On October 19, the first Bitcoin futures exchange-traded fund (ETF) in US history was launched. Applications forthe regulator has been receiving similar tools since 2013years, but only now the SEC has allowed access to large investment capital. Traded on the New York Stock Exchange, and the debut in daily trading volume was the second in US history.

Honor to launch the first cryptocurrency ETFthe tool was awarded to ProShares. Daily trading volume reached $ 1 billion on the first day, placing its ETF second behind BlackRock's "low-carbon fund".

Image source: twitter.com/EricBalchunas

If we talk about the strength of interest, then on the first dayof trades, the fund increased from the initial $ 20 million to $ 570 million, and the value of the shares increased by 5%. According to ProShares CEO Michael Sapir, the increased interest in the fund is associated with the ability to invest in Bitcoin for those who have a brokerage account for trading stock instruments and who fear the difficulties of creating a cryptocurrency wallet.

The news of the creation of the first ETF on a cryptocurrency asset in the United States came before the Bitcoin All-Time High (ATH) test. This increases the likelihood of a breakout of the significant $ 65K level.

Image Source: Cryptocurrency ExchangeStormGain

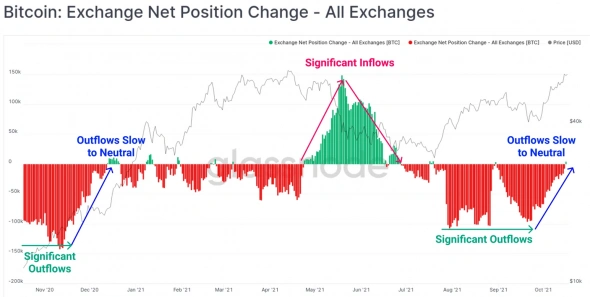

However, as the price reaches ATN,pressure from sellers who invested in cryptocurrency during the correction and want to partially take profits. According to metrics from the Glassnode agency, after the accumulation of Bitcoin in wallets over the past four months, an inflow of coins to cryptocurrency exchanges is now being recorded again. This will hold back the bulls for a short time and may cause a short-term correction, however, the inflow of investment capital will lead the price to new historical records.

Image Source:glassnode.com

ProShares is far from the only company inthe list of applications for SEC approval. Already this week, an ETF on Bitcoin futures from Valkyrie will appear. But the main expectation of the crypto community is still associated with the permission of ETF for spot Bitcoin - the regulator has over 50 such applications. Their approval has come a step closer this week.

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)