Messari analyst Ryan Watkins estimates that the price of Bitcoin (BTC) will exceed $50,000 if such institutionalinvestors will allocate only 1% of the assets for its purchase.

As we wrote in May 2020, successfulHedge fund manager Paul Tudor Jones said he will allocate a low percentage of his company's assets under management to Bitcoin investments to hedge against what he calls the "Great Currency Inflation."

At that time, Tudor noted that:

“The best strategy for maximizing profits —ride the fastest horse. If I'm forced to make a prediction, my bet would be Bitcoin. We are witnessing the Great Currency Inflation, an unprecedented expansion of all forms of money unlike anything the developed world has ever seen."

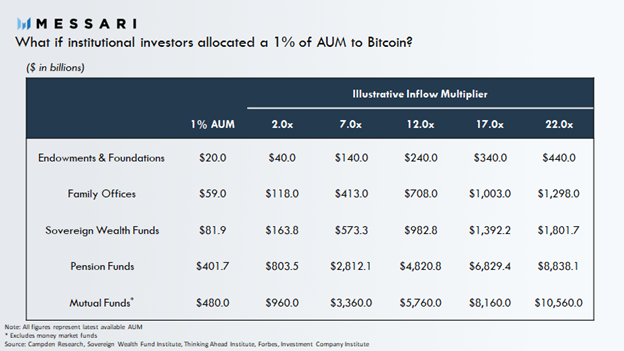

In his latest work, cryptanalyst MessariRyan Watkins has published the results of his research, giving us a picture of what could happen to the price of global cryptocurrency if all institutional investors allocated just 1% of their assets under management to purchase Bitcoin.

BTC capitalization will exceed $ 1 trillion

Watkins tweeted:

"What happens if institutional investorswill follow Paul Tudor Jones and highlight a «small percentage of a single figure» for investing in Bitcoin? Here's what we found using a valuation of assets under management by institutional investors around the world — Hundreds of billions, if not trillions of dollars."

What if institutional investors invest 1% in bitcoin:

To support his prediction, Watkins citedbased on data from Chris Berniske, researcher at Cryptoassets: Flow & Reflexivity. According to the analyst, “a cumulative 1 percent institutional investment in Bitcoin could easily push its market capitalization to over $1 trillion, or over $50,000 per BTC.”

Interestingly, Watkins categorically stated:

“Despite the fact that Bitcoin does not needfor institutional investors to succeed, as evidenced by the exponential growth of the digital asset in terms of acceptance and price action since its launch more than ten years ago, the influx of these large whales will however allow the revolutionary currency to maintain its status of a bona fide value collector. ”

In related news from June 23, 2020, surfaced.reports that leading centralized payments platforms PayPal and Venmo are actively preparing to begin offering Bitcoin trading services to their users.

If all goes according to plan, PayPal and Venmo users will soon be able to buy or sell Bitcoin, as well as other large-cap crypto assets, directly from their accounts.

At the time of publication, the price of Bitcoin is $9,150, and the market capitalization is — $168.5 billion:

</p>Rate this publication