In 2021, $220 billion in profits were realized on the Bitcoin network, which is more than 100% higher than realizednetwork capitalization at the beginning of the year.

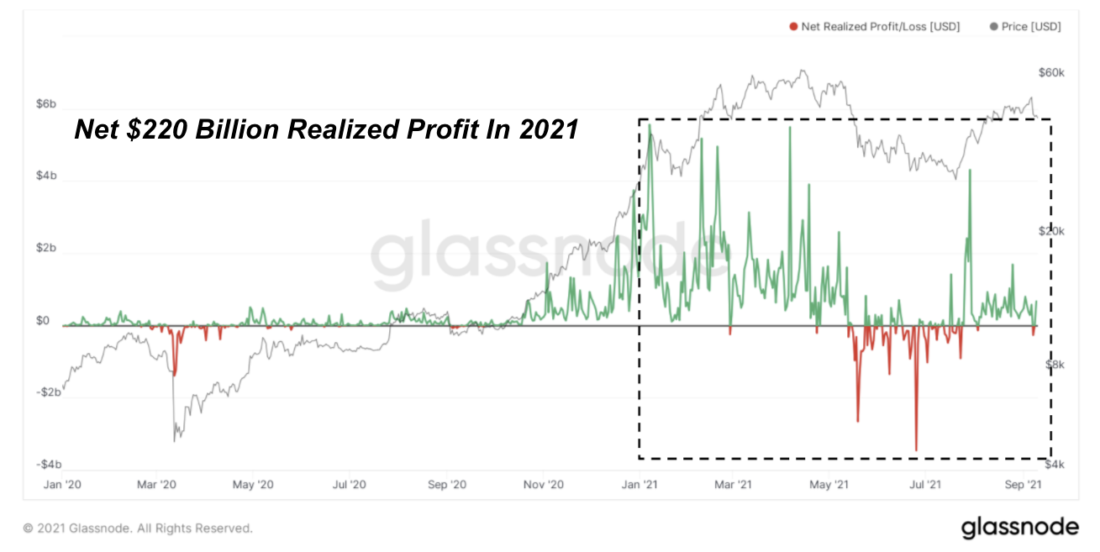

Below is a chart of net realized profit / loss for the day on the network:

Bitcoin: Net Realized Gain/Loss.$ 220 billion in net realized profit for 2021

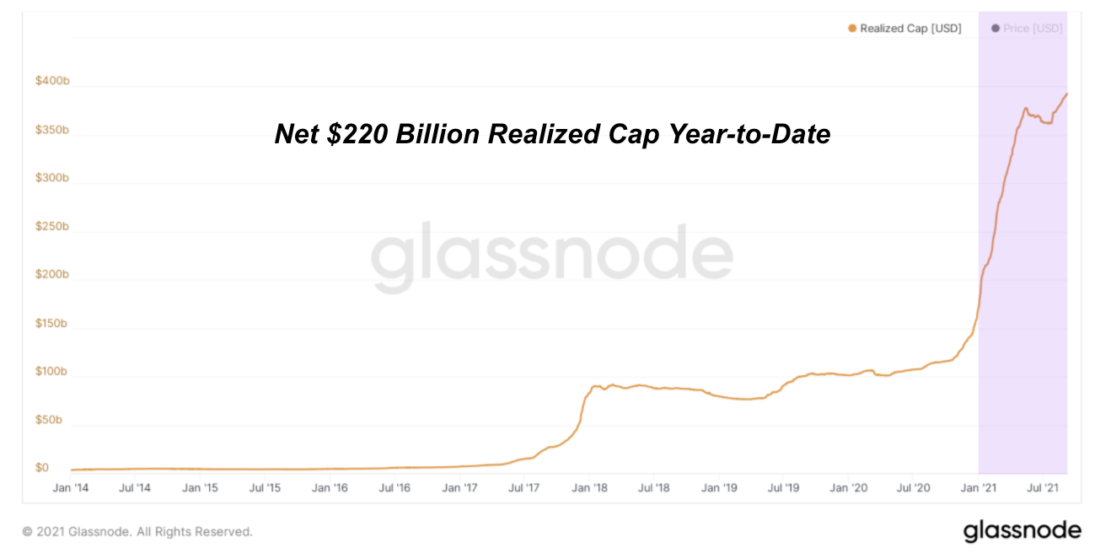

Realized capitalization reflects the total price paid for each “coin” (technically: UTXO) on the blockchain, instead of simply multiplying the circulating supply by the exchange rate.

Change in realized capitalizationshows how much capital has flowed into the network since the beginning of the year, as coins have been aggressively flowing into the hands of a new class of Wall Street investors who have become more active in monetary assets.

Realized capitalization of Bitcoin.$ 220 billion net realized capitalization since the beginning of the year

One of the most optimistic factors from the startyear is that the realized price of bitcoin significantly exceeded the market price, with the realized price increasing by 127%, while the spot price increased * only * by 57%.

Bitcoin MVRV Ratio

This led to a decrease in the MVRV ratio(ratio of market value to realized value) from 3.14 at the beginning of the year to 2.22 today. Investors can think of MVRV as a measure of “fair value,” meaning that in relative terms, Bitcoin today at $45.5K is cheaper than it was at $29K at the start of the year.

It should also be noted that the market price is veryrarely drops below realized (currently it is about $ 20.9 thousand), and those who are trying to wait for this event may miss the opportunity to capitalize on exponential growth.

The chart below highlights the few periods in Bitcoin's history when it traded below the realized price level, that is, periods of literal "flash liquidation" of inventory.

Bitcoin MVRV Ratio

BitNews disclaims responsibility forany investment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.

�

</p>