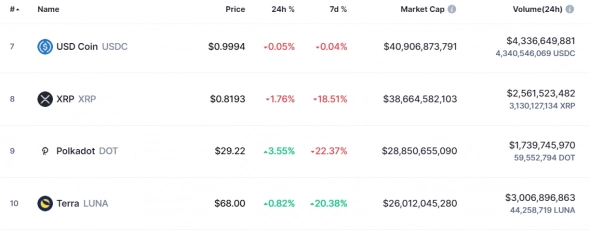

Despite the growth of the cryptocurrency market capitalization, Bitcoin continues to lose its share, giving way to more thanpractical solutions.In terms of capitalization, Terra, although it entered the TOP-10, has only $ 26 billion in value against $ 955 billion in Bitcoin. However, the goals of the project are ambitious - to become # 1 as a means of payment and exchange.

Image source: coinmarketcap.com

Bitcoin's problem isn't just about low bandwidthability, but also high price volatility. For example, it is unsuitable for real estate transactions, because within a few days the price of an object can rise by 1.5 times due to the correction of the cryptocurrency. The same thing happens with fiat in developing countries only for a slightly longer period of time. Terra is trying to solve all these problems by creating a supranational currency - Terra SDR, which balances market volatility. Terra SDR is an analogue of the International Fund SDR or a basket of currencies.

But first Terra needs integrationexisting financial system with decentralized blockchains. That is, to create an efficient payment system with a high degree of security, instant conversion and low commissions. This is implemented through proprietary stablecoins pegged to the US dollar, euro, South Korean won, and even the IMF's SDR. At the expense of an atomic swap, conversions take place without commission at market rates.

Image Source: Cryptocurrency ExchangeStormGain

To maintain mechanics, Terra usesfloating rate currency - LUNA. The coin allows you to reward validators for conducting transactions, and also provides the network with scalability and decentralization. The algorithm for changing the money supply is responsible for the stability of the stablecoin rates. This avoids the risk of increased emission for selfish purposes, as was the case with Ripple, and the outflow of funds in case of exceeding the exchange rate of 1: 1, as was the case with DAI on the Maker platform.

The uniqueness and practicality of Terra, as well asdecent staking rewards with an average annual return of 7.2% pushed blockchain to the third place in terms of blocked funds, surpassing Solana and Avalanche.

Image source: defillama.com

Over the past six months, the cost of LUNA has skyrocketed to 8times, thanks in large part to the rise in use of the stablecoin. Among algorithmic stablecoins, UST came out on top with $ 8.4 billion in capitalization. The rise of decentralized applications and the need for "independent" stablecoins suggest that the main growth of LUNA is yet to come.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)