The transition to proof-of-stake is expected early next year, after which they will begin to be responsible for conducting transactionsvalidators instead of miners.To receive passive income on the Ethereum network, you no longer need video cards and ASICs - it is enough to "freeze" coins in blocks of 32 ETH (~ $ 96,000). Many miners are already preparing to repurpose and stake their ETH.

Image Source: Cryptocurrency ExchangeStormGain

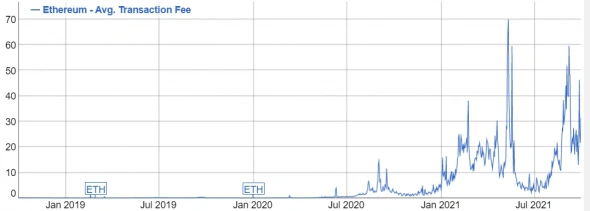

The leading altcoin has a capitalization of $ 354billion and is still one of the most promising in terms of growth. However, in September, he lost in dynamics to his "killers" in the person of Solana (23% increase) and Avalanche (52% increase). So far, Ethereum depends on miners, and the limited speed of the proof-of-work protocol leads to an increase in transaction costs. This paves the way for alternative projects. For example, Solana has an average commission of $ 0.00025, and an estimated transaction speed of 60 thousand per second.

Image source: bitinfocharts.com

But Ethereum enjoys great authority andsupport: 7,000 nodes and 90,000 validators versus 600 nodes and 1,000 validators for Solana. And after moving to PoS and full deployment, network speeds can reach 100 thousand per second.

Therefore, miners do not throw off Ethereum mined bycurrent prices, but increasing stocks and staking coins. After the London hard fork, according to TomsHardware, miners' revenues decreased by 15% due to the disabling of the auction fee, but they did not compensate for the loss by selling coins. On the contrary, since the implementation of the improvements, miners have accumulated a total of 2 million ETH, bringing the figure to 22.3 million ETH, or 1/5 of the total network capitalization.

Image Source:kraken.com

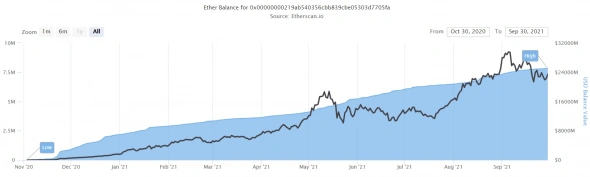

Users continue to stake ETH pendingmoving to a new protocol. In total, they have already "frozen" 7.8 million ETH, which is equivalent to $ 23.5 billion. These funds will become available for withdrawal only after the transition to PoS, which keeps many from more active coin placement.

Image Source:etherscan.io

According to the roadmap, the Ethereum network remainsgo through the last Altair hard fork, scheduled for late October, before merging the two branches. Tentatively, the transition to PoS should take place early next year. If everything goes smoothly and the deadlines are not pushed back again, Ethereum will see strong growth and an opportunity to compete for first place with Bitcoin itself.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)