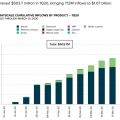

Grayscale Investments, a crypto asset management company, raised...a total of $ 503.7 million, nearly doubling its previous record of $ 354.8 million in the third quarter of 2019.

Investment company specializing incryptocurrencies, reported that a fall in the price of cryptocurrencies last month contributed significantly to a record capital inflow, as institutional investors acquired cryptocurrencies in a falling market by betting on Bitcoin Trust (GBTC), Ether Trust (ETHE) and other products.

For comparison, the Grayscale division of the company in New York raised $ 600 million for the whole of 2019.

Q1 2020 marks Grayscale’s strongest quarter yet,with >$500 million raised … that’s 83% of total capital raised for ALL of 2019, in just ONE quarter! Read more about the demand trends we witnessed in the first quarter here: https://t.co/TFwqIcAQEA pic.twitter.com/gSUh0ACNkj

- Grayscale (@GrayscaleInvest) April 16, 2020

According to the company, over the past 12 monthsthe flow of funds into cryptocurrencies exceeded $ 1 billion, and this is a new record. As a result, the total value of assets managed by Grayscale has now exceeded $ 2.2 billion.

It is noteworthy that 88% of the totalInvestments in the first quarter of this year came from investments by institutional investors, most of which are hedge funds that gain access to the cryptocurrency market. Over the past 12 months, 79% of investments also came from institutional investors, the lion's share of which again is hedge funds.

According to Grayscale information, even inIn the current environment of increased risk caused by the collapse of the market and the ongoing epidemic of coronavirus, investors are "increasing the level of their digital assets." And it was the increase in volatility over the last quarter that brought investors more opportunities.

</p> 5

/

5

(

1

voice

)