Willy Wu, alchemist and legend of on-chain analysis, presents his point of view on the current market situationbitcoin.

Summary as of January 30, 2022 (current price ~$38.1k):

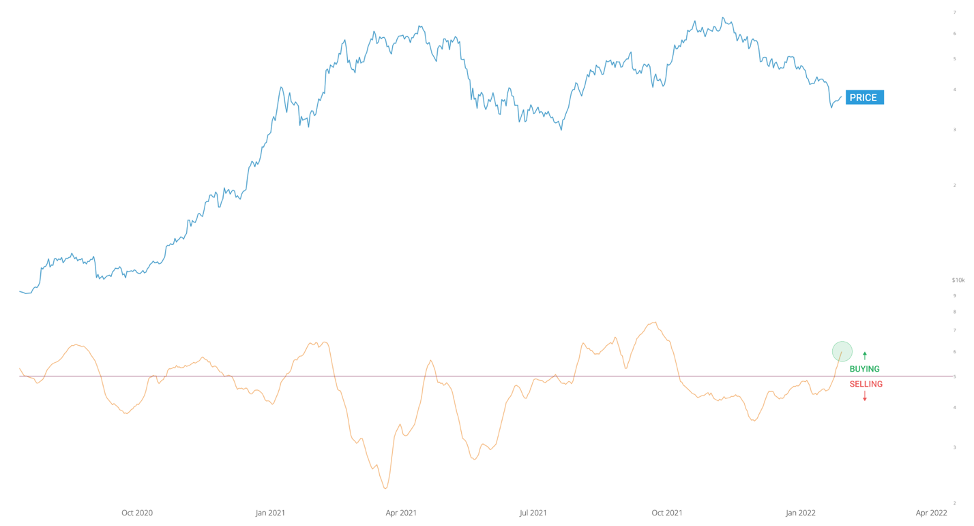

- Short term:the traders' sale has stopped, whichleads to the fact that the hodlers follow their example. Traders on the futures exchanges have recently stopped selling, while on-chain we are seeing buying by both HODLers and medium-term speculative investors.

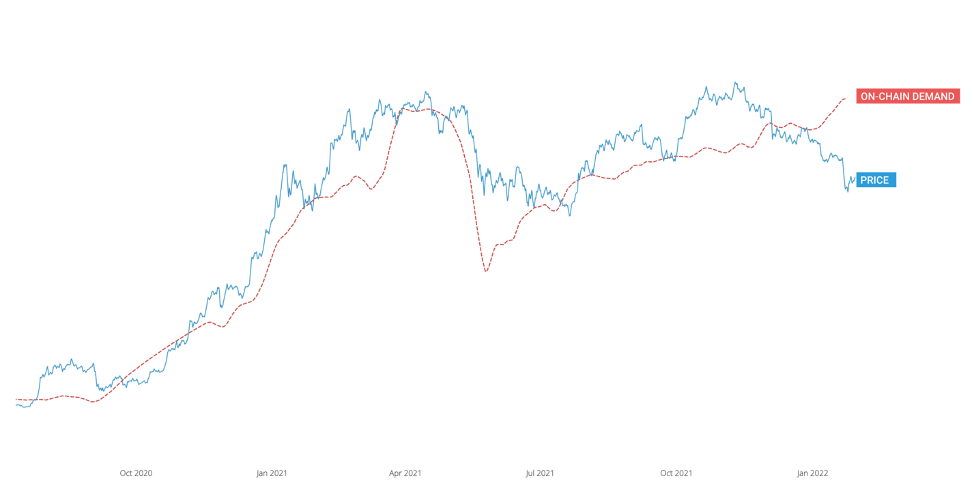

- The price of BTC is currently at an extremely low level compared to on-chain demand.

- Whales (owners of 1,000 BTC or more) are now actively accumulating coins, which indicates the return of institutional money to the market.

Be careful!

Please do not make trading decisions based on these forecasts and assume they are perfectly accurate. Allforecasts are probabilistic. Short-term market movements are subject to unpredictable events and market randomness.Manage risks accordingly.Longer-term forecasts are generally more reliable because it takes time for the fundamental effect to develop fully.

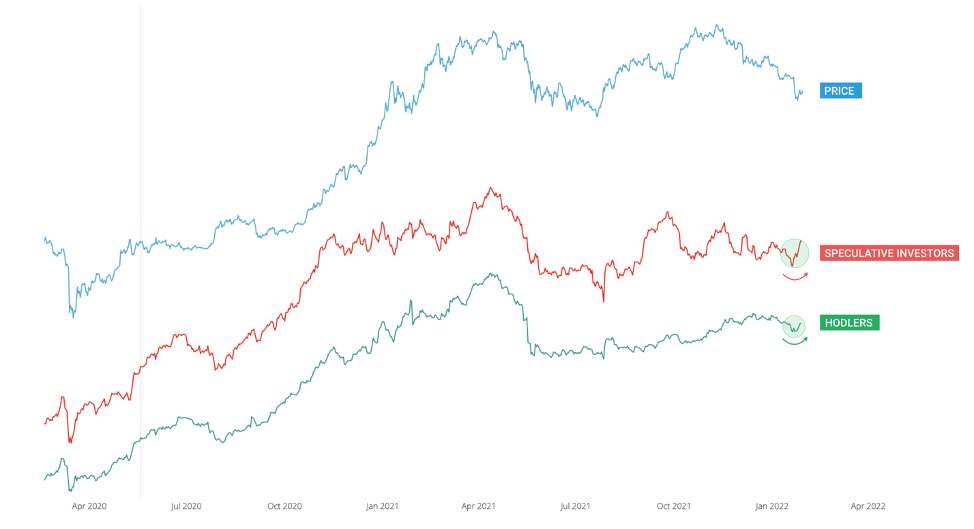

First signs of hodler demand returning to the market

Last week there was an on-chain reversal from sell to buy. Now both hodlers and speculative investors are buying.

Adjusted Supply Shock.The Supply Shock indicator measures on-chain activity to determine estimated future supply and demand using the ratio of investors who are unlikely to sell versus those who will.

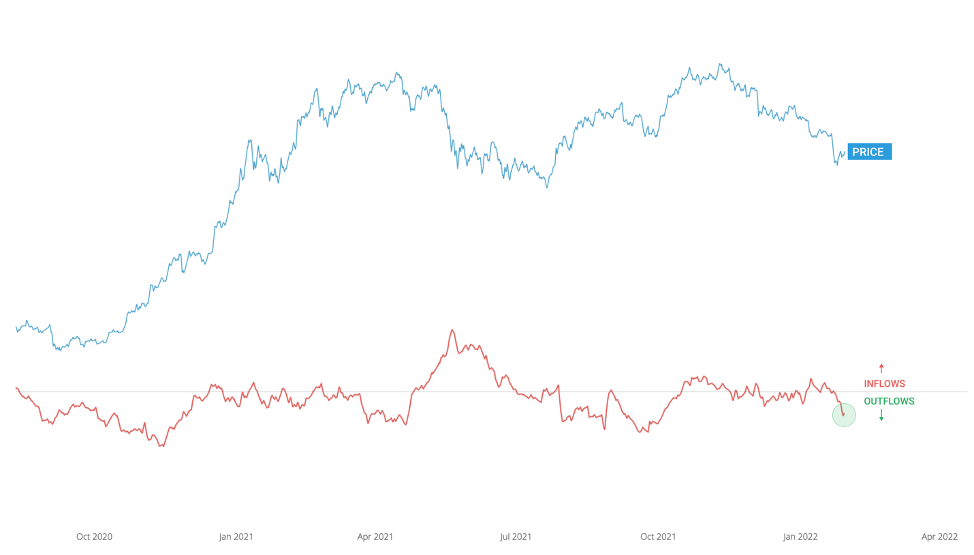

Below is a graph that tracksflows of coins coming in and out of exchanges. We are now in a net churn (buy) area, approaching levels that have fueled price increases in the past.

Net inflow / outflow of coins on the wallets of "whales"

The price in relation to the activity of investors is at peak levels of oversold

The price has dropped significantly in the last 2 months,exceeding the figure justified by the activity of long-term investors. I posted a chart below: it compares the market price with the on-chain demand that hodlers see. We are in a rare zone where price is trading at an extreme discount to demand.

Bitcoin Liquid Supply Shock Oscillator is a Supply Shock oscillator for BTC liquid supply. The indicator tracks the divergence between price and fundamental on-chain demand.

This is confirmed by the graph below, in whichuses a hindsight model to estimate how the market has valued bitcoin given similar levels of hodler demand. The market, which is dominated by traders, is currently experiencing a peak of fear. In previous situations, when the market did not experience fear, the price was close to $60,000.

Supply Shock Rating

Longer term outlook looks very strong

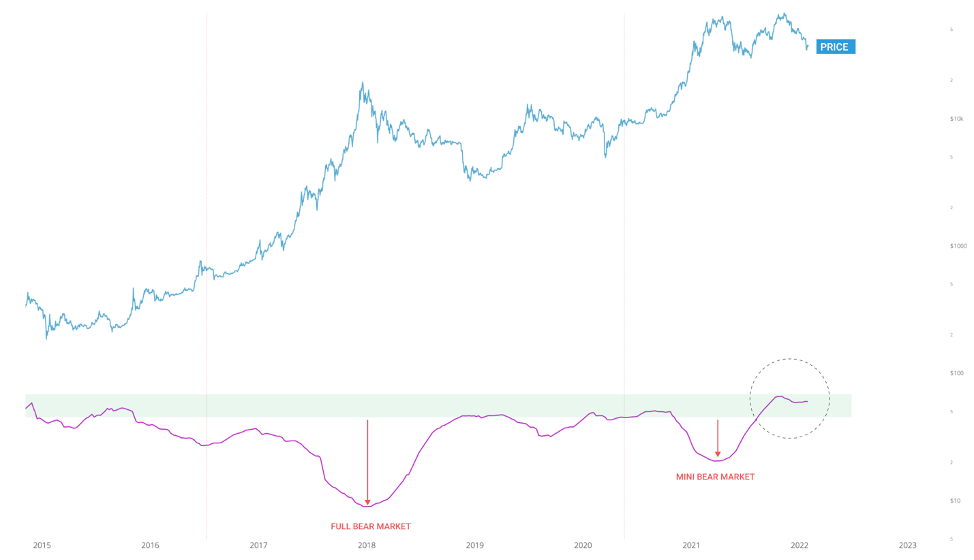

One of my favorite ways to appreciatelong-term macro forecast is to estimate the ratio of coins owned by long-term holders who have held their coins for more than 5 months, compared to new hodlers. It turns out that the holders who kept their coins during this period of time do not sell them until a profit appears. They have not sold and are patiently waiting for the next rally, which reduces the number of available coins that can be sold on the market.

We were in the peak area of these strongholders who have been dominant over the past 2 months, during which the price has been falling. In the chart below, I've highlighted what a bear market looks like and what a "mini bear market" looks like. What we have seen recently is a collapse in prices, provoked by traders, but not supported by long-term holders.

LTH Supply Shock (offer in handlong-term holders), z-score This indicator compares coins that have not moved in 5 months with coins that have moved more recently. This plot is modeled using a z-score that helps compare values over a long period of time.

Comments for a short period

The sell-off in the futures markets that ledto lower prices in the last 2 months, subsided and now the market is in the stage of a preliminary reversal. If the current level holds, backed by investor spot demand (as seen from on-chain data), we will form an implicit bearish divergence in technical analysis; which means that the price is oversold compared to its normal behavior, and then a strong rebound can be expected.

Institutional purchases have begun

The past week has seen significant buying from whales (holders of over 1k BTC), which is a sign that institutionals have started buying.

Coins moving to and from hodler whales

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.