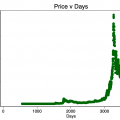

Bitcoin halvings cause supply shock. Gradual accumulation of the resulting deficit~ 18 months. As a result of the halvings of 2012 and 2016, the manias of 2013 and 2017 arose. Halving 2020 will give the same result. In this post I will try to visualize this mechanic.

Note:

As a result of halving, the inflow of new supply is cut in half, but net demand remains the same. From this moment on, the supply deficit begins to accumulate.

The supply deficit is gradually accumulating. Net demand translates into long-term ownership twice as much supply each month as is generated through mining.

The “available for purchase” supply on the exchanges is decreasing, but the accumulated influence is still small.

The accumulated supply deficit becomessignificant. As market participants buy out the “available for purchase” supply, the price rises. In the regular market, this would trigger an increase in supply and sales from current asset holders.

Miners cannot increase production, but hodlers are starting to gradually increase the “available for purchase” supply at the expense of some of their reserves.

However, due to the characteristics of Bitcoin,which is both a store of value and a kind of startup asset, in which 99% of people do not yet have any significant positions, the price increase also attracts additional interest and increases demand.

As enthusiasm grows, new demand grows faster than hodlers' willingness to sell their coins. This causes a sharp spike in the growth of the supply deficit, accelerating the price growth.

This is where the mania phase begins, which ends when the hodlers' willingness to sell their coins begins to exceed net demand.

Of course, this mechanic is largely

�

Source