A new round of increased regulatory interest in cryptocurrencies and restrictions on the operation of a number of crypto exchangesled to the correction of Bitcoin from $ 50 thousand to $ 40 thousand. However, a number of indicators indicate the imminent end of the correction.

Image Source: Cryptocurrency ExchangeStormGain

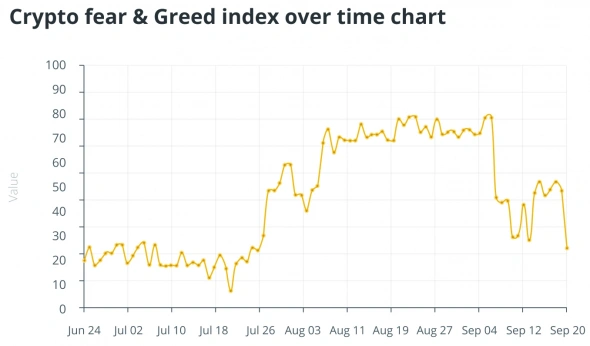

Extreme levels of the fear and greed indicatortalk about an impending trend reversal. Greed was at its peak when Bitcoin was at $ 60K, and it was replaced by fear at $ 30K. Now the level of fear is again close to summer lows, which supports current prices.

Image Source:cointelegraph.com

The most cautious holders remain those with small wallets (holding less than 10 BTC). After the fall in May, they returned to buying, bringing the share of ownership to a historic 13.9%.

Image Source:glassnode.com

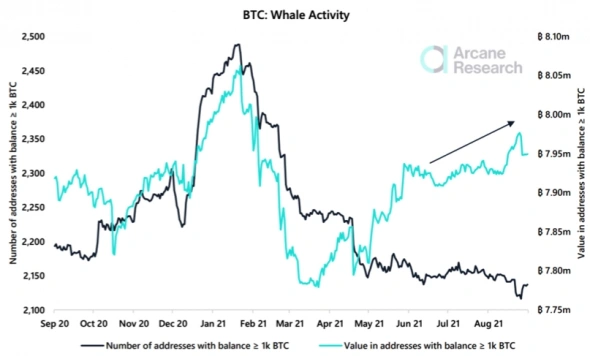

But whales (≥ 1BTC) continue to accumulate their reserves. Their number has decreased by 15% since February, however, the reserves of those remaining in the ranks have grown on average from 3236 BTC in February to the current 3722 BTC.

Image Source:research.arcane.no

A striking example of a true hodler isMicroStrategy, which bought an additional 5,050 BTC for $48,000 in September. The company now has a total supply of 114,042 BTC (~$5 billion) and an average coin purchase price of $27,713. As CEO Michael Saylor wrote: “If I had chosen gold instead Bitcoin last year, this would have led to multi-billion dollar losses.”

The timing is really right:Jerome Powell at the last press conference went against the expectations of market participants and once again did not set a date for curtailing monetary incentives. The regulator continues to print fresh dollars in the amount of at least $ 120 billion a month, which leads to a weakening of the American currency against most financial instruments.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)