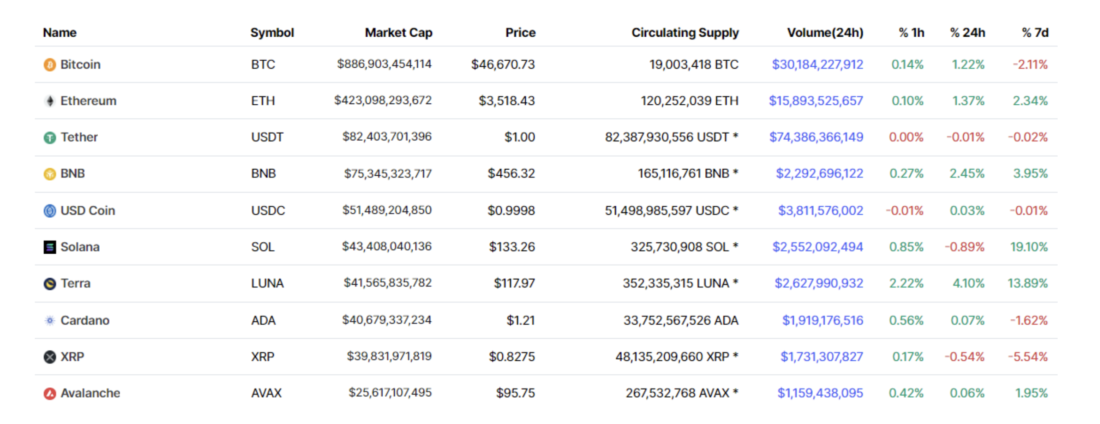

This week, Cred and DonAlt, the smug boomers from the Technical Roundup, look at range breakouts in BTC and ETH, as well asmarket structures of three altcoins: Solana, Terra and Avalanche.

https://coinmarketcap.com/coins/views/all/

Bitcoin: Still Above Resistance

The BTC/USD rate closed another week above the resistance level of ~$46 thousand. The market looks awkward, but still bullish - until the breakout level is lost.

The reason we see the situationclumsy, rather than confidently bullish, is that the market has recently been hit by a barrage of good news and narratives - massive purchases of Do Kwon and Sailor, a strong surge in the stock market and exit from the 2-month consolidation range in BTC and ETH - all just to slow down 4-6% above the breakout level.

For such favorable circumstances, this is a rather weak breakthrough. This week the market really needs to get off the (half) dead center.

As before, the nearest resistance on higher timeframes is in the area of $52-53 thousand.

The signal about the invalidation of the thesis is also the same.Any argument for strength would involve consolidation above this breakout level. Accordingly, if the breakout ultimately fails, then the bullish continuation scenario becomes untenable. Technically, this could look like a close on any higher time frame and/or signs of weakness with a move below $44-46k.

Ethereum passes the middle of the range

Ethereum closed above USD resistance and is showing strength against Bitcoin as well.

In simple words, narratives around cryptocurrenciesnow in order: the correlation with risky assets has recently decreased (last words are known), large energy companies are actively interested in mining, bitcoin after the start of the "special operation" in Ukraine has become the focus of attention as confiscation-resistant money, plus large-scale spot purchases of Do Kwon and Sailor , expectations of merging blockchains in Ethereum and a decent surge in the NFT market.

We are still in no hurry to statedisassociation from traditional risky assets and we believe that the crypto market is not immune from falling stocks, but yes, the narratives around cryptocurrencies are strong now.

From a TA perspective, Ethereum/USD/BTC pairs still look positive.

The pair against the USD has overcome important resistance~$3000, and as long as this area is support, it seems reasonable to expect continued growth. Immediate resistance is closer to $4000, with a more conservative $3600-3800 area of interest on the daily timeframe (not shown). In any case, growth rates here and above are already becoming less attractive in terms of risk / return. As we said, the growth thesis will be invalidated by the loss of $3,000 support.

ETH/BTC continued to rise after an unsuccessful breakdowntrend lines (failed bearish pattern = bullish signal) and is now close to resistance at ₿0.077. If this level is taken, then a larger high on the macro time frame is likely, and this almost certainly implies a move towards the USD closer to $4000. More conservative scenario: the market finds resistance at ₿0.077 and the range remains in place.

And the last thing worth noting:I would not like to see a big discrepancy between the movements of bitcoin and ether. As we have written here many times, historically, when Ethereum pulls Bitcoin higher, it rarely ends well, unless it happens at the very beginning of a bullish cycle. If bitcoin does not show strength at the same time, the market tends to be unnecessarily overheated, and often such periods end in significant drawdowns.

Solana reaches resistance on the macro timeframe

Although we are limited mainly to a couple of major crypto assets (dull boomers, what to take from us), it was nice to see strong movements in familiar altcoins.

We are talking primarily about Solana, Terra andAvalanche. Although they are often referred to as projects of the same group, they showed different returns, and today they offer quite different technical structures.

Solana's recovery of the past few weeks has led directly to weekly resistance ($136). This is against the backdrop of impressive gains from lows under $80.

This is the best "technical" resistance on the chart, which means that until it is broken, it is also the least attractive area for new longs.

The market is at resistance until the opposite is confirmed.

Continuation Scenario for Continued Gains: As with any ranges, a recovery above the low ($136) on the weekly timeframe would suggest a move to the high of the range ($174).

Terra outperforms the market by setting all-time highs

All the hype around Terra had a positive effect on the price of the asset.

A lot of positive narratives converge around this ecosystem, so it's no surprise that the token is doing great. This is definitely more promising than buying an algorithmic stablecoin.

As usual, we treat the breakout as bullish until the opposite is confirmed, i.e. until the price closes below the breakout point.

This applies to both trading pairs - both USD andto BTC - the structures in them are similar, and such a correspondence deserves attention. In a pair against the dollar, the breakout level is at $99, in a pair against BTC it is at ₿0.002. As long as the price is trading above these levels, everything is fine.

If the price closes lower, it will be possible to state an unsuccessful breakout in the altcoin with the strongest narratives - a definitely bearish signal.

Avalanche restores support against USD

AVAX/USD has restored support ($89-92) and is currently testing it. This is a pretty clear defining level. It's simple: above it, the expectations are "bullish", below - "bearish".

AVAX/BTC has been trading between ₿0.0017 and ₿0.0022 for some time now.

As you can see, the situation within this trio of altcoins is completely different. Solana approached resistance and was the only one of the three to have yet to recover her key level.

Terra looks to be stronger than the rest, both narratively and structurally, given the renewal of all-time highs and clear space for price determination ahead.

Avalanche sits somewhere in between, offering a clear support retest against the dollar, but not showing signs of exceptional strength like Terra.

You can choose your poison.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>