Assessment of the situation on the BTC and ETH markets and a forecast for them from Willie Wu.

At the time of my previous post, when BTCtraded at $60.7 thousand., the buying impulse was strong, but close to “overbought” levels. I gave the market about a week to break out of the previous all-time high before testing support. The price peaked at $67K and retreated slightly. Over the past couple of days, the BTC rate has been declining. In today's post, I will provide a small update regarding the on-chain structure of the market, which, interestingly, has not changed much.

Brief summary as of the beginning of October 28, 2021:

- Macro perspective:The Supply Shock ratio for long-term holders is consolidating around its peak levels, foreshadowing growth in 2022.

- Short term:the price of BTC exceeded the demand observed byon-chain metrics. Currently, the BTC market remains in the “overbought” zone. Meanwhile, in the last two weeks there has been some growth in on-chain demand. It's simply not enough to justify prices above $60K. Also worth noting is the high level of speculative interest in the derivatives markets; this increases market volatility.

- Ethereum: demand for ETH continues to reach record highshighs. On-chain fundamentals for ETH continue to look stronger than for BTC, promising a strong rally once the price breaks above the $4.3k resistance zone.

- Expectations regarding price movements:continuation of difficult to trade consolidationbelow all-time highs with strong support at ~$55K. Demand momentum from new investors should cushion any major move lower.

- Confidence in price movement:average.

Be careful!

Please do not make trading decisions based on these forecasts and assume they are perfectly accurate. Allforecasts are probabilistic. Short-term market movements are subject to unpredictable events and market randomness.Manage risks accordingly.Longer-term forecasts tend to be more reliable because it takes time to fully develop the effect of fundamental factors.

Macro Perspective: Peak of Long-Term Accumulation

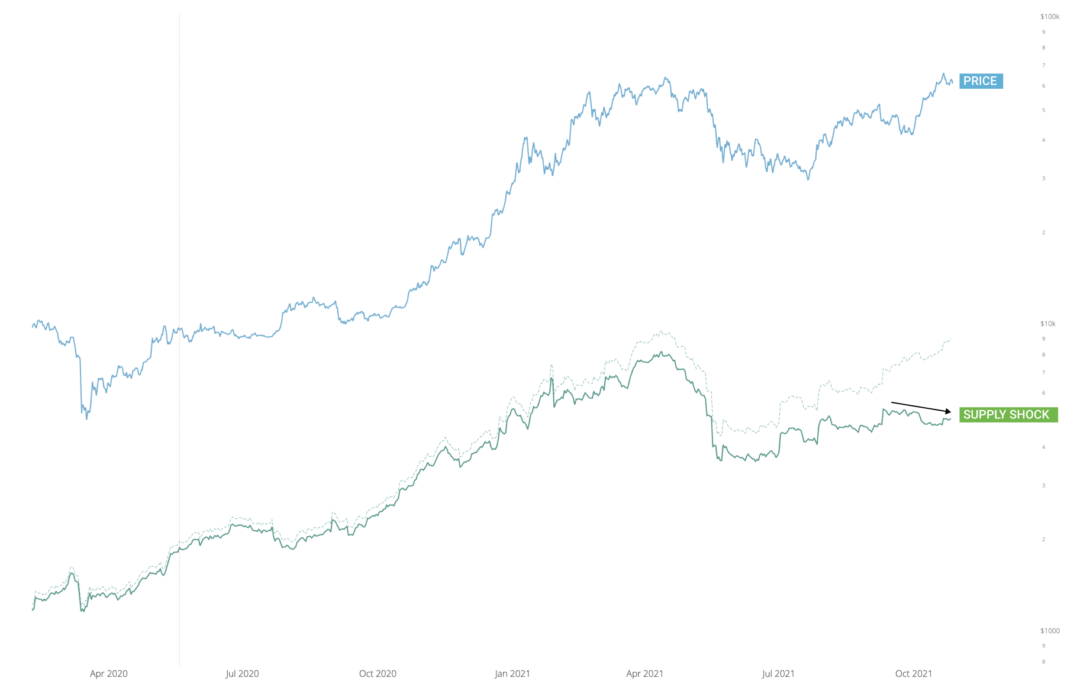

Supply Shock Ratio for Long Termholders are consolidating in the area of peak accumulation. It is not known how long it will remain in this peak area, indicated in the chart below, but generally this indicator starts to decline with the onset of a strong rally: long-term holders are gradually selling out bitcoins in bull markets. From this point of view, the macrostructure is still at a very early stage in the formation of the setup. This promises the possibility of a strong bullish trend in 2022.

Supply Shock Ratio for Long Term BTC Holders (Chart: charts.woobull.com)

Short term: investor demand remains at the same level

Latest rally to $67k.was not supported by on-chain demand. The drift-adjusted Supply Shock ratio remains predominantly in a horizontal trend and is even showing signs of turning bearish.

Supply Shock Ratio for BTC (Chart: charts.woobull.com)

In addition, the Supply Shock indicator presented in the form of an oscillator is clearly in the "overbought" area.

Supply Shock Oscillator for Liquid BTC Supply (Chart: charts.woobull.com)

BTC price is now retreating from the "overbought" area, returning to match with fundamental demand.

Meanwhile, against the background of the "cooling" of the BTC rate, the flowscapital on the addresses of spot exchanges (graph below) indicate the presence of some new demand in the last two weeks, expressed as a net outflow from the BTC exchanges and a net inflow of USDC to them. This is a classic buying pattern.

Net capital inflows / outflows on spot exchanges (chart: charts.woobull.com)

Summary: The price of BTC needs some time to cool down and recharge. Meanwhile, investors are already starting to buy back the decline.

Futures Demand Remains High After ETF Launches

In our retrospective model showing,How the market valued BTC previously, when supply and demand observed from on-chain indicators were at similar levels, shows a large gap that formed between the modeled and market price. The Supply Shock model is currently priced at $45,000, which is well below the current market price. I included this chart in the review because it is a great way to show where the market is in an alternate reality where past activity does not reflect present activity.

Supply Shock BTC Pricing Model (Charts: charts.woobull.com)

The world has changed:we now have several exchange-traded investment funds (ETFs) for bitcoin futures traded in the US stock markets. Long-term investors buying ETFs will now express their demand through futures contracts, and this demand will not be reflected in traditional on-chain metrics.

This means that the balance between where the price shouldto be relative to the demand shown by on-chain, it has now deviated from the previous status quo. It will take some time before we have sufficient data on where the new balance will be found.

Overall, my empirical estimate is that the market-adjusted “fair price” according to this model should be in the ~$55K region.

Commentary on ETH and Altcoins

In line with the previous forecast, ETH has outperformed BTC in recent weeks, driven by comparatively stronger on-chain demand.

Supply Shock Ratio for ETH is now completebroke record highs while the price is just below its peaks. The price will have to rise to close this imbalance.

Supply Shock Ratio for ETH (Chart: charts.woobull.com)

Below is the Supply Shock Ratio for ETHin the form of an oscillator. It can be seen that it is in a healthy zone of the unheated market compared to the overbought zone of BTC. This opens up opportunities for a strong rally in ETH once it overcomes resistance.

ETH Supply Shock Oscillator (Charts: charts.woobull.com)

Summary:On-chain demand indicates that ETH will continue to outperform BTC in the coming weeks and is likely to be poised for an immediate strong rally once it breaks through resistance from its previous all-time high. This should create an optimistic market backdrop for the altcoin market as a whole.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.