This week, regular contributors to Technical Roundup discuss the fall of markets after the publication of higher thanThe main focus is, as usual, on the two largest cryptocurrencies – BTC and ETH.In addition, the Cosmos and S&P 500 are included in the review.

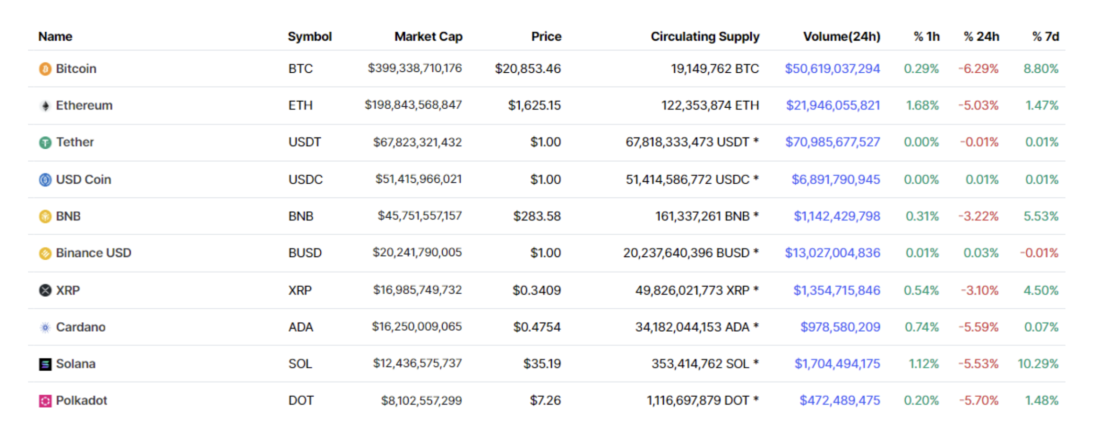

https://coinmarketcap.com/coins/views/all/

Bitcoin: pullback from range high

BTC/USD is trading at $20k again, having corrected from the $22.6k resistance.

The main catalyst for the markets this week was the published inflation data on Tuesday, which definitely turned out to be higher than the market's expectations.

The difference, although it looks insignificant (+0.1% tothe previous month, instead of the expected -0.1%), but suggests that inflation is still high and there is no good reason to believe that it is declining at a pace that would contribute to "tightening" by the Fed. And it also means that the arguments about the past peak of inflation and the expected “Fed turnaround” are currently not supported by the data.

Goldilocks-type scenario as applied toThe crypto market could look something like this: signs of strength at the highs of the range → good inflation numbers → rally in risk assets on the inflation peak narrative → the crypto market breaks the resistance of the upper border of the range and rises stronger, with The Merge as an additional catalyst a day later.

But instead, at the moment we have a number of pullbacks from technical resistance levels, complemented by poor macroeconomic dynamics.

From the TA point of view, for Bitcoin the picture remainssimple. The market is in a range on the daily timeframe, with resistance at $22.6 thousand and support at $19 thousand. And at the time of preparing the review, the downward impulse was enough for a confident breakout of the middle of the range at $20.8–21.2 thousand with one candle. In addition, In general, market swings in the middle of a range are generally not recommended for building high-confidence positions. These may be good levels for scalping on volatility, but bad for building anything medium-term.

The most optimistic scenario is thatthat the market will shake off this news and regain mid-range support - with some form of failed downside breakout, perhaps with a positive candlestick structure in the $21k area.

The alternatives look bad:a return to the low of the range ($19K) is accompanied by an increased likelihood of a breakdown of support on a high time frame, and a recovery to the high of the range does not look likely at the time of writing.

In other words, if the market hasn't caught you with your pants down, now is the time to just wait.

Ethereum stumbles before the merge

Ethereum rolled down with the rest of the marketjust a day before the merge. While the actual activation day of the update could be the occasion for some volatility (especially if something goes wrong, which could have an absolutely killer effect), we still believe that the inflation data here and now is a stronger catalyst.

Merge + favorable macro environment ispowerful duet. But Merge + shitty macro environment is not the same thing, especially considering that the expectation of the merge has already become the catalyst for a major move from the lows. It doesn't look like you're among the first, if you have the desire to merge Ethereum in the short term. The entire crypto market has been living in anticipation of this event for the past weeks and months.

In terms of technical levels, the marketreturned to a dubious support level on the daily timeframe ($1550-1600). It is questionable because it has been tested many times lately, in contrast to the weekly support, which is closer to $1300-1400.

Again, like bitcoin/dollar, ETH/USDoffers you some mediocre options. You can either buy from this bruised $1550-1600 support in hopes of a bounce and a positive merge effect (bad level, maybe not so bad chart) or look long at the aforementioned $1300-1400 weekly support (better level, worse chart).

The market on Tuesday clearly reminded of the futilityholding positions against the backdrop of major news events, so it seems like a good idea to look for more clarity after the merge, when the “dust settles”, rather than chasing a deal right before it.

In case it's not obvious, ourthe prevailing view is that the best-case scenario for cryptocurrencies has not materialized, resistance has held, current levels look questionable (if not broken), and it makes more sense to wait for better opportunities.

Cosmos at the resistance

Cosmos approached the resistance.

DonAlt likes the chart, we shared it last week: price rises to resistance, DonAlt hits the red button, price goes down. Why can't everything in the world be that simple?

In any case, our "technical" goals for Cosmos were achieved. The pair against the dollar reached our first troubled level at $15, the pair against BTC reached its range high at ₿0.0007634.

We have no particular opinion regardingfurther price action, and we are not particularly concerned about it. This alt did its job, and we will return to altcoins when the market as a whole looks a little more reasonable.

S&P500

No surprise: risky indices reacted badly to high inflation figures.

First, our slightly bullish scenario forcryptocurrencies (and markets in general) was largely associated with a retest of the weekly support of $3900–3940 in the S&P500. This bounce has now been fully played out and the market is pulling back from the immediate resistance at $4150-$4200. Support supported, now resistance has worked out, and a convincing macro-catalyst for continued growth is not visible in the near future.

At best, the market will remain sandwiched betweenthese two levels, but given the lack of change in conditions for "quantitative tightening", a continuation of the downtrend looks likely as the monthly and weekly resistance levels have been tested and held.

In a downtrend, resistance is expected to be more likely to hold, while support, on the contrary, is more likely to be broken.

Although we would prefer that the aforementionedthe range from $3900-3940 to $4150-4200 remained intact (since that would have contributed to at least some decent price action in the crypto market), we don’t take it for granted and wouldn’t be surprised if the downtrend continues in the coming weeks.

Doesn't sound very optimistic, but it's truespeaking, the overall picture in global markets still looks bad and technical resistance levels are working out as they should. Give other data, and we can tell something more encouraging. Give other graphs, and it turns out that we are not so dull boomers. But it's hard to be positive when the markets are playing a completely different game.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>