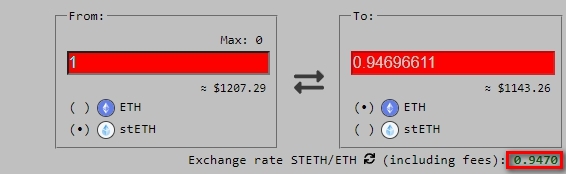

The discount for Ethereum-based Lido Finance tokens - stETH - exceeded 5% amid the sale of the asset by large holders.

Data: Curve.

PeckShield service specialists noticedlarge swaps generated by wallets believed to be associated with Three Arrows Capital. In two transactions, over 56,000 stETH were exchanged for ETH.

Earlier, The Block experts noted another major sale: on June 9, one of the wallets sold about 50,000 stETH.

Liquid staking platform Lido provides users with stETH, which represents ETH locked in the Beacon Chain PoS network.

What is Lido?

Decrease in the price of the underlying cryptocurrency and reductionliquidity of stETH could put further pressure on the price of the derivative asset. According to Curve, the pool ratio is 20% ETH to 80% stETH at the time of writing, making swaps difficult.

The price of stETH is also affected by the fact thatusers will be able to withdraw ETH to the Beacon Chain only after the merger (The Merge) of the blockchains on the PoW and PoS algorithms. This is expected to happen in August.

What to expect from the upcoming biggest Ethereum update, read in the exclusive ForkLog article:

The Merge: what to expect from the biggest update of Ethereum