TechnicalRoundup is back from vacation, and regular contributors Cred and DonAlt have a lot to discuss this week. INmajor trading pairs is weakness in BTC/USD onbackdrop of exceptional strength in ETH/USD and ETH/BTC. We also have time to insert our two cents about The Merge. From altcoins, the authors decided to pay attention to Binance Coin, Cosmos and FTX Token.

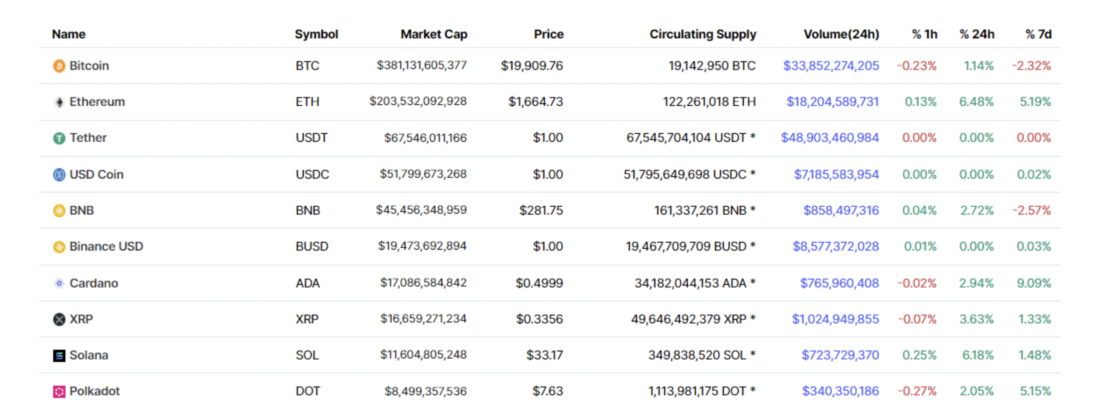

https://coinmarketcap.com/coins/views/all/

___

Dear reader, we thank you for reading our review and hope that you will stay with us for a long time.

On the occasion of the first issue after the break, we recallmain idea of this review. It's simple: you get higher time frame charts for the most important digital assets in one place, at the same time, every week.

Whether you are a short-term trader who wants to checkgeneral vision of the trend and important levels in terms of market structure, or a cautious investor trying to figure out this new asset class, we hope you find something of value in our reviews.

There will be no direct signals here, it's pretty obvious. But we can offer something better: logical structure, consistency, and methodical and reliable analysis. Every week.

We are not perfect. We make mistakes.And when we make a mistake, you will definitely know about it, because we will discuss our mistakes here. If the situation in the markets from the point of view of TA seems unclear or of no interest to us, then we will not suck out an analysis that we ourselves will not consider convincing. And although we cannot promise perfection, we try to be as honest and transparent with you as possible.

But enough words, it's probably time to move on to the charts. We hope you enjoy.

___

Bitcoin is back to $20k.

Bitcoin/dollar returned to the most important support level.

In the previous few weeks, while stocks were rising andETH also joined the party amid anticipation of the merger, and BTC/USD price action was sluggish. The BTC rate only rose to $25 thousand, after which it corrected.

Technically speaking, the market has returned to support.The second test of support is by no means a death sentence, but it is important that the market demonstrates some demand in this area to mark a difference from the 2018 situation at $6000. For those who don’t remember, then the market bounced from the $6,000 support for several months, but each time it became weaker. Ultimately, this level did not hold, which led to the price halving to $3,000. Overall, Bitcoin's weak performance against the dollar is not good for the crypto ecosystem, so we would like to see either a failed breakout around $18-20k (daily and weekly range lows) or a constructive move towards the middle of the range ($22k). as a likely signal of further growth. However, hanging around the $20k mark without moving anywhere would be a bad sign. Below is good, as long as the breakout attempt is absorbed by demand, above is also good. Stagnation is a bad sign.

In terms of context, the bitcoin marketis under great pressure. Ethereum has taken the lead in terms of narrative, price action, and futures contract speculation. The ETH/BTC chart has been one of the strongest recently, and this is against the backdrop of a larger multi-year uptrend. As for Bitcoin, the hedge against inflation thesis has burned out — bitcoin has shown itself weaker than other risky assets in recent months, even in countertrend bounces — the Stock-to-Flow fairy tale has failed, on-chain analytics has faded significantly, and the institutional holder base looks greatly thinned: someone went bankrupt, someone sold, someone at a loss, but somehow nothing is heard about new ones. The successful transition of Ethereum to proof-of-stake also promises a new wave of criticism from ill-informed “greens”, which will inevitably point out that if a large network like Ethereum can move to proof-of-stake, then why Bitcoin can't?

In any case, from a trading point of view, one of theThe main risks to Ethereum's uptrend is that if Bitcoin falls below $20K and continues to decline, it will almost certainly ruin the holiday for the market as a whole. We believe ~$20k is support, but in terms of buy-side speculation, Bitcoin is not our preferred vehicle today. As we said, a failed break below $20k (with a quick recovery) or a return to $22k could tip the scales somewhat, but so far the data suggests weak demand.

Ethereum rally ahead of the merge

Ethereum looks very strong. The price action against USD is good, against BTC everything is fine, and most altcoins are trying to keep up, but look much paler.

Concentration of narrative and capital in a deal forEthereum merge expectation is very high, as evidenced by the aforementioned factors, as well as ETH derivatives trading volumes exceeding those of BTC for non-trivial periods of time.

Technically, the pair slightly corrected against USDfrom resistance $1800–2000. This pullback has been absorbed by demand at the previous cycle peak ($1,400 or so) and the price is recovering again. On the daily timeframe, there is a useful close target at $1550-1600. As long as this structure is not broken, it is reasonable to expect a larger low with a rise towards $2,000 ahead of the news.

Structurally, the deal looks more complicated.It is tempting to focus on the upcoming activation of The Merge, but the elephant in the room is that risk asset indices have bounced well against the trend in previous weeks and are now testing support levels. Another confirmation that we are living in a simulation is that the activation of The Merge and the release of the next key US inflation data are expected on the same day. If the inflation figures turn out to be good and risky assets rise, then it will seem “obvious” after the fact that The Merge was not priced in, and we will probably see continued growth. If the data is worse than expected, then everyone will repeat with no less "obviousness", they say, "buy on rumors, sell on the news." There is probably a version of reality in which Ethereum starts trading without correlation with traditional markets, but this is of course much less likely, especially given that they are testing important support levels.

So it is possible that in terms of price inIn the short term, The Merge doesn't really matter at all, and it was just a good narrative to play on when risky assets bounced in general.

Be that as it may, when the market trades betweenlevels and a huge number of headlines looming on the horizon, positioning on the news (if you have not done it before) looks like a more difficult and ambiguous task than trading on the rise or fall that should follow them. On Day X itself, complex market movements and increased volatility can logically be expected, and with a high probability this can also set the tone for the coming days and weeks. Unless you are a short-term trader or are already in a comfortable position in the market, it may make sense to wait until the market shows itself more clearly, most likely in a little over a week.

Binance Coin in a horizontal movement in a bear market

Binance Coin has held up very well throughout this downtrend.

Technically, the pair against USD remains in the range between $210 and $295 (currently at the top of this range).

The pair to BTC continues to set new highs.

In terms of price action against the USD, there has already been a failed breakout of the $295 resistance, and another weekly close above that level is likely to be a successful breakout.

We like exchange coins, especially if they are owned by companies with a large market share.

Plus, they're great for narratives.early phase of the bull cycle. New users come to the market, they trade on the exchanges, the commissions and income of the exchanges grow, then some other magic trick happens just in time - burning tokens or something like that - and prices go up. Isn't it wonderful?

But in any case, given the strength against BTC and the clear range against USD, it makes sense to keep a close eye on Binance Coin, especially if a weekly close above $295 materializes.

Cosmos at the highs of the range

Cosmos has mixed perceptionsaltcoin speculators. Despite the fact that the pair against BTC has only been moving upward for months along with the recovery in the pair against USD, it is also called a harbinger of “doom” for the altcoin market - in the sense that if Cosmos its “alts” are growing and doing well, then everything will soon be covered ( like with DeFi 1.0 or the Litecoin pump).

But at least from the point of view of TA, the situation in this tool looks quite clear.

The pair against USD recently tested the low of the range at $10. As long as this level serves as support for the price, the opposite side of the range at $15 remains the next resistance level.

The pair to BTC has been growing for several months.And for several years now, it has been trading in a wide horizontal range. In terms of technical structures, ₿0.0007634 is the maximum of the macro range. And this is a logical target after an unsuccessful breakdown of its low at ₿0.0002734.

There is also an intermediate level at ₿0.0006074 - it can also be useful - however, the range in pair with USD and the macro range with BTC are more significant structures.

And Don just likes this chart, and technical analysis is just for show.

FTT doesn't leave us alone

Another exchange coin.

If you think we've missed any morecurrent coins with sufficient market capitalization, you can tweet us, but for now this is a show of the Ethereum name plus a few more exceptions.

Exchange coins have not suffered as much as many others, so they are in our field of vision. FTX Token is essentially a weaker version of Binance Coin.

The pair against BTC is close to setting new highs. It looks strong above ₿0.0011636.

The pair against the dollar, like Binance Coin, has a veryclear weekly range between $24.50 and $34. This support is important because, structurally, the next viewable levels below it are abysmal, and we love well-defined do-or-die levels.

There isn't much we can add here. A chart with good levels hasn't crashed to zero and doesn't look like complete garbage.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>