In this article, we'll take a look at a new metric for determining Bitcoin lows.This metric will beuse the realized price of two separate cohorts of Bitcoin investors: long-term holders and short-term holders.

</p>First, before diving into the metric, let's define some terms:

Realized price: the realized price is the average pricewhich each coin (technically: UTXO) moved across the network. For some, realized market cap is an easier metric to understand. The realized market cap, which is almost identical to the realized price, takes into account the aggregate of every bitcoin on the network at the price at which it was last moved.

Realized price is currently$ 21.1 thousand, and the realized capitalization is $ 397.4 billion. Otherwise, the realized price can be considered as the base cost for all network users on average.

The realized price breaks the level$ 21 thousand

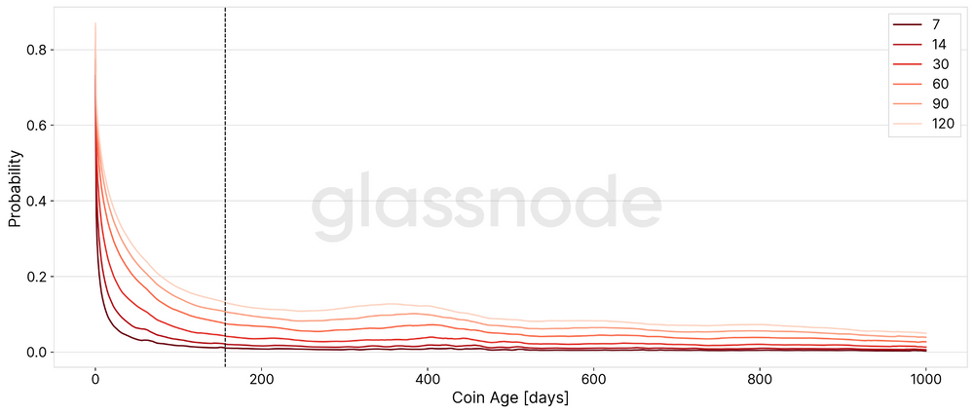

Long term holder: a long-term holder is defined as onewhose bitcoin hasn't moved between wallet addresses in 155 days. While 155 days may seem like a bit of an arbitrary threshold, the timing was chosen because the statistical likelihood that a UTXO will be spent decreases as it is held.

The graph below shows the probability that a UTXO will be spent within the specified time in days based on the age of the coin.

Determination of the amount of BTC held by short-term and long-term investors

When defining long-term holders, anyone whose coin has been dormant for less than 155 days is classified as a short-term holder.

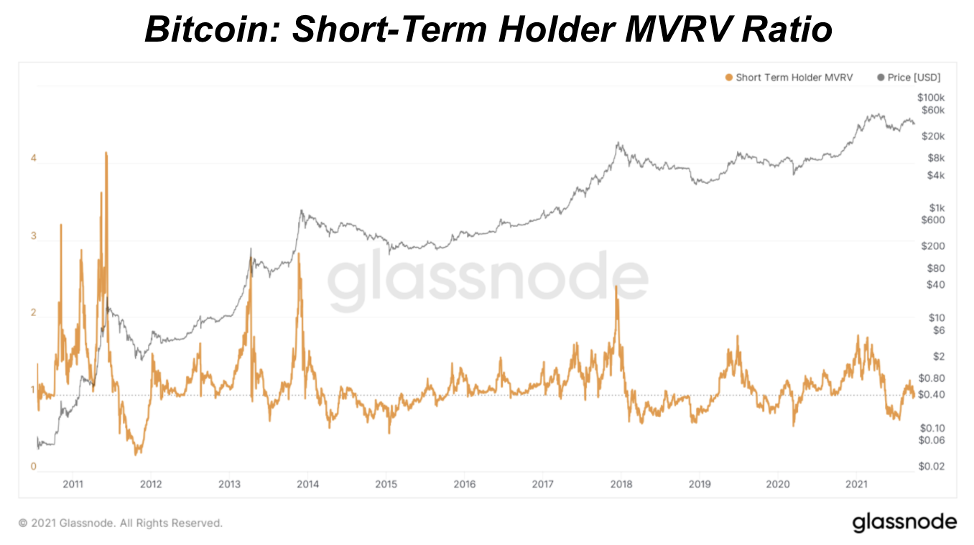

Using the Glassnode dataset, we canbuild a realized price for both long-term and short-term holders. Although Glassnode does not provide a realized price for these two groups of investors, it is easy to calculate using the data provided. Using the Market Value to Realized Value (MVRV) ratio for two separate groups, you simply divide the price by the MVRV ratio of the two groups to calculate the realized price in reverse.

Below is the history of MVRV for long term holders (LTH) and short term holders (STH):

Note that LTH MVRV is on a logarithmic scale, while STH MVRV is on a linear scale.

Calculation of the realized price of LTH and STH

RatioMVRV long-term holders

RatioMVRV short-term holders

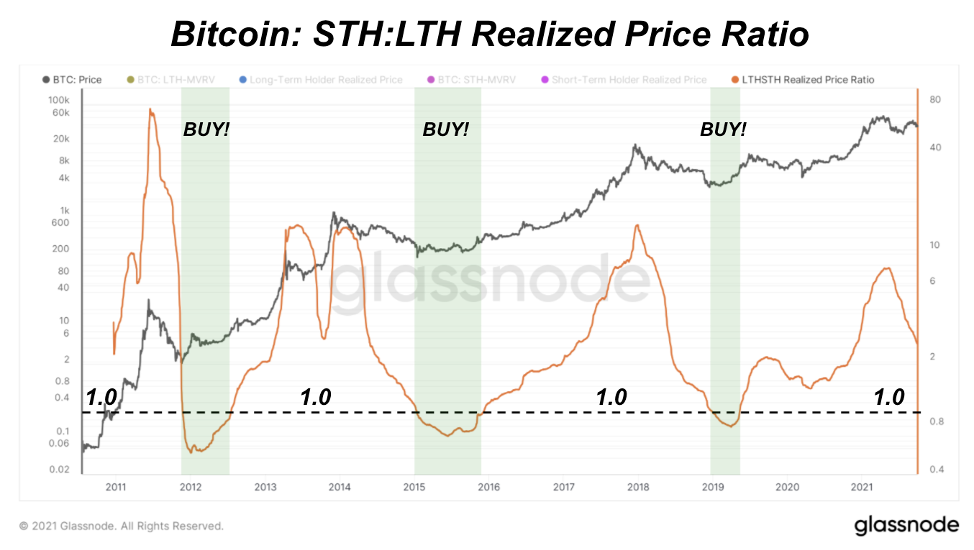

So how can the realized price of LTH and STH help us pinpoint the bottom of Bitcoin and potentially help pinpoint the tops of Bitcoin? Let's explore this point.

Using Realized Price LTH and STH to Determine Bitcoin Bottom

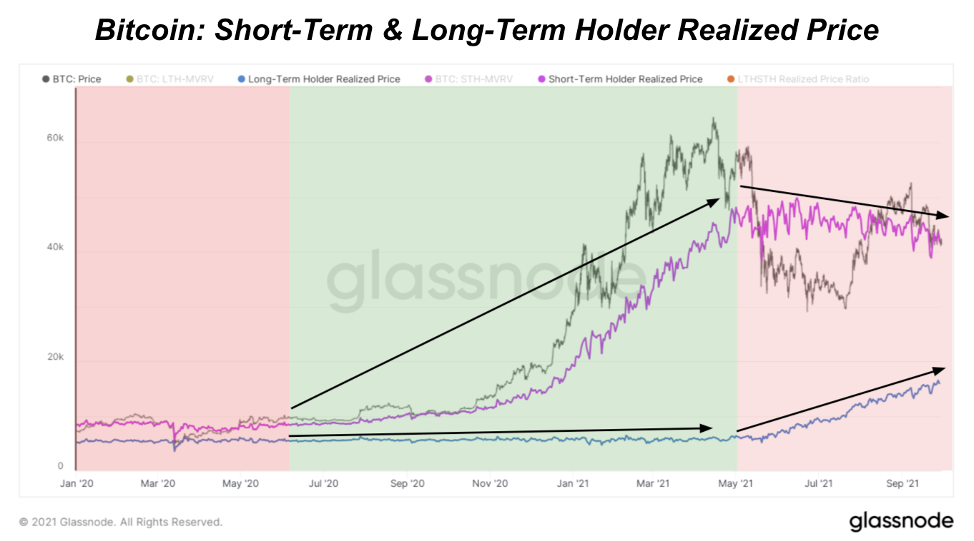

Realized price of long-term and short-term holders

A study of the above graph revealssome interesting trends (note: LTH realized price = blue, STH realized price = purple). In particular, when the price that short-term holders paid for their coins is lower than the price of long-term holders who have subsequently been in the market longer and therefore would usually have much earlier points of entry into the market and make more attractive profits.

Highlighting these periods shows that this happened during the three bear markets and indicated opportunities for investors to buy bitcoins from generation to generation.

Realized price of long-term and short-term holders

Taking it one step further, let's present the STH: LTH realized price ratio.

Realized Price Ratio STH: LTH

Splitting the base cost of short-termof long-term holder base value holders gives a devastatingly accurate signal of the state of the market. As described above, when the cost (realized price) of STH falls below LTH, this is the market's way of shouting:

"SALE!"

Realized Price Ratio STH: LTH

This can be seen from the ratio whenever the orange line falls below the black dotted line. But can something else be seen from this ratio? Yes.

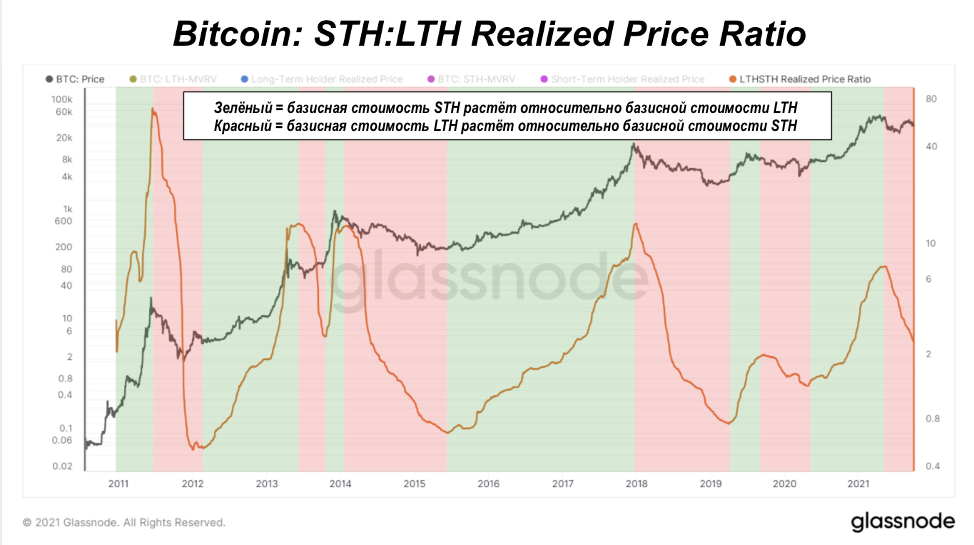

Realized Price Ratio STH: LTH

When the STH realized price ratio is:The LTH increases, which means that the STH base value increases relative to the LTH, and conversely, when the STH: LTH selling price ratio decreases, the LTH base value increases relative to the STH base value.

This is extremely insightful since the pricebitcoin rises when the margin seller is depleted. This is why you can see that the base value of LTH remains somewhat stagnant during bull markets, while the base value of STH (many of whom are new entrants to the market) is skyrocketing - there are simply not enough coins to meet the new demand. Thus, the property of constant growth manifests itself in action.

During bear markets, we saw that howdue to surrender and coin maturation (after the 155-day STH age threshold in LTH), the value of LTH rises, while the value of STH declines due to the price pullback from the highs.

Where is Bitcoin today?

Realized price of long-term and short-term holders

During the last months of 2020 up toOn May 2021, as the bitcoin price rallied, the STH's underlying value exploded while LTH remained dormant, but after a correction of more than 50% and a consolidation of $ 40K, the STH's underlying value began to slowly decline, currently at $ 42K, while the base value of long-term holders began to rise steadily, and now stands at approximately $ 16K.

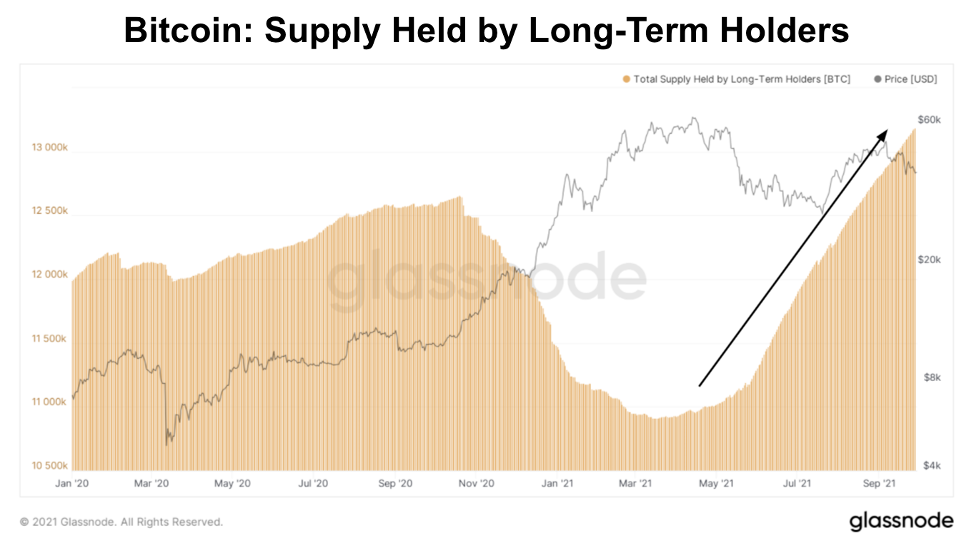

This steady growth is driven by aging coins.according to LTH classification, but this is extremely revealing for one main reason: 155 days ago was April 27, 2021, which means that any bitcoin that is aging in the cohort of long-term holders today has not budged even with a price decrease of more than 50% ... The Bitcoin supply held by LTH has been on a straight line up and to the right since April.

Amount of supply held by long-term holders

So, if we once again return to the ratiorealized price STH: LTH, is it necessarily bad that the indicator tends to decline, as it did in bear markets before? No, rather the opposite. Think of this trend as a spring that coils tighter: this is exactly what is happening with the supply of bitcoin today.

Does this mean that a further decline is comingprices? This is possible, but it is not an inevitable scenario for the development of events. In fact, Bitcoin seems to hold up very well in the face of growing macroeconomic uncertainty.

To summarize the above usingrealized price and base value of long-term and short-term holders of bitcoins, it is possible to determine which phase of the market cycle we are in, and although bitcoin is currently hovering above $ 40K, the market does not look overheated, and the price is getting more and more more and more profitable.

As long term holders willcontinue to absorb the free circulation of the available BTC supply, the notorious bitcoin price spring will eventually explode upward and the reflexive bull market cycle will re-emerge.

BitNews disclaims responsibility forany investment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.