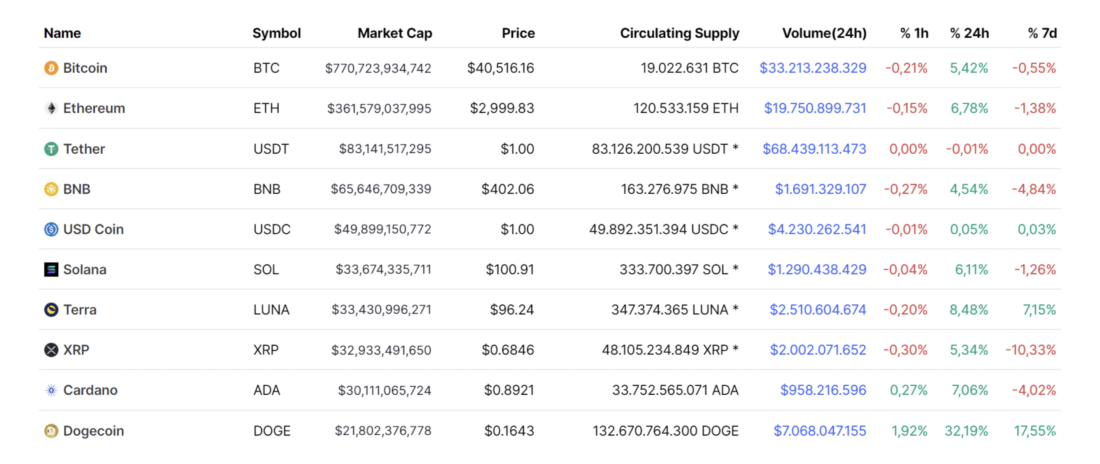

In the new issue, Cred and DonAlt, regular contributors to Technical Roundup, discussanother difficult week in BTC/USD and a retest$3000 resistance in ETH/USD.For altcoins, the authors have updated the Terra review, once again reminding readers of how they look at failed breakout patterns (and how they can turn into a strong bullish signal if price closes again above a key level). The review ends with a small comment about the purchase of Twitter by Elon Musk.

https://coinmarketcap.com/coins/views/all/

BTC/USD stuck to $40k.

Bitcoin/Dollar continues to trade at $40K.

Price action on Monday was mirroreda reflection of the previous week: sellers tried to force a breakout, and were rewarded for their efforts with a long wick and a candle close deep in the green zone.

But no matter how exciting the pricelower time frame action, especially fueled by news events such as Elon Musk's Twitter buyout, higher time frame action still needs to be corrected.

Last week we wrote that “areas for more confident transactions are still at the edges of the macro range: $32-34 thousand and $42-43 thousand.”

The thesis remains valid. $32-34 thousand.is the minimum of the range, and the clearest bets are usually made at the extremes and on clear boundaries. Meanwhile, a breakout of $42-43k would be the first decent sign of strength on the higher timeframe. Outside of these areas, any bets, in our opinion, are short-term and riskier.

The market's willingness to buy BTC below $40k is a good start. But breaking through resistance again would mean much more.

Given that one failed breakthrough here alreadyoccurred, the probability of a second failed breakout in a row, if the price closes again above this level, will be significantly lower. "Lightning doesn't strike the same spot twice" or something like that. In fact, this idiom is incorrect, but it describes the logic correctly.

To summarize, the preferred areas to buy are −this is still support at $32-34k or a recovery above resistance at $42-43k. In the shorter term, the $40k level appears to be key.

Ethereum Needs to Correct the Situation on the Weekly Chart

ETH/USD is still below $3000.

And anything below $3,000 is not particularly attractive to us. This is the clearest area on the weekly chart.

And right now it's resistance.

Weekly or at least daily closeabove $3,000 would be a significant confirmation of strength. This idea is all the more relevant given that, as with bitcoin, buyers have so far readily absorbed selling below the $3,000 round psychological level.

If the current failed breakout pattern does turn out to be a range exit, it would be a worthy upside setup to the next resistance levels closer to $4,000.

On the weekly chart, this entire area is ~$3000($3,050-$3,300) looks like it's sticky, so this week's price action must eventually break out of it confidently to turn the bearish retest into a meaningful breakout.

So, based on the weekly chart, anyprice rises to the ~$3000 area are technically tests of resistance. Whether there is still a breakout of this level, it will be necessary to determine dynamically on smaller timeframes (for example, daily) or more conservatively: expect a weekly close above this level.

Terra teases with $100 dough

Terra is still trying to correct its weekly chart against the dollar.

As we noted a couple of weeks ago, the market made a new all-time high, but then was sold back to the previous range ($43-99) with force.

Patterns like this suck.This is a technical trap (failed breakout) with increasing pressure when a new high is formed, which usually attracts even more buyers who want to buy a breakout and who find themselves in a loss when the market pulls back to the previous range.

Given the failed breakout, the situation is technically bearish until this pattern is refuted by a weekly close above $100.

And as we have said more than once, such a recovery would not just be an invalidation of the bearish pattern.

Rebutting a good bullish setup makes for a great bearish setup. Rebutting a good bearish setup makes for a great bullish setup.

That is, if this structure of an unsuccessful breakthroughnot enough to push the price lower, that in itself is a sign of significant market strength. An example that comes to mind is the Solana/USD at $50 in August 2021. A nasty bad breakout, a dip, but once the breakout level was restored, the market took off.

Accordingly, if the market as a whole this weekcan turn around and show strength, then one of the setups that makes sense to follow will be the closing of the weekly candle in Terra above $100. The pair against BTC is still holding a breakout of ₿0.00178-0.002, which looks constructive.

Against the dollar, Terra is at resistance, but this is not the type of structure you want to ignore if that resistance is taken again.

Elon buys Twitter

Elon Musk bought Twitter for $44 billion. Time to let the world know what we think about it.

First, to centralized ownership of keya source of news, information and discourse should be treated with skepticism. Especially awkward in this light is the comparison of Twitter with the city square, which Musk cited when commenting on the deal. And this skepticism does not become less legitimate (rather vice versa) because “our people” buy the resource. Musk's apparent commitment to free speech and transparency may be somewhat reassuring here, but this verbal stance is by no means binding.

Secondly, we would not be surprised by the dramatic changes inpublic opinion regarding the new owner of Twitter and its management. People have short memories. Remember how Musk went from being a bitcoin hero in an instant when Tesla bought bitcoin into the company’s balance sheet and was about to accept payment in BTC, to a bitcoin villain when he withdrew support for bitcoin due to concerns about its carbon footprint? One might hope that Musk will be a responsible manager, but on the whole he comes off as a rather eccentric (politely speaking) impression, and it is hardly possible to do without badly thought out and unpopular decisions.

Thirdly, we expect further integration withcryptocurrencies. We won’t be at all surprised if here one way or another it doesn’t do without Dogecoin. Maybe as a payment mechanism for tips, anti-spam, or even verification? Who knows. The market doesn't know, but likes the idea enough to have a couple of small Dogecoin pumps on the news of the likely deal and its confirmation.

Finally, Dogecoin price action this weekcould be quite indicative of the market as a whole. If Elon Musk's purchase of Twitter is not enough to trigger a full-fledged Dogecoin pump and perhaps even short-term growth in the crypto market as a whole, then the state of the market is deplorable. In a bull market, such news would send all assets up by double digits. And if this micro rally simply fizzles out, it will be good confirmation that the market is still in the grip of correlation with the S&P500 and NASDAQ.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>