There are only a few months left until the long-awaited update of The Merge, which will become an important milestone in the development of Ethereum.Not only the consensus algorithm will change, but Ethereum will become more environmentally friendly and deflationary, which can positively affect its price in the medium and long term.

ForkLog figured out the features of the upcoming upgrade and its potential impact on the investment attractiveness of the second largest cryptocurrency by capitalization.

- There are final preparations left for Ethereum to switch to the Proof-of-Stake consensus algorithm during the activation of The Merge update.

- The upgrade will significantly affect the fundamental qualities of the cryptocurrency, making it deflationary and much more environmentally friendly.

- The price-affecting rate of Ether issuance will depend on the number of validators and on-chain activity.

A journey of seven years

The transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) is the most important and complex upgrade in the history of Ethereum. The process, which has been going on for seven years, has reached the finish line.

In the past, the upgrade has been referred to by various names: Serenity, Casper, Shasper, Ethereum 2.0, and finally The Merge.

The update will change the consensus mechanism that determines the principles for validating transactions and issuing blocks.

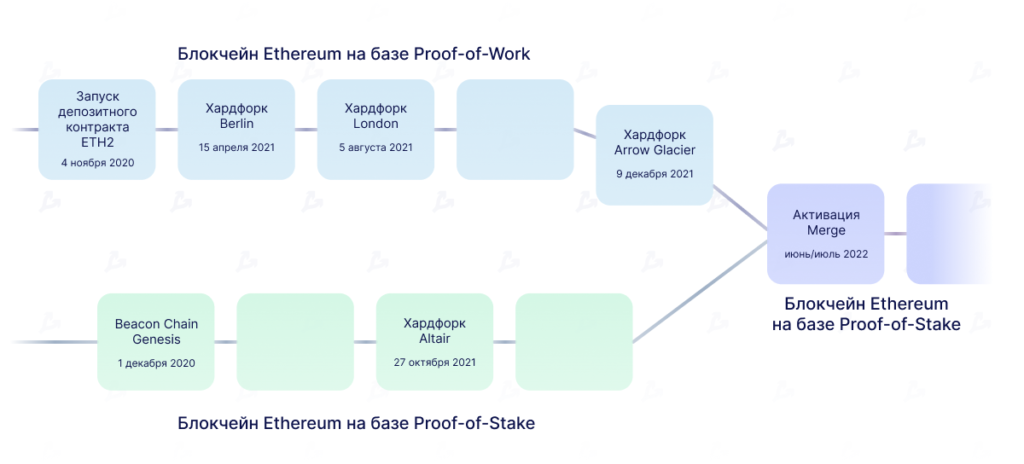

The history of Ethereum hard forks on the way to The Merge activation. Data: Galaxy Digital Research.

Since 2014, developers have explored the possibilitiesPoS as an alternative to PoW systems. Due to the novelty and insufficient knowledge of the then-new algorithm, Ethereum was launched in 2015 based on Ethash technology based on Proof-of-Work.

That same year, the developers presented an ambitious roadmap, with the final stage of development called Serenity. It involved a complete transition from Ethash to a stable PoS algorithm.

One of the main motives is to increaseEthereum energy efficiency. Developers expect The Merge to reduce energy costs by more than 99.9%. Instead of miners, validators will play a central role in the network, each of which requires 32 ETH in the form of collateral.

According to Galaxy Digital Research,the upcoming upgrade will not change the algorithms of user interaction with dapps in any way. Exchange customers, custodial services, as well as ordinary ETH holders will not be required to move their coins anywhere.

From inflation to deflation

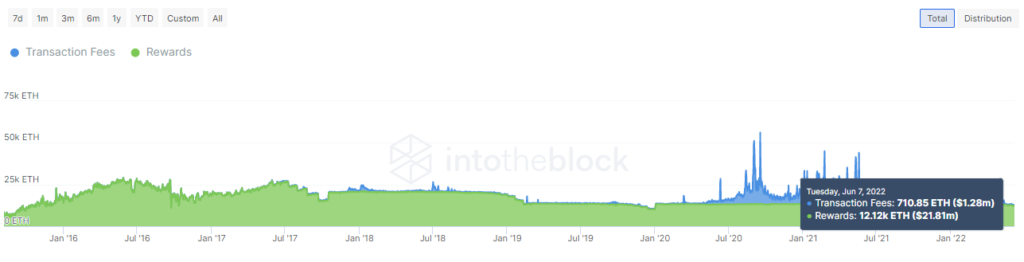

Currently, most of the new Ethereum issuance occurs on the traditional PoW blockchain -performance level. Miners receive 2 ETH per mined block, for a total of over 12,000 ETH per day.

Data: IntoTheBlock.

A small portion of ETH is issued on the Beacon Chain. This PoS based network is calledconsensus level.

The launch of Beacon Chain (or the zero phase of the second version of Ethereum) took place on December 1, 2020.

Ethereum 2.0 Phase Zero Launch: What Will Happen and What Users Can Expect

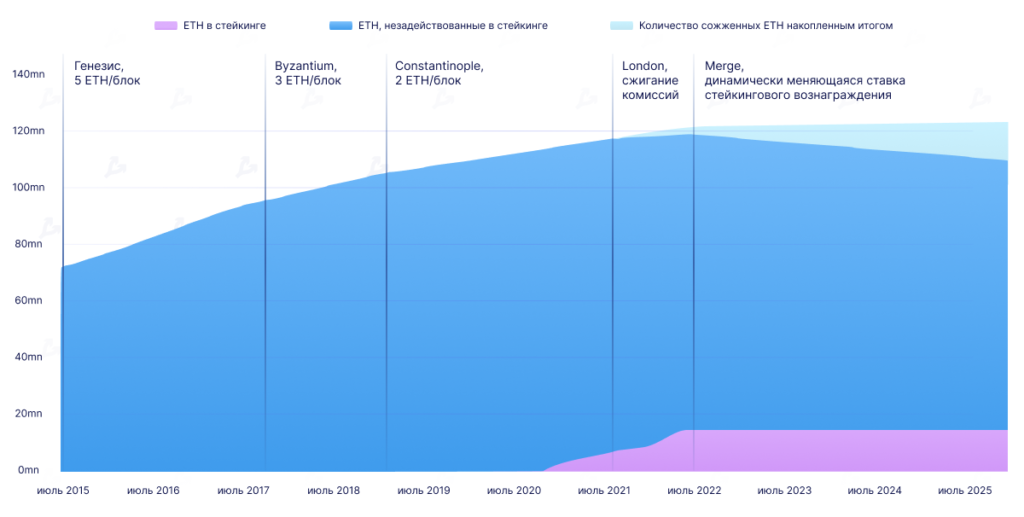

Number of ETH issued at the consensus levelvaries depending on the number of validators and the amount of coins staked. Another factor affecting the emission is the burning of part of the transaction fees, depending on the network load. This mechanism (EIP-1559) was activated in the London hard fork, since which more than 2.4 million ETH have been burned.

Information about Ethereum inflation and the amount of coins burned since the activation of EIP-1559. Ultrasound.money data as of 06/08/2022.

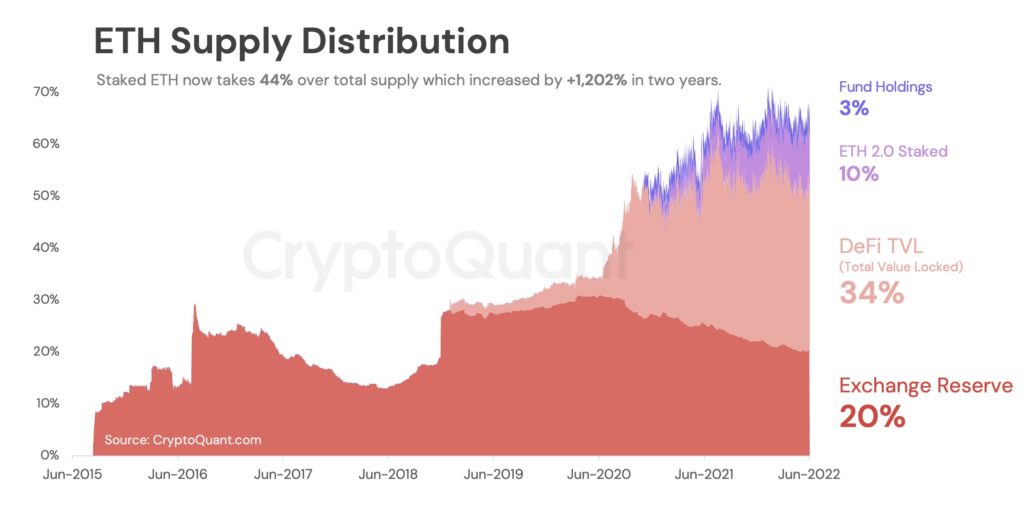

With a current 12.7M ETH in staking (about 10%from the market supply of ether) and a daily burn rate of 7900 ETH, inflation will be 2.1%. In other words, the annual volume of new emission will be approximately 5.4 million ETH.

ETH supply distribution chart: funds, ETH2 staking, DeFi, exchange reserves. Data: CryptoQuant.

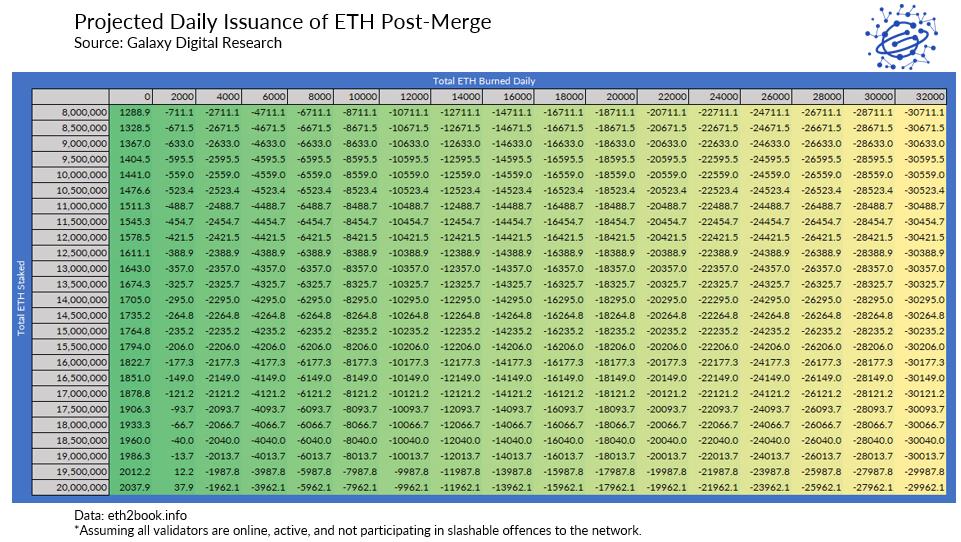

The following screenshot is a heat map. It shows how changes in the burn rate and staked ETH at the consensus level affect the daily supply of Ethereum.

Data: Galaxy Digital Research.

After activating The Merge, the emission mechanism is no longerimplies a fixed reward to miners per block. The amount of ETH in the form of a reward to validators will change dynamically, every epoch lasting 6.4 minutes.

Let's say there are 11 million ETH involved at the consensus level. The heat map above shows that with this parameter, 1511 ETH will be issued per day.

If we take into account the burning of coins -for example, 4000 ETH per day - Ethereum will become deflationary. The supply volume under these parameters will decrease by 2489 ETH per day or by 0.77% per year.

The amount of ETH burned directly depends onon-chain activity, which, after the end of the hype around DeFi and NFT, is declining. The chart below shows that the number of transactions in the Ethereum network has significantly decreased in relation to the peak levels of May 2021. The daily figure is below the 1 million mark, which is in line with the values of the beginning of 2018.

Data: IntoTheBlock.

“If user adoption of Ethereum picks up in the coming months and years after the Merge upgrade, Ethereum supply will shrink even faster,” Galaxy Digital Research said.

Then, according to them, the value proposition of the second largest cryptocurrency by capitalization will increase, especially in the context of a store of value.

As already mentioned, the security of the PoS networkThis is not provided by energy-intensive miners, but by validators that block collateral in the form of ETH in the network. The more coins are staked, the more difficult it is for a potential attacker to gain control of the system and change transaction history.

The Ethereum consensus level is designed so that validator rewards are automatically adjusted based on the amount of Ethereum involved.

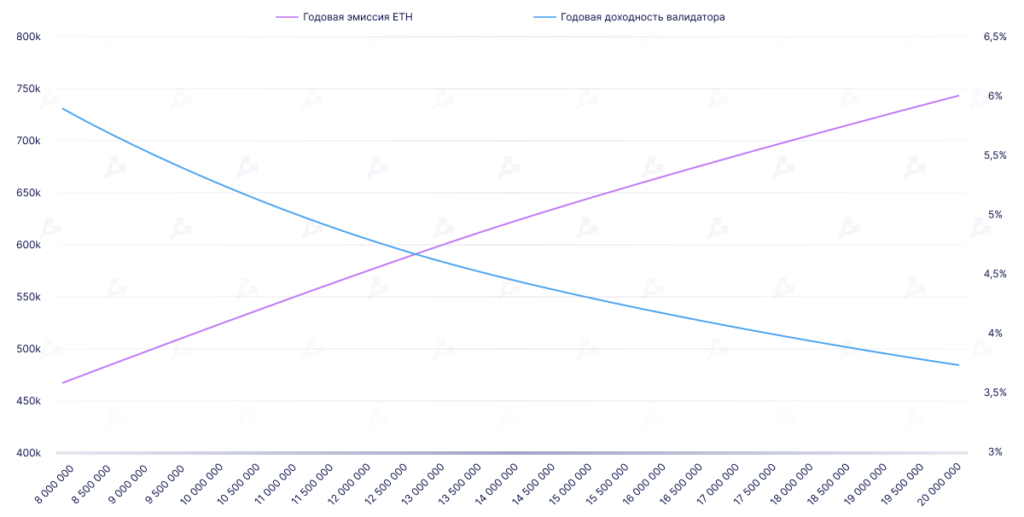

ETH annual supply vs validator annual yield. Data: Galaxy Digital Research.

When the amount of ETH in staking grows and on the networkmany validators are actively working, the profitability of the latter is declining. In the opposite situation, when there are few validators and coins in stake, the yield increases to encourage their more active participation in the network.

As of 06/08/2022, there are 399,554 validators.

Growth dynamics of the number of accounts that deposited 32 ETH in an Ethereum 2.0 deposit contract. Data: Glassnode.

The algorithmically changing issuance rate ensures that no matter how much ETH is staked, validators are always sufficiently motivated to work.

“However, such a dynamic approach is fraught with difficulties when it comes to predicting Ethereum’s monetary policy for the long term,” Galaxy Digital Research experts emphasized.

In addition to the number of ETH in stake and the number of coins burned, analysts should also take into account less significant indicators: online validators and slashed ones.

Data: Galaxy Digital Research, ultrasound.money.

The graph above illustrates the projected declineETH offers after activating The Merge. According to Ultra Sound Money, burning 2.9 million ETH per year (or about 8,000 ETH per day, which is the average since EIP-1559 was activated) will reduce the number of coins in circulation by 2% per year.

Other factors will also affect the structure of income:

- Priority fees currentlyreceived by Ethereum miners, after activating The Merge, they will go to active validators. According to Coin Metrics, the total amount of such “tips” is just over 1,000 ETH per day, and about the same is the daily income of validators. Consequently, the income of the latter will double.

- In addition to tips, validators will receive Maximum Extractable Value (MEV). Flashbots researcher Alex Obadiah calculated that MEV earnings could boost their revenue by 75%.

Liquid Staking and Centralization Risks

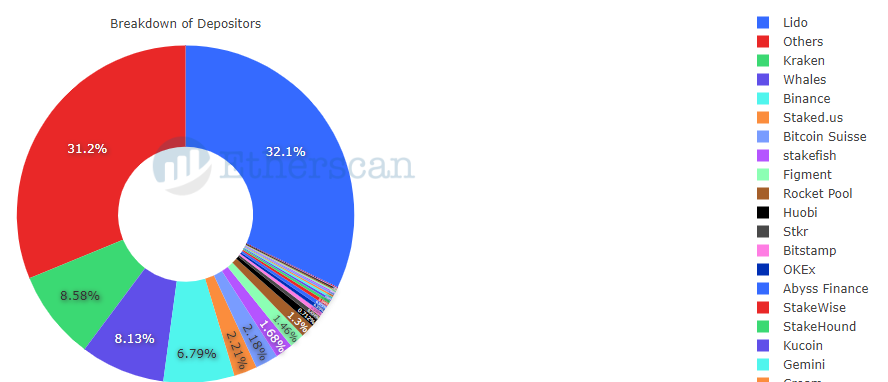

An increasing share of the Beacon Chain comes from Staking-as-a-Service (SaaS) platforms. The undoubted leader in this segment is the liquid staking service Lido.

The chart below shows that large exchanges also have significant weight: Kraken, Binance and Huobi.

Data: Etherscan.

The popularity of SaaS providers in many waysdue to the fact that such platforms greatly simplify and democratize staking due to the possibility of delegation. Users do not need to have 32 ETH - small amounts can be used. No deep technical knowledge is required.

In addition, many SaaS providers offerusers the opportunity to insure losses from slashing. Also, liquid staking services help increase capital efficiency – for example, Lido issues derivative tokens that represent funds locked in a staking contract. Such coins can be used in DeFi protocols to generate additional income.

“Given the higher yieldETH derivatives over ETH itself, tokens like rETH and stETH may at some point become competitors and even surpass ether in the context of liquidity and acceptance as the main currency for DeFi operations,” representatives of Galaxy Digital Research shared their thoughts.

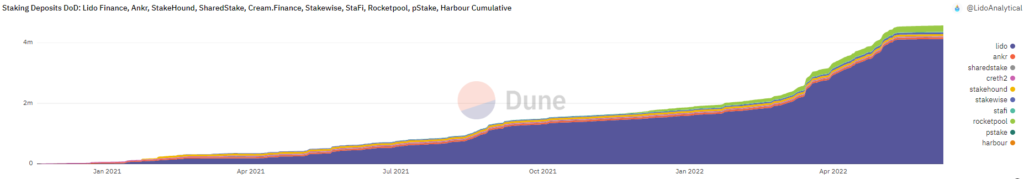

The chart below shows that Lido is far ahead of the competition in its segment.

The dynamics of the volume of funds in popular staking protocols. Data: Dune Analytics (@LidoAnalytical).

Bankless co-founder Ryan Sean Adams admitted,that over time, ETH will become something like a perpetual Internet bond, the holders of which will simultaneously be creditors and owners of the network. Thus, ether, as an underlying asset, will be used less and less in dapps.

Given the wide range of interesting options from SaaS providers, we can expect their popularity and therefore the value of assets under management (TVL) to continue to grow.

The segment is trending towardsdecentralization. For example, Lido is implementing distributed validator technology. A newer service, Rocketpool, is gradually gaining momentum, positioning itself as a decentralized staking platform.

When is Merge activated?

Testing of The Merge is in full swing: on June 8, Ethereum developers switched the Ropsten network to PoS. Goerli and Sepoila testnets are expected to transition within a few weeks.

In May 2022 one of the lead developersPreston Van Loon stated that the mainnet transition to PoS will take place in August. Vitalik Buterin also called the last month of summer the most likely date, but allowed the event to be postponed to September-October in case of "potential risks".

According to conservative scenarios from Messari, The Merge will be activated at all in November-December.

Analysts expressed confidence that after the upgrade, Ethereum would no longer be perceived as a “utopian experiment”. On the contrary, cryptocurrency will attract long-term investors.

Messari has assumed that the staking reward will be in the range of 7%-13%.

Future development

After activating The Merge, an important event will beShanghai hard fork. It is designed to increase the scalability of the network, make the withdrawal of staked funds available, and modernize the Ethereum virtual machine (EVM).

In March, Vitalik Buterin shared the idea of Proto-danksharding, a data validation script focused on transactions that carry so-called blobs that cannot be executed by the EVM.

Proto-danksharding is intended to replace danksharding- a sharding technique in which only one author of the proposal selects all transactions and data that fall into one or another slot. This approach was introduced in February 2022 by Ethereum Foundation researcher Dancrad Feist.

The founder of Ethereum proposed to automatically delete blob data every 30 days so that the network does not impose too large requirements on data and memory storage.

There is also an EIP-4488 aimed at extendedusing Ethereum-based Rollups. Initially, this relatively simple solution was planned to be implemented before the activation of The Merge. EIP-4488 reduces the cost of sending batches of transactions from second-tier networks to the Ethereum blockchain by five times.

“While The Merge is the most complex upgrade in the history of Ethereum, this is not the last upgrade of the network,” Galaxy Digital Research emphasized.

After this, the researchers are sure, the developers will focus on other pressing issues that have been under development for years, such as scalability and statelessness.

Galaxy Digital Research researchers predicted other consequences of Ethereum's transition to PoS:

- The popularity of mining cryptocurrencies on the GPU will decrease.Some miners will switch to alternative coins like Ethereum Classic or Ravencoin. Many will simply sell video cards, which then go to gamers and designers. This will reduce the prices of devices on the market and affect the income of manufacturers.

- Bitcoin, which remains the largest PoS-cryptocurrency, will become even more criticized for the high energy intensity of the network.

findings

According to optimistic forecasts, the activation of The Mergeexpected in August. However, given the technical complexity of the merger process and the tendency of developers to postpone upgrades, this event may take place in late autumn.

One of the most significant consequences of the transitionon PoS will be the elimination of miners from the game. This can significantly affect market conditions in the short term. Selling pressure is likely to ease and hashrates for altcoins like Ethereum Classic rise.

In the medium to long term Ethereummay become a more investment-attractive cryptocurrency. First, the project will prove its antifragility. Secondly, the asset will comply with the trend towards environmental friendliness.

Finally, deflation will certainly do its job. However, its level will depend on user activity.

The Merge is far from the last major Ethereum update. It will help to solve the problem of scaling, where sharding and Rollups play a big role.