This week's Technical Roundup's Cred and DonAlt discuss BTC/USD's attempt to break below $40k and the weekly close belowsupport $3000 in ETH/USD.As for altcoins, DonAlt finally decided to somehow justify his nickname (so-so…), but for some reason he did it by purchasing Litecoin (no, seriously?). The authors also added the Binance Coin/USD pair to further illustrate the argument in favor of Litecoin in another chart.

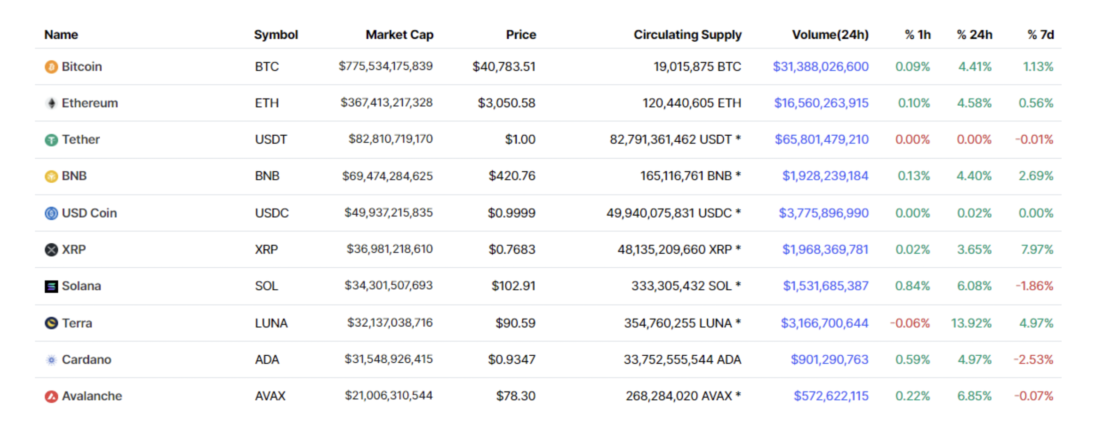

https://coinmarketcap.com/coins/views/all/

Bitcoin tickles the nerves with a breakdown below $40 thousand.

Bitcoin/Dollar rebounded to $41.5K after attempting to break below $40K earlier in the week.

But the main theme for Bitcoin remains the failure to break out of the resistance range at $44-46 thousand.

That is, caution in the medium term is still justified - until either the low of the range ($32-34 thousand) is reached, or the resistance of $42-43 thousand is broken.

These ideas are most clearly seen on the weekly chart.

As for the daily, it is here that the instability and confusion of price action is clearly visible in recent times. There are two structures on the chart.

First, the trend line can still be useful.There was already a false breakdown of it, so if it is broken again, then the second attempt will most likely be successful. Not necessarily so, but the chances of this are definitely higher than another false break.

Secondly, the market formed an unsuccessful breakoutbelow $40K If we expect some strength before reaching the lower end of the macro range, then the low set on Monday should be held.

A recovery above the trend line is a worthy confirmation of a short-term rebound.

But as always, the areas for more confident trades are still at the edges of the macro range: $32-34 thousand and $42-43 thousand.

And trading on current local movements is much more like guessing on coffee grounds.

Ethereum closes below support, now resistance

ETH/USD closed the week below the $3,000 support. This area is now being tested as implied resistance.

Last week we wrote that while the market looked pretty bad and while we personally weren't in the mood for a $3,000 retest, it was the clearest support structure in any major coin.

The market fluctuated around this level and closed lower.

At the same time, the picture looks different on the daily timeframe, given the bitcoin-like false-break structure formed at $3,000.

One of these timeframes is misleading.

Either a bounce on the daily chart straight into weekly resistance, or a bearish weekly close, some of which will be debunked this week.

DonAlt described the situation as "murky". I agree.

Both BTC and ETH have yet to recover from false breakouts on the higher timeframes and both pairs have formed a bounce on the daily chart in the area of the weekly resistance.

The market looks a little more day-trading than it used to be, but we're not very interested in these daily swings until the unsightly weekly closes are refuted.

Binance Coin may be preparing to take off

DonAlt offered Cred some altcoins. Cred didn't buy anything.

And this, of course, increases the chances of successful DonAlt purchases. The first victim is BNB/USD.

DonAlt(a)’s perspective on altcoins – applicable toBinance Coin, Litecoin, and other coins with similar structures - comes down to the fact that this is the last relevant buying area, beyond which the abyss opens.

In other words, these rates are so close to the invalidation levels (testing decent technical structures) that the risk/reward ratio seems acceptable for the first time in a long time.

There are two options for BNB/USD: a higher low at $400 or a free fall.

Litecoin at (something like) weekly support

LTC/USD is testing weekly support at $109. Well, how about support… With a stretch, in general.

In fact, DonAlt first got into LTC, and then after the fact drew an uncharacteristically short-term horizontal. As is typical of all the best traders, yeah.

As for the thesis, it looks extremelyno wonder. To quote DonAlt, “I just bought it to see if this whole decline was fake… Looks good, plus some MimbleWimble bullshit in a few weeks.”

Convincingly, you will not say anything. It didn't even take a thread of 20+ tweets.

Well, if DonAlt is right, then the target is a break above $131.

Either that, or eternal shame for having fallen for the bait and decided to buy Litecoin from all the coins.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>