Let's take a look at some of the key on-chain indicators of market cycles: what do they tell us about the currentposition of the bitcoin market?Today we will present all indicators additionally as percentiles to compare current values with historical ones, in order to show when they indicate that the market is ready to form a bottom or top, or the values are neutral.

Judging by about 20 on-chain market indicatorscycles we are tracking, the market setup appears to range from neutral to bullish. However, we understand that on-chain, the macro environment, and the state of the bitcoin derivatives market all have an impact on bitcoin’s growth trajectory in one way or another, especially given its current high correlation with risky assets.

The ratio of BTC market value to realized(MVRV) is a major focus of ours as this metric tracks the current state of the price against the BTC cost basis for current holders, or “fair value”. The z-score for MVRV, MVRV-z, adds the standard deviation of market cap to the calculation to provide a better signal.

Bitcoin price highs in 2021played out like the tops of previous cycles - with a period of parabolic growth, a sharp peak and a subsequent decline. But after comparatively less growth, it is probably reasonable to expect comparatively less decline. As of today, Bitcoin's MVRV-z indicates a neutral market after several price rallies out of the $30K area. Another move down into the "oversold" zone below the 15th percentile of the indicator looks unlikely today, unless there is a sudden sell-off triggered by another " black swan."

BTC price weighted by MVRV-z (top); MVRV-z for BTC (bottom).

MVRV-z for BTC in percentiles

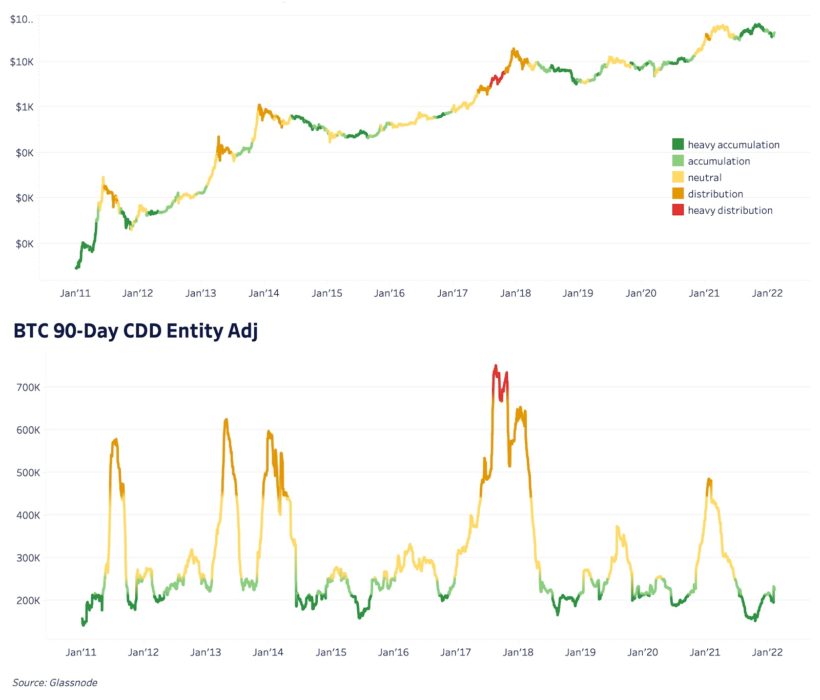

90 Day Rolling Amount CDD (from Coin DaysDestroyed is another important indicator that helps analyze the activity of long-term holders. While the top of BTC in May 2021 could see an increase in the number of destroyed coin days, there was no significant increase in spending by long-term holders at the November top. In the past few months, the old coins have hardly moved, which suggests that most of the “smart money” is sitting quietly and waiting for growth, with no intention of parting with their bitcoins at current prices.

In the past few months, the indicator's readings indicate a period of accumulation ranging from moderate to active, with the 90-day rolling sum CDD below its 25th percentile.

BTC price weighted by 90-day user-adjusted CDD (top); 90-day CDD adjusted by user (bottom).

90-day CDD, adjusted by user, in percentiles

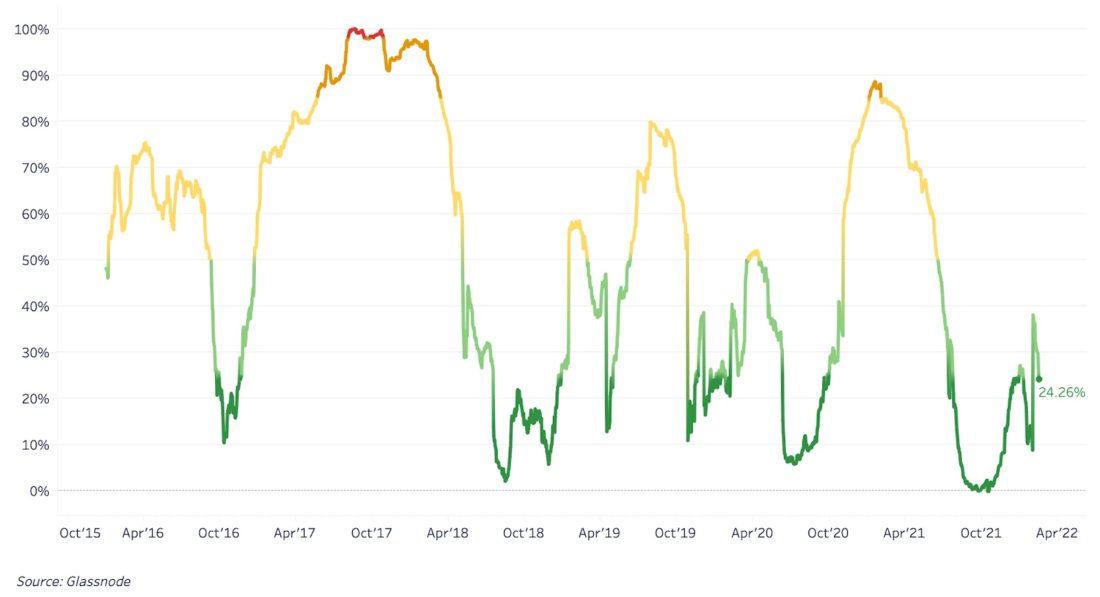

Reserve Risk, which we talked about in detailhere, is a more sophisticated on-chain indicator that evaluates the risk/return ratio for investing in bitcoin based on the conviction of its long-term holders. The indicator is calculated as the ratio of the price of BTC to the expression of conviction of long-term holders. For more detailed information about the calculation, please refer to the overview mentioned above.

Reserve Risk is currently accelerating,bouncing off the bottom reached when the BTC price fell to ~$35K. Reserve Risk has generated very few “maximum opportunity” buy signals in the history of Bitcoin. The indicator's current readings, which are in the "opportunity" zone, support our assumption of a smaller decline following a more modest and neutral 2021 market top.

Low Reserve Risk values are observed athigh conviction of hodlers against the background of a relatively low price. And this is yet another metric that indicates the strong confidence of long-term holders in the further growth prospects of BTC.

BTC price weighted by Reserve Risk (top), Reserve Risk (bottom).

Reserve Risk for BTC in percentiles

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.