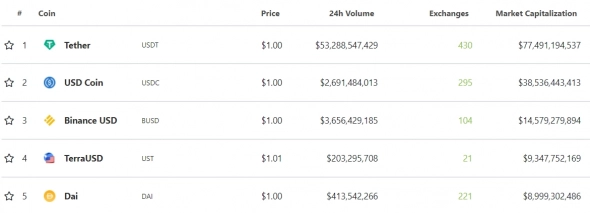

By market capitalization, the top three stablecoins include centralized coins: Tether, USDC and BinanceUSD. “Centralized” means the fact that a separate company is responsible for issuing tokens. This imposes certain risks on both investors and the industry as a whole.

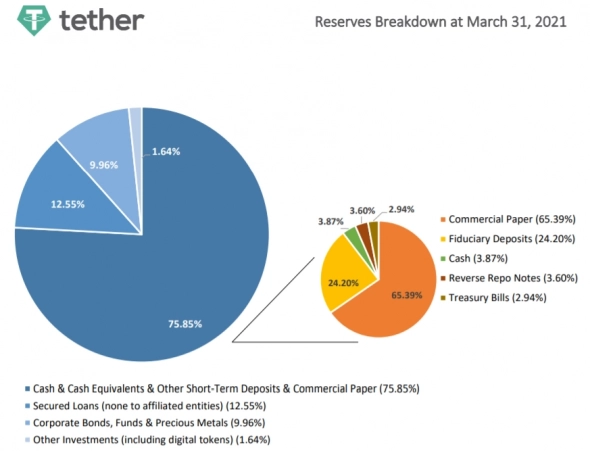

For example, when issuing USDT, Tether promised to keepon their accounts the same amount of US dollars to maintain liquidity. However, due to an investigation by the New York State Attorney's Office, "dollar reserves" have been supplemented with "cryptoassets and lending proceeds." And after a forced audit in March, it turned out that about half of all collateral are publicly undisclosed debt obligations. In other words, by issuing tokens, the company lends to other crypto companies. And if the majority of users suddenly want to exchange their tethers for usd, the market will not have enough liquidity and there will be a risk of a 1: 1 rate collapse with all the ensuing consequences.

Image source: tether.to

The risk of breach of trust can be avoidedthe transition to decentralized stablecoins, whose emission is spelled out in the algorithm and does not depend on the will of the publisher. This month, UST of the Terra project came out on top in terms of capitalization among such coins, overtaking Maker's DAI.

Image source: coingecko.com

The money supply algorithm supportsUST / USD exchange rate in a 1: 1 ratio due to the floating exchange rate of LUNA's own coin. Generally speaking, with an excess of money supply, part of the LUNA is burned, and with a deficit, the reward of validators increases. Due to the high potential of the project, the coin has grown 1,500 times this year, and in the Defi sector it has overtaken Binance and is second only to Ethereum.

Image Source: Cryptocurrency ExchangeStormGain

The Terra project has ambitious goals and plansto become the leading blockchain link between traditional finance and cryptocurrencies. The proliferation of decentralized applications and the expected boom in the metaverse will give LUNA an impetus for continued growth in 2022, and UST may enter the TOP-3 stablecoins in terms of capitalization.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)