Test networks continue to rehearse Ethereum's move to the proof-of-stake algorithm. On July 6, the merger of the two chains wasworked out in Sepolia, now it's the turn of the dress rehearsal in Goerli. Apart from the temporary shutdown of a third of the validators who did not install the latest updates, the test was a success.

The final transition of Ethereum to PoS has becomea step closer, however, the expected date of the move was traditionally shifted: the complexity bomb was postponed for another two months, and on the project website the time frame was extended to the fourth quarter.

Image source: ethereum.org

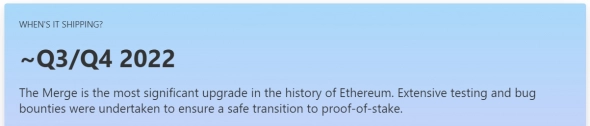

At the same time, 74 thousand users have already staked 13 million ETH to receive passive income. Now the amount is equivalent to $14 billion or 11% of the network's total capitalization.

Image source: etherscan.io

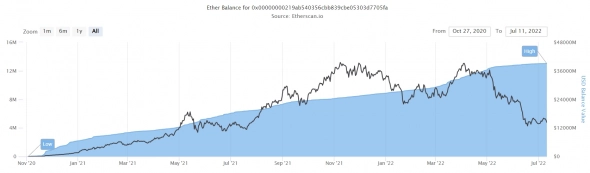

Because self-reserving coinsinvolves freezing them until the network actually moves, and staking to generate income is necessary in blocks of 32 ETH, third-party services have gained great popularity. The leader among them is Lido, which significantly lowers the entry threshold for passive income, and the annual return for staking is now 4%. Moreover, in exchange for the deposited ETH, the service provides stETH, which can be used in staking or exchanged for other coins.

The convenience of Lido has led the service tocurrently provides 32% of the total frozen ETH. The downside was that it was heavily leveraged, as Lido used a number of investment projects, including the infamous 3AC. The lack of liquidity has led to a drop in the price of stETH against ETH.

Image Source: dune.com/LidoAnalytical

Due to the high interdependence of a number of projects, a further separation of stETH, which has a capitalization of $4.5 billion, from ETH could lead to a cascade of liquidations and even more pressure on the cryptocurrency market.

Image Source: Cryptocurrency ExchangeStormGain

So, one of the operators for exchanging stETH for ETHPlatform Aave announced in June three potential risk-mitigation steps: freezing stETH transactions, raising the liquidation threshold to 90%, and suspending ETH borrowing. And in the largest pool of Curve for 465 thousand stETH, only 172 thousand ETH remained.

Lido is a big player in the market, its problemshard to ignore. The situation can be saved by the rapid transition of Ethereum to PoS and the subsequent unlocking of ETH 2.0. Perhaps this will encourage developers to take more action.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)