The Puell Multiple indicator and the market-to-basis ratio tracked by analytical startups Glassnode and MessariBitcoin prices indicate an underestimation of the first cryptocurrency. This was stated by representatives of Messari.

Since March 12, when the minimumthis year, the level of $ 3800, bitcoin has risen in price by almost 2.5 times. However, according to the “Bitcoin market cycle barometer” proposed by the Cryptopoiesis researcher, cryptocurrency still has not reached fair values.

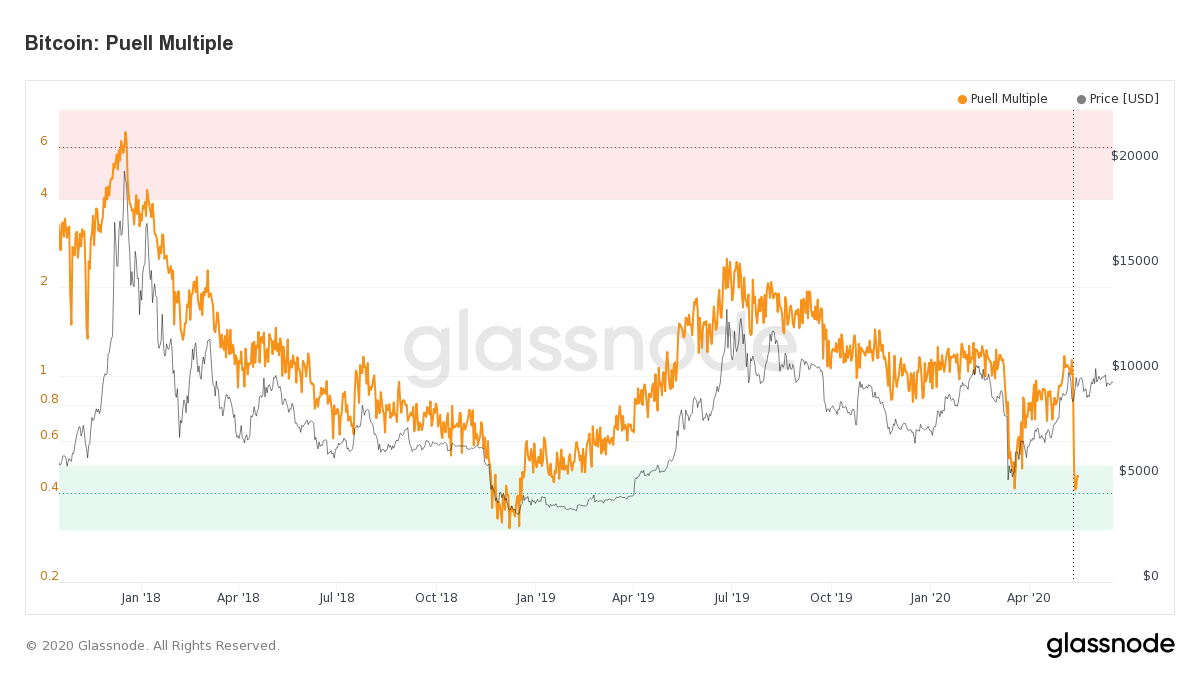

This metric, dubbed Puell Multiple, represents the ratio of the daily issue volume in dollar terms to the same indicator, but already smoothed by the 365-day moving average.

The hypothesis of the presence of bitcoin growth potentialillustrates a graph in which you can see that the indicator has lowered into the buying area, below a value of 0.5. This behavior means that the cost of newly released BTC on a daily basis is low compared to historical data, especially during the rally.

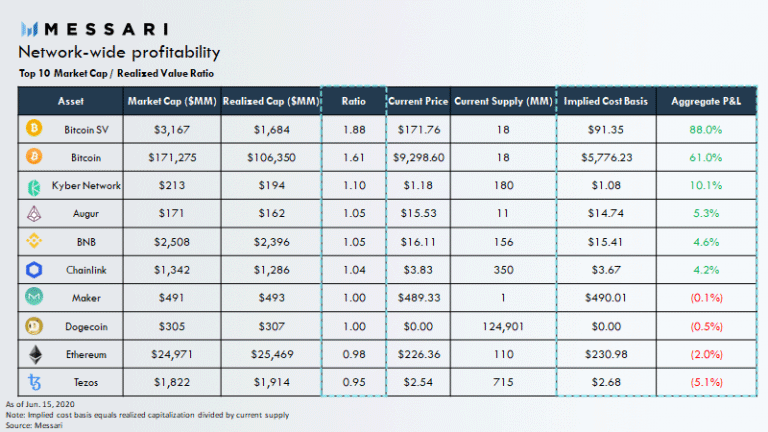

Another metric, the ratio of market and basicThe price tracked in Messari also allows us to conclude that there is an underestimation of bitcoin. According to these data, investors' view of the coin remains bullish, as most investors are in profit.

“Despite the fact that in 2017 bitcoin gotalmost to $ 20,000, in reality, not many transactions have been completed at these levels. A relatively small number were also priced above $ 10,000. The average purchase price now is less than $ 6,000. ", Said Messari researcher Ryan Watkins.

When Bitcoin rocketed to ~ $ 20,000 in 2017 it became front page news.

However, despite the hype, not much Bitcoin actually traded near $ 20,000.

Nor has much traded above even half of that.

In fact, the estimated cost basis for the Bitcoin network is just under $ 6,000.

1 / pic.twitter.com/EzcLKGpA02

- Ryan Watkins (@RyanWatkins_) June 16, 2020

The analyst explained the mechanism of operation of this indicator:

“Under the base price refers to the price at which the asset was purchased. For the purposes of calculation, the indicator is calculated by dividing the realized capitalization of the cryptocurrency by its current offer. ”

This way you cansee the indicator of realized capitalization developed by CoinMetrics, normalized to the value of the coin. This indicator itself is calculated by pricing each unit of supply at the price at which the last transaction took place. Realized capitalization can be thought of as an estimate of the total underlying value of a cryptocurrency.

Watkins also cited the TOP 10 cryptocurrency tableby this ratio. According to his calculations, Bitcoin is second only to Bitcoin SV (BSV). Ethereum is in ninth place. Holders of this coin incur losses, which average 2%.

Rate this publication