At the beginning of the year, Jerome Powell said that regulating stablecoins is more important than issuing its own digitalcurrencies (CBDC), and now Boston Federal Bank President Eric Rosengren called Tether a "challenge" for financial stability.

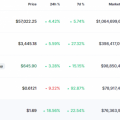

Image source: coinmarketcap.com

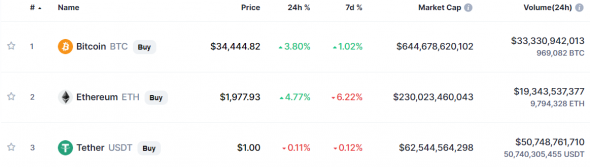

For a year and a half, the US Federal Reserve has printed a third of newdollars and doubled its own balance sheet - up to $ 8.1 trillion. This led to overheating of certain sectors of the economy, for example, property prices in May rose by 14% compared with the previous year. However, in his presentation, Eric Rosengren notes Tether with a capitalization of only $ 62.5 billion as one of the threats to financial stability.

Growth in real estate prices in the United States,% (YoY)

Tether is issued at a 1: 1 ratio against the dollar and is the bridge currency between crypto and fiat money. Now the coin ranks third in terms of capitalization.

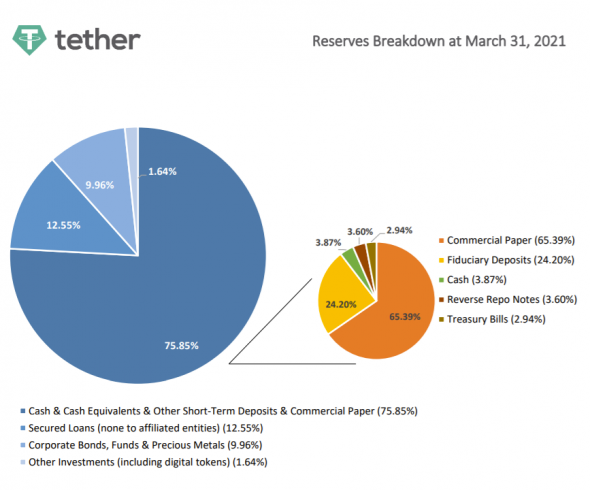

For the past two years, Tether has beenclaims from the New York Attorney General's Office. In February, the parties reached an agreement, after which the company submitted a report on the provision of cryptocurrency with assets and the result of an audit from Moore Cayman. It turned out that the company's consolidated assets exceed its liabilities.

However, the risks for Tether holders remain, since about half of the assets are held by commercial papers, the content of which has not been publicly disclosed.

Image source: tether.to

Billionaire Mark called for regulation of stablecoinsCuban affected by the Titan coin collapse, which together with USDC formed the collateral for the IRON stablecoin. The mechanics of the project initially raised doubts, which did not prevent a number of investors from getting burned, and the FRS again turned its attention to this financial sector.

Image Source: StormGain Cryptocurrency Exchange

The next step of the regulator is unknown.Tether is used by most crypto exchanges, including StormGain, as the underlying asset for trading. Attempts to tighten financial supervision or a ban on stablecoin on American exchanges will lead to a decline in the crypto market, but will not relieve the US financial system from the problems caused by monetary policy.

Analytical group StormGain