The second quarter of 2020 will be even more successful for the investment company Grayscale Investments than the first threemonth of the year, its founder and CEO Barry Silbert is sure.

Earlier this week Grayscale Investmentsannounced a record amount of assets under management. Their total value has reached $ 3.8 billion, of which $ 3.3 billion falls on GBTC, the company's flagship bitcoin trust.

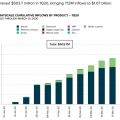

Investor and financial analyst Kevin Rook addressedPay attention to another graph from the company’s latest report - the average size of weekly investments in GBTC. If in the first quarter of 2019 this figure was $3.2 million, then for the same period in 2020 — $29.9 million

The corresponding Twitter entry attracted the attention of Barry Silbert himself.

“Wait, you'll still see the second quarter,”— The head of Grayscale Investments and Digital Currency Group responded to Kevin Rook’s statement that institutional money is finally starting to flow into the industry.

Note that if in 2019 Grayscale Investments attracted investments of $ 600 million, then only in the first quarter of 2020 this figure amounted to $ 503 million.

In April, Grayscale Investments also announced thatthe influx of investments in its second most popular product, Ethereum Trust, amounted to $ 110 million. This turned out to be more than all previous revenues combined over the past two years ($ 95.8 million).

According to analysts, the company acquired 48.4% of all Ethereum coins that were mined from the beginning of the year.