on the distribution of tokens, because, in their opinion, the actions of the SEC are contrary to common sense.

Nevertheless, the transfer of the trial from the SEC to Telegram was called a “positive step”, noting that this would allow the company to provide the maximum possible support for its position.

Libra Association has found a replacement for companies that have left the project

The Libra Association, which is responsible for developing the digital currency project from Facebook, said this week that more than 1,500 firms have expressed their desire to join the organization.

At the same time, a charter was signedorganization and approved by the board of directors. It included Matthew Davy (Kiva Microfunds), Patrick Ellis (PayU), Katie Hown (Andreessen Horowitz), David Marcus (Calibra) and Wences Casas (Xapo Holdings Limited). Bertrand Perez has been appointed Operational and Interim Managing Director.

The statement also says that among many firms that have expressed a desire to join the Libra Association, 180 fit the criteria of the organization and can become potential partners.

Previously, PayPal, Mercado Pago, Visa, Stripe, Mastercard and the eBay online trading platform left the project.

Peter Thiel and Digital Currency Group invested $ 50 million in a future competitor to Chinese miners

Supported Digital Currency Group (DCG)Layer1 raised $ 50 million from a number of well-known venture capitalists, including PayPal co-founder Peter Thiel. Following the successful closure of the Series A funding round, the company's market value reached $ 200 million.

Initially, Layer1 focused on support.ecosystem of confidential cryptocurrency Grin. However, now the San Francisco-based firm intends to focus on bitcoin mining and plans to compete with Chinese miners over time.

To implement the plan, the company acquiredland in Texas for the construction of substations, entered into a partnership with a Beijing manufacturer of semiconductors and built its own infrastructure for mining cryptocurrencies.

Nasdaq has added an index based on 100 crypto assets

The world's second largest stock exchange, Nasdaq, has added the CIX100 index based on 100 crypto assets.

It is noteworthy that when forming a basket ofHundreds of leading digital asset tools from Cryptoindex.com use neural network algorithms that take into account more than 200 different factors. Allegedly, such a comprehensive analysis eliminates coins with fake volumes.

The index draws data on transactions on ninethe largest bitcoin exchanges, and also analyzes information from social networks and the media. Only those coins that last in the top 200 for at least three months can become components of the CIX100. The composition of the index will be reviewed monthly.

Study: 60% of crypto projects ceased to exist due to the loss of investor interest

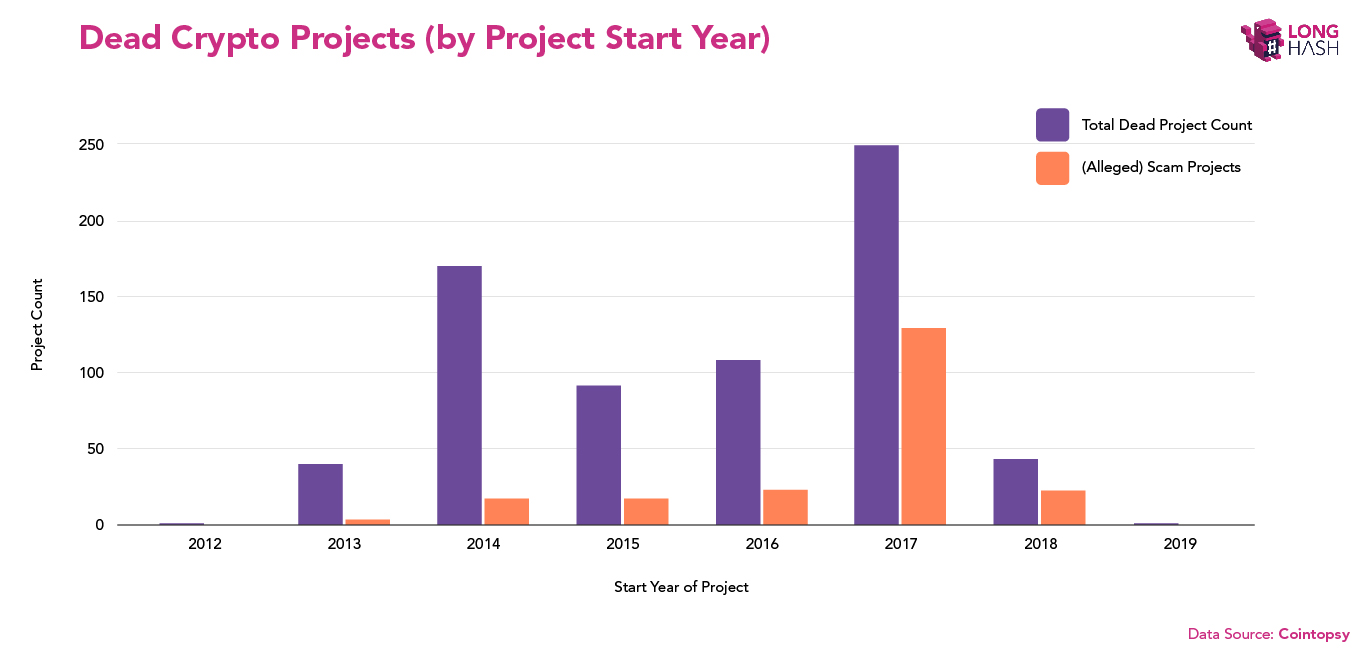

According to the Coinopsy platform, the main reasonThe “death” of crypto projects is the loss of investor interest in them. Such a fate befell 63.1% of depreciated tokens, according to a new study by LongHash.

Almost 30% of closed projects werefraudulent. Most of them were launched in 2017 against the backdrop of the rapidly growing market and ICO boom. Already in 2018, their number has significantly decreased. Other reasons for the closure of projects were failed ICOs (3.6%) and tokens that started as jokes, such as AnalCoin, BagCoin and BieberCoin (3.2%).

The exact number of such projects is notdefined, since the evaluation criteria on different services vary, noted in LongHash. In addition, many of them simply do not fall into the analytic database. For example, services often do not take into account Russian-language and other projects, since the platforms are aimed at an English-speaking audience.

The largest child pornography market in the darknet has been eliminated

US Department of Justice reported this weekon the closure of the largest darknet market for child pornography, through which more than 1 million videos were distributed from June 2015 to March 2018. Calculations on it were made in bitcoins. The operation was carried out by joint efforts of law enforcement agencies of the USA and South Korea.

During the international operation since March 2018managed to detain 337 site users from the UK, Brazil, Germany, Saudi Arabia, the USA and the UAE. Law enforcement officers also released 23 victims of sexual violence in the United States, Britain and Spain. They were exploited to produce illegal content on a regular basis. All of them were minors.

</p>The intended site administrator isA 23-year-old South Korean citizen, Jung Woo Song, is currently serving an 18-month sentence in his homeland. In the US, he was also charged. The servers, according to the US Department of Justice, were located in Wu Son’s apartment. During this time, the number of detected cases of storage, production and distribution of child pornography increased from 1.1 million (2014) to 18.4 million (2018).

A VIP account for unlimited download for six months cost 0.03 BTC (in March 2018). Payment was proposed to be made through several cryptocurrency exchanges, including Coinbase, BTC-e and Bitfinex.

Blockchain technology regulation memorandum signed in Ukraine

A memorandum has been signed in the Verkhovna Rada of Ukraine,designed to give the green light to blockchain technology in the country. It is alleged that the legislative, executive branches of government and business for the first time were able to come to a "clear consensus."

The document is concluded between the Verkhovna Rada Committeeon issues of digital transformation, the Ministry of Digital Transformation, the inter-factional parliamentary association Blockchain4Ukraine, the Office of Effective Regulation (BRDO), a number of specialized associations, for example, the Association of Blockchain of Ukraine and other market participants.

As the parties to the agreement hope, the signingThe memorandum will be the first step that will allow Ukraine to leave the gray zone in matters of regulating blockchain technology, as well as act within the framework of recommendations for cryptocurrency market participants adopted earlier this year by the FATF Financial Action Task Force.