Cryptoassets are a promising innovation in the evolution of money and the modern financial system.HoweverIssues related to the assessment of crypto assets are still open.

Fundamental concepts on the basis of whichformalized methods for evaluating crypto assets are being created; they are just beginning to emerge. Nevertheless, experiments in this field have been conducted for more than 10 years.

ForkLog Magazine Offers Readerstranslation of an article by Kevin Liu from CoinMetrics, which briefly discusses six basic approaches to the study of the evaluation of crypto assets: the exchange equation, the discounted future utility model, Metcalf's law, regression price models, production cost models and market bubble detection.

Equation of exchange

Irving Fisher's exchange equation originallyexplained the relationship between money supply and price levels in the monetary economy. It has been used in the field of crypto asset valuation and is currently one of the most widely studied theoretical concepts.

The basic idea is intuitive and simple - the equation of exchange is the relationship MV = PQ, where:

M is the nominal money supply;

V is the velocity of circulation of money;

P is the price level;

Q is the volume of production.

In the context of bitcoin, this model in 2014Bitquant Research Labs Joseph Wang was succinctly justified. In its version adapted for crypto assets, P is calculated in fiat currency units, M is defined as the number of existing coins multiplied by the price (i.e., market capitalization), Q is the value transmitted over the network, the interpretation of V remains unchanged.

The essence of this model is that costthe crypto asset is inversely related to the speed of circulation. In other words, high turnover leads to lower coin value. Wang argues that the price of BTC is determined solely by the probability that the coins will be stored, and not participate in transactions.

Researchers Pavel Chayan, Miroslava Rajkaneva and d’Artis Kants in 2015 came to the conclusion that factors such as supply and demand, as well as circulation speed significantly affect the price of BTC.

Bitcoin circulation rate over the pastyears decreased with price growth, which is consistent with the equation of exchange. The chart below shows the offer circulation rate for the year (the model does not take into account spam transactions):

Questions about speed were asked by Ethereum creator Vitalik Buterin and entrepreneur John Pfeffer. In their articles, the exchange equation is applied to utility tokens.

Both researchers claim that such tokensextremely susceptible to high velocity. This is because users use small amounts of coins to use the services provided on the network. Suppliers of the latter, in turn, immediately sell the received tokens.

In 2017, Buterin concluded thatthe value of the crypto asset “to a decisive extent depends on the retention time” of tokens. Then he described the mechanisms by which the offer or circulation rate of tokens is reduced, for example, by burning transaction fees.

Pfeffer believes that at a high equilibrium circulation speed of a utility token, its price tends to decline to the actual cost of resources to maintain the network.

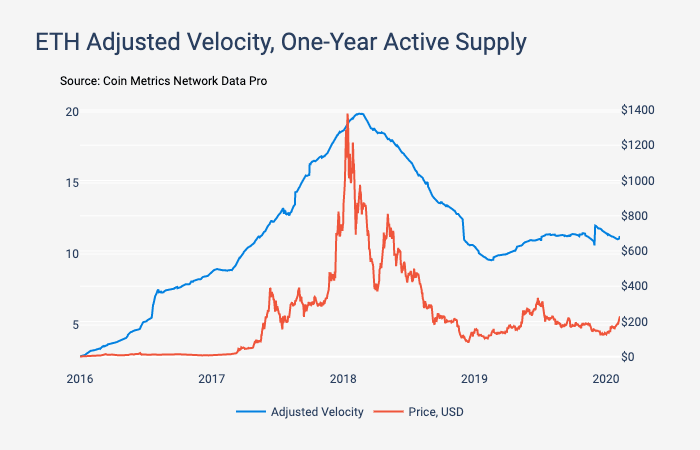

In the chart below, the ETH circulation rate increased to the coin's peak price in 2018 and has since leveled off somewhat.

The rapid growth of the indicator in 2017 coincidedwith a boom in initial coin offerings (ICOs) and the number of utility tokens, but subsequently decreased significantly. Now the ETH circulation speed seems to be roughly consistent with the price.

In 2017 and 2018, the managing partnerMulticoin Capital investment fund Kyle Samani described economic models that solve the “speed problem”, which allows the cost of the utility token to grow. These models involve combustion and staking mechanisms.

In general, published by industry expertsarticles in 2017 and 2018 had a strong impact on token architecture. However, the thesis of a high velocity of circulation has been repeatedly criticized. So, Alex Evans, a researcher at Placeholder venture capital firm, criticized the previously discussed models because the token's velocity in them is an exogenous variable. In the Evans model, speed is an endogenous variable, a function of PQ, which can be adjusted to the desired value through a change in the token architecture.

A similar point of view was expressed by Brian Koralewski ofAustere Capital, questioning the thesis of exogenous speed. Researcher Scott Loklin even calls the generally accepted conclusions false, both about the velocity of circulation and about optimizing the token architecture in the context of the exchange equation.

Despite criticism, the exchange equation continuesremain one of the most widespread approaches to assessing tokens. In the coming years, when winners and losers appear among utility tokens, one can expect that in this area they will conduct more in-depth studies and check theses on the speed of circulation.

Discounted Future Utility Models

They have much in common with the concept of discounted cash flows from traditional finance, but take into account the unique characteristics of crypto assets.

Placeholder venture partner Chris Berniskein 2017 introduced a model for evaluating a hypothetical utility token. Its key determinants: the number of coins in circulation, the total size of the market where the token is used to pay for services, the network acceptance curve, the token circulation speed and discount rate.

ARK Invest researcher Brett Winton in the same year introduced a similar model with identical parameters, but taking into account different expectations of returns by different groups of investors.

Berniske also coined the terms “currentutility ”and“ discounted expected utility ”. These categories provide a theoretical basis for describing how value fluctuates over the life cycle of a utility token.

Possibilities of applying discounted modelsfuture usefulness little studied. Functional networks with utility tokens are still being developed and only a few projects demonstrate significant activity. Modeling the value of utility tokens with a new architecture involving burning and staking also remains an active area of research and experimentation.

Metcalf's Law

This law states that the cost of the networkproportional to the square of its users. Metcalfe’s Law has been successfully applied to evaluate social networks, and was first used in 2014 to evaluate crypto assets.

Ken Alabi of New York State UniversityStony Brook tested Metcalfe's Law on BTC, ETH, and DASH in 2017. In his work, the scientist emphasized how deviations from forecast values can be used to identify bubbles in the market.

American researcher Timothy Petersonapplied Metcalf's Law to determine periods of alleged market manipulation in 2013. As input values, he used the number of bitcoin wallets on the blockchain.info service (now blockchain.com).

Clearblocks researchers have activated the lawMetcalfe and its competing concepts for BTC and ETH. They managed to create an indicator that allows identifying periods of undervaluation or overvaluation of an asset.

The relationship of onchain activity with real-world objects and individuals is still poorly understood and is an active area of research.

Price Regression Models

Typically, in such models, the relationship between price and time is investigated, and in the forecasts often difficult long-term values appear.

Some experts do not take this seriouslyfamily of models because of the overly simple, in their opinion, approach. However, we believe it would be a mistake to completely neglect them - some of the earliest of them showed surprisingly accurate results, reliably determining the historical periods of under- and overvaluation of assets.

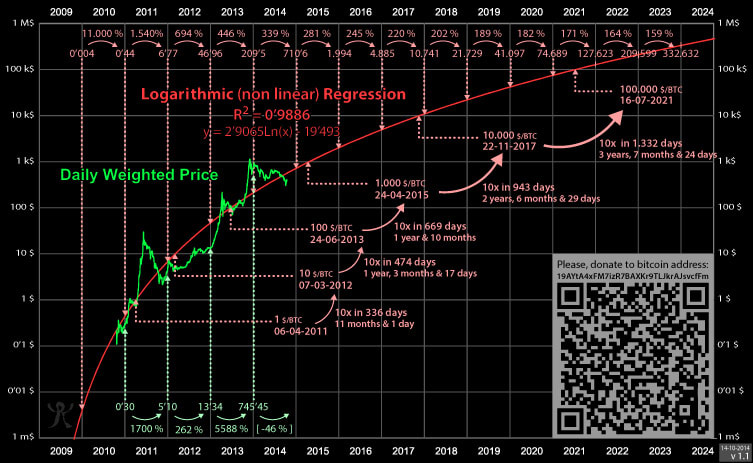

In 2014, when BTC was trading at $ 275,a participant in the famous Bitcointalk forum under the nickname Trololo presented his own version of the price regression model. Thanks to her, he was able to predict the achievement by Bitcoin of the mark of $ 10,000 with an error of only a few days.

Researchers at Awe & Wonder in 2018 took a similar approach with updated data that provided a very accurate forecast of the bottom of the market cycle.In 2019, Harold Christopher Burger introduced various regression models, using subsets of data to test them.

Significantly advanced in this field andPopular blogger PlanB. His articles served as a powerful impetus for the study of models for evaluating crypto assets. Inspired by the work of Seyfedin Ammus, PlanB insists on the effectiveness of the Stock to Flow (S2F) model, which emphasizes the scarcity of bitcoin and its suitability as a means of preserving value. According to S2F, the price of the first cryptocurrency will exceed $ 50,000 after the next halving in May 2020.

Price regression models are quite popular, however, they are all based on the assumption that BTC will continue toA path to long-term equilibrium as a global store of value – a digital analogue of gold.

Over the next years, we will receive additional data that can be used to test these models, including S2F.

Production Cost Models

When evaluating crypto assets, these models rely on mining costs. This approach is intuitively simple and originates from classical economic thought.

So, even Adam Smith introduced the concepts of market andthe natural price of the goods. The latter reflects the cost of various factors of production necessary to create a product. Market price - the actual value at which the goods are sold. Smith argued that market value tends to a central price of natural value.

Satoshi Nakamoto quite succinctly explained this fundamental concept:

“The price of any product gravitates to its costproduction. If the price is below cost, output is reduced. If higher, then profit can be obtained by increasing output and sales. On the other hand, production growth increases complexity, bringing production costs closer to price. ”

For the first time, a mining cost model was appliedback in 2009, when bitcoin just appeared. The first website to offer BTC exchange was New Liberty Standard. The same resource in October of the same year for the first time set the rate of the first cryptocurrency at the level of 1.309.03 BTC for $ 1. Since there was no market then, the site administrator calculated the exchange rate based on the cost of electricity needed for cryptocurrency mining.

American economist Adam Hayes in 2015He presented the first serious approach to this issue - a model that takes into account the cost of electricity, the efficiency of mining technology, the market price of BTC and the complexity of mining. In 2016, Hayes analyzed 66 cryptocurrencies and came to the conclusion that their value can be justified by the complexity of mining, the rate of issue and the type of algorithm used to mine coins.

Noteworthy models proposedCambridge University researcher Mark Bevand in 2017 and Charles Edwards in 2019. In the latter, the value of bitcoin (referred to as energy value) is a function of energy consumption, issue emissions and energy cost in fiat currency.

Mining economics and, in particular, conceptualA cost estimation model for the extraction of crypto assets has now been developed quite well. Further research in this area is likely to involve a more thorough collection of empirical data on which these models are based.

Market bubble detection

The crypto asset market is prone to bubble formation. This has happened more than once during the short history of bitcoin. Based on the extent and frequency of bubble formation, it is possible to apply their detection techniques, originally developed for traditional financial assets.

Researchers Jeremy Eng-Tuck Cheah and John Fry were among the first to apply such models to BTC, identifying the latter's susceptibility to speculative blistering.

Using similar techniques, Adrian Chun and Jen-Soo Su in 2015 revealed many short-term and three large bubbles in the period from 2011 to 2013.

In 2018, scholars of the Swiss financialSpencer Wheatley, Tobias Huber, Max Reppen and Robert Gantner presented a model based on the Metcalf Law, where four bubbles are correlated with deviations from the predicted values.

***

Founded in 1602, Dutch East Indiesthe company was the first corporate entity to issue bonds and shares. For more than 300 years, fundamental concepts have been developed, and only in the 1930s a formalized system of approaches to the valuation of securities appeared.

Over the past 10 years, significantprogress in valuing crypto assets. The techniques available in many disciplines are gradually adapting to the new industry. Unique, specific for crypto assets approaches are also being actively developed. However, fundamental concepts are only just beginning to take shape; many of them have not been studied enough.