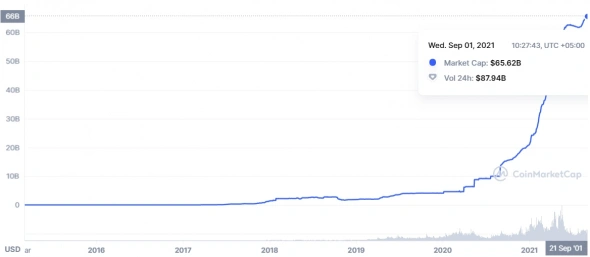

Tether is the leading bridge currency between fiat money and crypto assets, with a capitalization of$ 66 billion and a daily turnover of $ 88 billion.The stable operation of crypto exchanges depends on the financial condition of the company of the same name, the overwhelming majority of which use Tether as their base currency. According to the company's initial statements, there is a full-fledged US dollar behind every USDT, but audits have shown that this statement is untenable. Now the company is trying to hide the real state of affairs from the public.

Image source: coinmarketcap.com

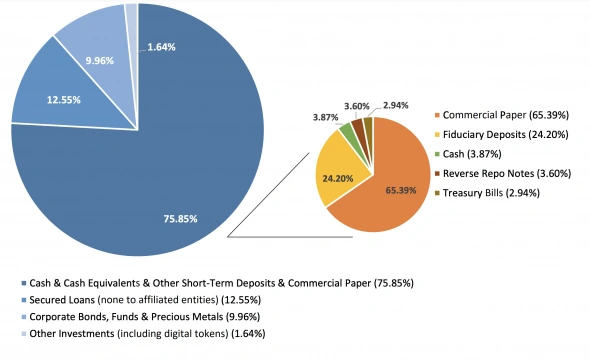

This year the investigation of the General Directorate was completedNew York State Attorney's Office (NYAG): As part of the pre-trial settlement, Tether agreed to pay $18.5 million and provide the authorities with an ongoing report on reserves (more details in our article). At the same time, it turned out that half of USDT’s reserves consist of undisclosed commercial paper, and less than 4% are stored directly in fiat.

Image source: tether.to

The volume of reserves exceeds liabilities, but theirthe structure raises a lot of questions: in the event of a crisis, the impossibility of converting Tether at a rate of 1: 1 to USD will lead to a sharp drop in the value of the stablecoin, undermine confidence in crypto exchanges, and cryptocurrencies will experience a stronger correction than in May of this year.

Image Source: Cryptocurrency ExchangeStormGain

Unsurprisingly, the community is keeping a close eye onfor the state of affairs at Tether, but the company is not satisfied with such attention. On August 31, representatives of the organization asked the Supreme Court of New York to prohibit news agencies from accessing the state of reserves.

... we strongly oppose the idea of disclosing our confidential information simply to satisfy the curiosity of internet trolls or other ill-wishers ...

Now it depends on the decision of the Supreme Court that there will bewhether more details have been disclosed, such as which commercial paper half of the USDT collateral is made of. If the assets turn out to be of low grade, it will undermine the confidence in the token and cause excitement in the cryptocurrency market.

Analytical group StormGain