The decentralized organization behind the development of the Lido Finance project initiated a vote regardingrestrictions on the protocol's share in the Ethereum 2.0 staking pool.

Lido Finance - service for liquid stakingcryptocurrency. The protocol allows you to deposit coins into a relevant contract and receive in return a sum of “derivative” tokens that can be used in DeFi services. In the case of Ethereum, these are stETH tokens.

What is Lido?

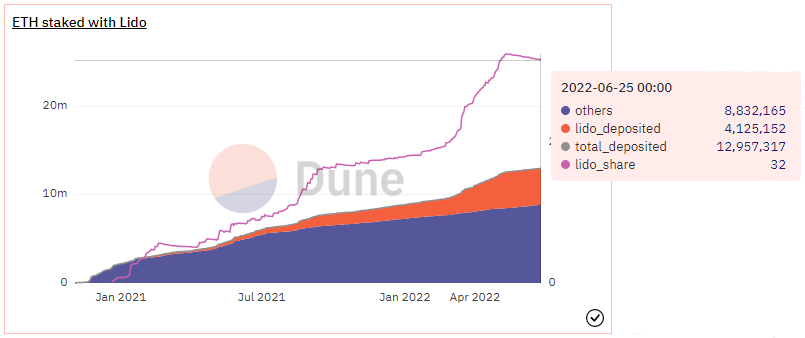

According to Duna Analytics, Lido accounts for over 31% of all staked ETH.

Data: Duna Analytics.

In the discussion preceding the vote, the authors of the proposal noted that authoritative community members recommended limiting the share of one protocol in staking.

For example, Ethereum co-founder Vitalik Buterin said that one project should not account for more than 15% of ETH.

The authors of the proposal believe that dominanceLido in the Ethereum 2.0 staking pool will pose a threat to the security of the blockchain after the so-called “merger” (The Merge). The protocol's dominance has been cited by some analysts, such as Danny Ryan, as a potential point of centralization.

Voting ends July 1st. If Lido DAO accepts the proposal, the authors will initiate another discussion regarding how exactly the developers will limit the participation of the protocol in staking.

In June 2022, the discount on stETH exceeded 5%. At the time of writing, derivative tokens are trading almost 4% below native Ethereum coins (Curve decentralized exchange).

Let us remind you that CoinShares analysts urged not to compare the situation around stETH with the collapse of the Terra ecosystem.

Read ForkLog bitcoin news in our Telegram - cryptocurrency news, courses and analytics.